The cost of providing employee health insurance has become crippling for small businesses. Despite the passage of the Affordable Care Act, health insurance premium costs nationwide continue their seemingly inexorable rise. In this guide, you’ll learn ways to get affordable group health insuance for your employees.

Affordable Group Health Insurance Guide 2025

According to Pricewaterhousecoopers Health Research Institute, health care costs rose 5.5 percent in 2022, and 6 percent in 2023.

So plan sponsors and employers need to take initiative to make significant structural changes to their health benefits strategies, or they’ll continue to struggle to maintain competitiveness while continuing to attract and retain quality talent.

But what do these changes look like at the small business ownership level, for employers with fewer than 30-50 full-time workers? Or even micro-businesses with 12 workers or fewer?

If you are a small employer with fewer than 50 employees, here are several strategies that may help you reduce your benefits overhead while still providing quality, affordable health benefits to employees.

1. Think beyond traditional health insurance

If you have fewer than 50 full-time equivalents, you actually have a competitive advantage over large employers: You don’t have any legal requirement to provide an employer-paid health insurance plan to workers.

This means you won’t have to pay a penalty under the Affordable Care Act for not paying outrageous insurance premiums to cover your workers and their families.

That doesn’t mean you don’t provide meaningful and valuable health benefits. You do need to keep your top talent, after all, and recruit other outstanding employees. And they expect health benefits.

Fortunately, there are other lower-cost alternatives to expensive, overstuffed employee health insurance plans – which are more affordable for employees and their workers alike.

2. Address all levels of the Employee Health Care Pyramid

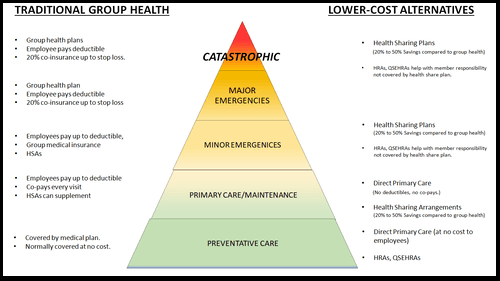

Plan sponsors should recognize that workers and their families have a spectrum of healthcare needs, ranging from basic, routine, primary care to catastrophic medical events that can cost hundreds of thousands of dollars.

Here is how we think of the Employee Healthcare Pyramid:

The Employee Healthcare Pyramid

On the left, we list common traditional insurance-based solutions that address each level of the Care Pyramid. Most business owners are at least broadly familiar with these.

On the right, we list some more affordable, lower-cost alternatives that address each of these respective levels of the Pyramid.

Employers should look for ways to help address each of these five levels, or employees may face a significant gap in coverage.

Even the lowest levels, the Preventative and Primary Care levels of the Pyramid, demand your attention, because many cash-strapped employees can’t afford all the care they need on their own. And this can quickly affect the profitability of your business.

If you don’t provide some assistance at the preventative and primary care levels, some workers will delay or skip needed health care, or go without important medication.

Over time, this leads to worse and worse health outcomes. Minor medical conditions become major ones without intervention. And this results in more health care utilization over time, directly driving up your health insurance premiums.

It also results in absenteeism, presenteeism, higher employee stress levels, lower productivity, and even increased workplace accident rates.

Compare Pricing on the Best Insurance Plans Available

3. Offer High-Deductible Health Plans (HDHPs)

One of the easiest ways small employers can “bend the cost curve” in their favor is to transition employees to the “consumer directed healthcare” model.

With this approach, employers encourage their workers to take more direct ownership of their healthcare experience by offering plans with higher deductibles.

These high-deductible health plans (HDHPs) HDHPs have lower monthly premiums than traditional plans.

These immediately make their premiums more affordable for both employers and employees.

4. And Supplement Them With Health Savings Accounts

However, while the premiums are more affordable, the higher deductibles can be a burden on cash-strapped workers in the event they or a family member needs care.

If this affordability gap is not addressed, employees may put off going to the doctor… resulting in higher costs down the road.

As a plan sponsor, you don’t want your workers skipping the care they need because they don’t have the cash to pay the copays and deductibles necessary to see the doctor.

That’s where Health Savings Accounts (HSAs) come in:

HSAs allow employees to contribute pre-tax dollars for medical expenses.

Either the employer or the worker can fund HSAs, up to an annual maximum.

These funds are then available to the employee to pay for any future qualified medical expenses tax-free and penalty free.

The cash is available to help employees pay deductibles, co-pays, treatment-related travel and lodging expenses, and even car and home modifications to accommodate disabilities.

Tax Treatment of HSA Contributions

No matter who makes the contribution – the worker, the employer, or any combination thereof, contributions are tax-free.

For the employer, any money contributed to an HSA is tax-deductible as a qualified business expense.

For the worker, any money contributed is an above-the-line tax deduction. They don’t have to itemize in order to benefit from it.

And if the worker contributes to their own HSA via payroll deduction, both the employer and the employee derive yet another benefit: HSA contributions are not subject to Social Security/payroll taxes.

HSA contributions vest to the worker immediately, and are immediately available to help pay for medical care.

There are no income caps or thresholds: Anyone can contribute to and benefit from HSAs – no matter what their income level.

Tax treatment of HSAs during accumulation

If the money is not needed for care that year, the assets in the HSA will continue to accumulate, tax-free, for as long as the money is held in the account. If the worker makes withdrawals for anything other than a qualified medical expense (as defined in IRS Publication 503 – Medical and Dental Expenses), then there’s a 20% penalty.

But that penalty goes away at age 65. At that point, the money is available to help supplement workers’ retirement incomes… or for any other purpose… penalty free.

The worker only pays income taxes on the withdrawal, just as they would with a traditional IRA or 401(k) account.

But HSAs are better for the employee than either a traditional IRA or 401(k) account in retirement:

- There are no required minimum contributions (RMDs)

- Withdrawals to pay for qualified medical expenses are still tax-free.

Click here to learn more about specific HSA-related tax forms you need to understand.

Don’t Miss: How Higher 2024 HSA Contribution Limits Allow You To Save Even More on Taxes

Embracing Consumer-Directed Healthcare

The idea behind consumer-directed healthcare, including the use of HSAs, is that when employees spend their own money for healthcare, they are more likely to make cost-conscious decisions, and avoid overconsumption of healthcare.

Eventually, this results in lower structural costs for everyone. But employees are not likely to be forced to skip needed medical care due to deductibles or other cost hurdles, because the cash in their HSA is there to help pay the costs.

By encouraging employees to take a more active role in their healthcare spending, HDHPs can lead to cost-conscious decisions and savings over time.

Tip: Lower-paid employees are likely to need more help contributing to HSAs. Consider taking some or all of the savings in premiums from switching from a standard group health plan to an HDHP and using it to contribute to employees’ HSAs.

For higher-paid work forces, they may be in a high enough tax bracket where they don’t need a direct employer HSA contribution. Instead, there’s enough tax incentive for these higher-aid employees that they’ll be likely to want to contribute on their own initiative.

5. Switch to Health Sharing

Healthsharing is a more affordable alternative to traditional health insurance approaches.

Monthly costs for health sharing plans are typically much lower than those for traditional health insurance premiums – up to 50 percent lower, in many cases.

Unlike traditional group HMOs that dominate the employee group health insurance market, healthshare plans typically allow plan members significant freedom to choose their own doctors, hospitals, and other providers.

Some employers are dropping traditional health insurance altogether and migrating employees to these lower-cost health sharing plans.

Health sharing plans can offer tremendous benefits for the upper tiers of the Employee Healthcare Pyramid, including even catastrophic coverage. And they do so at just a fraction of the cost of traditional health insurance.

Healthsharing works best for work forces that are relatively young and in good health. This is because health sharing plans typically impose a waiting period before they will share costs related to pre-existing conditions.

Employer costs for health sharing plans are deductible as a compensation expense. However, employer-paid contributions on employees’ behalf are taxable to the employee.

Nevertheless, the cost savings from health sharing compared to traditional group health are so significant that migrating to health sharing in lieu of group health plans is still a worthwhile consideration.

Furthermore, health sharing plans are much easier to sponsor than group health insurance plans, with less overhead, administrative headache, and less potential liability for employers.

Everything You Need to Know About Health Sharing Plans for Small Business

6. Drop Group Health Insurance Altogether

One strategy that is undergoing a tremendous surge in popularity among small employers is dropping overpriced group health insurance plans completely, and instead replacing them with Health Reimbursement Arrangements, or HRAs.

HRAs allow employers to contribute tax-free dollars to reimburse employees for qualified medical expenses.

- Employer contributions are tax-deductible.

- There are no payroll taxes on money contributed or received via an HRA.

If you’re an employer with fewer than 50 employees that does not currently offer a group health plan, or you are open to canceling your group plan to save money, you may consider starting a Qualified Small Employer HRA, or QSEHRA.

With a QSEHRA, you provide your workers tax-free dollars every month that they can use to buy a health insurance plan that suits their needs.

As of 2023, employers can contribute up to $5,850 ($487.50/month) for single employees and $11,800 ($983.33/month) for families to help them purchase their own health insurance on the individual market. The 2024 limits should be announced in November of 2023.

Additional Benefits of QSEHRAs

In addition to saving money for both employers and employees, this approach has several other benefits as well:

Employees can choose a health plan that best fits their own needs and budget. For example, they can opt for a high deductible health plan so they can fund a health savings account.

Or they can choose a plan that offers a bigger network, or that has their preferred local hospitals and clinics listed as “in-network” providers where your old group plan excludes them.

Under current law, employees cannot use QSEHRA money for health sharing plan contributions. You must use them to help employees buy traditional ACA-qualified health insurance plans.

QSEHRAs vs ICHRAs

QSEHRAs (Qualified Small Employer HRA) and ICHRAs (Individual Coverage HRA) are both known as stand-alone HRAs.

QSEHRAs are exclusively for small businesses with 50 or fewer employees who do not offer a group insurance plan. They can be very simplistic in how they work, compensating employees via payroll for the cost of their individual premiums.

ICHRAs take the stand-alone model of QSEHRAs and offer it to larger companies. ICHRAs are available to companies of any size. They also give large employers more options over setting benefit levels for different employee groups.

ICHRAs have no maximum contribution, and neither type of HRA has a minimum contribution.

Combining HRAs with HSAs and High Deductible Health Plans

Another strategy employers can implement to lower costs while extending coverage is to switch their group health plan to a high deductible health plan (HDHP) and supplement it with a group coverage HRA (GCHRA), also known as an integrated HRA.

This may be an excellent option for your younger and healthier employees who don’t have as many healthcare costs. The benefit of an HDHP is the lower health insurance premiums for you and your employees.

If you’re worried about the high deductible employees will have to meet, you can offer a GCHRA to help offset the out-of-pocket costs.

With a GCHRA, you simply offer a tax-free allowance for your employees to spend on the healthcare expenses they incur before they meet their deductible or for items that aren’t fully covered by the group plan.

This helps address the lower levels on the Employee Healthcare Pyramid while providing tax advantages for employers and workers alike.

7. Consider Direct Primary Care Benefits

According to the Kaiser Family Foundation, around 1 in 3 U.S. adults report that they have not sought necessary medical care or delayed care because of high out-of-pocket costs.

These include deductibles and copays that traditional insurance requires before workers can even see their primary or family doctor.

Even with insurance, many workers still find it difficult to afford even basic medical care due to these high out-of-pocket costs.

This can have severe knock-on effects for employers.

Without timely medical care, minor conditions can become much worse, over time. This increases employee stress.

- Stressed employers are less productive on the job.

- Stress causes or exacerbates absenteeism, presenteeism,

- Stress impacts workplace safety, as stressed or distracted employees are more accident prone, and take longer to recover from accidents.

Direct Primary Care focuses exclusively on the critical bottom two levels of the Employee Healthcare Pyramid.

DPC solves for these healthcare disconnects by completely removing the cost barrier standing between workers and getting needed medical care from their primary care doctor.

How Does DPC Work?

Direct Primary Care takes the traditional group health insurance policy out of the equation altogether when it comes to primary care, and replaces it with a simple and easy-to-understand subscription model.

You as the employer pay a flat, predictable and affordable monthly subscription per employee or covered family member to a direct primary care practice.

In return, your employee or covered family member receives unlimited primary care services from their DPC physician.

There’s no additional copay or deductible. The patient can make appointments as necessary to address any medical concern normally handled in a family doctors’ office, at no charge. Before it becomes a bigger problem.

So employees don’t have to skip on needed care.

DPC practices try to make the most out of virtual/telehealth visits. This keeps costs down. And employees don’t need to take a half-day off work for a doctors’ appointment.

They can punch out for 20 minutes, speak with their primary care doctor over their cell phones, and punch back in.

Direct primary care is excellent for frequent, routine health care needs:

- Checkups

- Follow-up care

- Immunizations

- Colds and flus

- Sick note verification

- Minor infections

- Scrapes and sprains

- Well baby visits

- Medication management and updates

Benefits of DPC for Employers and Employees

Employees receive timely and comprehensive care when they need it, leading to better health outcomes and increased productivity.

Employees can schedule longer and more personalized appointments, allowing them to address their health concerns more thoroughly, which can ultimately reduce the need for costly specialist referrals and emergency room visits.

Employees also avoid the high out-of-pocket costs associated with traditional fee-for-service healthcare plans. This not only eases the financial burden on your employees, but also lowers your overall healthcare spending as an employer.

DPC can enhance employee satisfaction and retention. When employees feel well-cared for and have access to a dedicated primary care physician who knows them personally, they are more likely to stay with your company.

This can result in lower turnover rates and the associated costs of hiring and training new staff.

Additionally, by offering DPC benefits, you send a message to your employees that you value their health and well-being, which can boost morale and create a positive work environment.

Combining DPC With Other Approaches

Direct Primary Care memberships do not include catastrophic care, ER or urgent care clinic visits, specialist care, surgery, hospital costs, or prescription drugs.

DPC should never be a stand-alone health benefit for employees.

Instead, you should always include DPC as part of a suite of health benefits that also addresses catastrophic, specialist, and other medical care needs.

DPC pairs very well with health sharing plans – especially DPC DIRECT, which is a popular health sharing plan specifically designed to dovetail with direct primary care plans, picking up exactly where DPC memberships leave off –– resulting in a smooth transition from primary care to specialist or hospital care with no gaps or surprise medical bills.

DPC also pairs well with high-deductible health plans and health savings accounts, which provide real savings opportunities for employers and workers alike.

Tax Considerations of Direct Primary Care

Direct primary care membership costs are tax-deductible for employers as a compensation expense. However, employer-paid DPC subscription benefits are taxable to the employee as ordinary income.

Don’t Miss: How To Combine DPC Memberships With a Health Sharing Plan

Compare Pricing on the Best HealthShare Plans Available

8. Invest in Wellness Programs and Preventive Care

Investing in wellness programs and preventive care initiatives can help reduce long-term healthcare costs.

These programs can include health screenings, vaccinations, smoking cessation programs, and fitness incentives.

When employees are healthier and engaged in proactive healthcare, they are less likely to develop chronic conditions or require expensive treatments, ultimately saving both the company and its employees money.

9. Take Advantage of the Small Business Healthcare Tax Credit

The small business health care tax credit benefits employers that have fewer than 25 full-time equivalent employees, with relatively low average wages.

It’s available to businesses that offer a qualified health plan, or that qualify for an exception to this requirement, and that pay at least 50% of the employee cost (excluding dependents).

The maximum tax credits are as follows:

- 50 percent of premiums paid for small business employers and

- 35 percent of premiums paid for small tax-exempt employers

- The credit is available to eligible employers for two consecutive taxable years.

10. Conduct a Periodic Audit of Your Health Benefits

Is everybody you are paying group health insurance premiums for actually a qualified member?

Occasionally, employees try to defraud employers by enrolling non-qualified people in their employers’ plan. For example, they may try to get the plan to cover non-spouses or children of other parents.

It’s a good idea to go over your employee and plan census every six months to a year, and make sure you aren’t still carrying people who have left the company, ex-spouses, and others who are on the plan but shouldn’t be.

Small business employee benefits can be complex. There are a lot of factors that go into planning and implementing an employee health package.

Don’t try to go it alone. Make an appointment for a consultation with an HSA for America Personal Benefits Manager today.

Our highly-trained PBMs have years of background and experience in employee health benefits. Many of them are successful business owners and entrepreneurs in their own right.

We’ve been in your shoes, and we understand the challenges.

We also understand the health benefits industry inside and out, and are ready to put our experience to work for you.

Working with a Personal Benefits Manager, and having them help you custom-design an affordable benefits package to suit your budget and workforce costs you nothing. Our fees are paid by the insurance companies, health sharing ministries, and other vendors we represent.

Contact us today and let us show you the HSA for America difference.

For Further Reading: Complete Guide to Small Business Health Plans | Everything You Need to Know About HRAs for Small Business | The Small Business Health Care Tax Credit | Affordable Alternatives to Employer Health Insurance | The Complete Guide to Direct Primary Care | Health Benefits for Restaurant Workers – A Guide For Restaurant and Catering Business Owners

Health Insurance News Roundup

KFF.org: The average annual health insurance premiums in 2023 are $8,435 for single coverage and $23,968 for family coverage. These average premiums each increased 7% in 2023. The average family premium has increased 22% since 2018 and 47% since 2013.

Bloomberg.com. Health insurance premiums now cost $24,000 a year, survey says.

Wall Street Journal. Surge in Health Insurance Costs Pose Next Challenge for Finance Chiefs

Wall Street Journal. Health Inflation’s Big Hike This Year, In Charts

Read More About Group Health Insurance Options in Your State

Hi! I’m Mike Montes, and I’m one of your Personal Benefits Managers. I like working with HSA for America because we’re creating solutions to healthcare problems. Our focus on money-saving alternatives like HSA plans and health sharing programs, and the variety of health share programs we offer, are what set us apart. Read more about me on my Bio page.