North Dakota Small Business Health Insurance Options

The Complete North Dakota Small Business Health Insurance Guide (2024 Edition)

A Guide for North Dakota Independents, Self-employed Workers, and Small Business Owners to Saving Money on Health Plans

Do you run a small business in North Dakota? Or are you an independent contractor? Freelancer, or self-employed worker?

If so, you know how important it is to have access to affordable healthcare. You also know that finding the right health insurance plan can be a challenge, especially in a state like North Dakota, where the landscape is vast and many people live far from urban centers.

That’s why we created the essential guide to health insurance for North Dakota small businesses. This comprehensive guide is designed to help you find the best health insurance plan for your small business, whether you have 50 or fewer employees.

We understand that small businesses have unique needs, and we’ll help you navigate the complex world of health insurance to find a plan that meets those needs. We’ll also help you compare plans and understand the different costs and coverage options so you can make the best decision for your business.

In addition to helping you find the right health insurance plan, we’ll also provide you with information on other health care resources available to small businesses in North Dakota. We want to make sure that you and your employees have the healthcare coverage you need to stay healthy and productive.

So if you’re a small business owner in North Dakota, don’t wait. Get started today by downloading our Essential Guide to Health Insurance for North Dakota Small Businesses.

Topics will include:

- The high cost of traditional group health insurance

- Health sharing—a more affordable alternative

- Health reimbursement arrangements (HRAs)

- Health savings accounts (HSAs)

- Direct primary care (DPC) plans

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

The Problem

As a small business owner, freelancer, or independent professional, you understand the value of good health insurance for your team.

In today’s competitive labor market, a quality health plan also helps businesses attract and retain the best available talent.

But thousands of North Dakotan small businesses and freelancers have been essentially locked out of traditional health insurance solutions, thanks to rising costs.

The problem is especially acute for smaller businesses that don’t have ready access to vast sums of capital, and for independent contractors and self-employed individuals who don’t qualify for a subsidy under the Affordable Care Act to help them pay for health insurance.

Traditional Health Insurance Coverage is Increasingly Out of Reach

In North Dakota, the high cost of living is no secret, and health insurance is just one of the many expenses that can put a strain on small businesses.

According to data from the Kaiser Family Foundation, it costs $22,196 to insure just one employee and his or her family, as of 2022. This means that small businesses in North Dakota are spending a significant portion of their budget on health insurance, which can take away from other important business expenses.

The good news is, for many North Dakota business owners and independent workers, there is a better way: dropping traditional health insurance altogether, and switching to more cost-effective solutions.

These include health sharing, health reimbursement arrangements (HRAs), and direct primary care (DPC).

Introducing the Health Sharing Alternative

By offering health sharing plans, North Dakota small businesses can save money on their health insurance costs without sacrificing coverage.

Health sharing plans are not insurance policies. They function very differently and are regulated differently.

But they do provide a way for people to pool their resources to make medical care much, much more affordable for individual members.

This can be a great option for small businesses because it can help them reduce their health insurance costs while still providing their employees with access to quality healthcare.

If you are a small business owner in North Dakota, you should consider offering a health sharing plan to your employees. It is a great way to save money on health insurance costs without sacrificing coverage.

We’ll describe health sharing, HRAs, and direct primary care in more detail below.

Why is Health Insurance in North Dakota so expensive?

Health insurance is expensive in North Dakota for a number of reasons. Here are just a few:

- High demand for healthcare: North Dakota has a high demand for healthcare, which also contributes to the high cost of health insurance. The state has a large population of uninsured and underinsured residents, which puts a strain on the healthcare system as a whole and drives up the cost of care.

- Government regulations: The federal government and the state of North Dakota have a number of laws and regulations that contribute to the high cost of health insurance. These regulations require health insurance plans to cover a wide range of services, including mental health and substance abuse treatment, maternity care, and preventive care. This can drive up the cost of health insurance premiums for small businesses, as they are required to offer these comprehensive benefits to their employees.

- Geography: North Dakota is a large and sparsely populated state, which contributes to the high cost of health insurance. It can be expensive to provide health care services to people who live in rural areas, and this cost is often passed on to consumers in the form of higher premiums.

- Insurance company profits: Insurance companies are for-profit businesses, and they need to make a profit in order to stay in business. This profit is reflected in the cost of health insurance premiums.

The high cost of health insurance is a significant challenge for small businesses in North Dakota. It can make it difficult for small businesses to attract and retain employees, and it can put a strain on their bottom lines.

Fortunately, there are a number of things that North Dakota small businesses can do to try to reduce their health insurance costs.

North Dakota Small Business Health Plans: Thinking Outside the Box

Small businesses in North Dakota are in luck. If you have fewer than 50 employees, you don’t have to offer traditional health insurance.

The Affordable Care Act only requires that for companies with 50 full-time workers or more.

We know that you need to attract and retain top talent, and health insurance is a big part of that. But you don’t need to spend a fortune on overpriced, traditional group health insurance policies. There are other options.

Except for certain individuals, sole proprietors, independent contractors and others who receive a subsidy under the Affordable Care Act, traditional health insurance is the costliest by far.

There are several other potential solutions to the problem of providing affordable access to quality healthcare for you and your employees and their families, all at a much lower cost compared to unsubsidized health insurance premiums.

These options include:

- Health sharing plans

- Hybrid health sharing and HSA-qualified plans

- Health reimbursement arrangements (HRAs)

- Direct primary care plans

The best health insurance strategy for your small business will depend on a number of factors:

- Company Size. Employers with fewer than 50 full-time equivalents are exempt from the Affordable Care Act mandate to provide a qualified group health insurance plan to employees working 30 hours per week or more.

So you can offer a health sharing benefit in lieu of insurance, or use a health reimbursement arrangement to help employees purchase their own health insurance with tax-free dollars. With fewer than 50 full-time employees, you can also start a QSEHRA plan.

Health reimbursement arrangements are explained in more detail below. - Age and life stage of your employees. Younger employees are generally healthier than older employees, so you may be able to get a lower rate on your health insurance if you have a younger workforce. However, you need to be aware of the potential for health problems that can occur as employees get older.

- Budget. Your budget is another important factor to consider when choosing a health insurance plan. You need to decide how much you are willing to spend on health insurance each month. It is also important to consider the out-of-pocket costs that you may incur, such as copayments and deductibles.

- Pre-existing conditions. If you have employees or family members with pre-existing conditions, you need to make sure that the health insurance plan you choose will cover these conditions.

A good plan would take all of these factors into consideration. Often, the best strategy uses a combination of strategies, products, and solutions to provide a full spectrum of healthcare benefits to suit your employees’ budget.

Learn More: The Complete Guide To Small Business Healthcare Plans.

Drop Obsolete Group Health Insurance and Choose Health Sharing Instead

The Affordable Care Act (ACA) has some good news for small businesses in North Dakota. If you have fewer than 50 employees, you don’t have to offer traditional health insurance.

That’s right: you don’t have to provide health insurance for your workers, and there’s no penalty for doing so.

That doesn’t mean you shouldn’t! Offering a quality benefits package is a must in today’s economy, if you want to attract quality workers and keep your best workers from leaving.

But you can still offer your employees a valuable health benefit, and even purchase coverage for yourself and your family, at a fraction of the cost of traditional health insurance.

How? Offer a health sharing plan.

You can offer a health sharing plan, and pay some or all of the costs for your employees. This has the advantage of lower costs for your business — even if you pay the entire cost of your employee’s health sharing plan.

However, the disadvantage is that any money you provide to your employees to pay the cost of the health sharing plan is a taxable benefit for your workers.

Or you can offer a health reimbursement arrangement, and help your employees pay their health insurance premiums, and, if you choose, reimburse them for other medical costs, as well.

Taxation of Employer Health Coverage in North Dakota

Health insurance premiums you pay as an employer are fully deductible as a business expense under both federal and North Dakota state law.

The same is true of health sharing costs, and all other compensation costs: all of them are fully deductible to the employer as a business expense.

They are also not taxable to the employee.

Health Sharing plans feature lower overall costs compared to traditional health insurance. Their monthly costs are also tax-deductible to the employee. However, employer assistance for paying health sharing costs are taxable to the employee.

The table below summarizes the tax treatment of health benefits in North Dakota for small businesses.

| Health Benefit | Tax Treatment for Employers | Reduces Employee Payroll Taxes | Tax Treatment to the Employee |

| Traditional health insurance | Fully deductible as a business expense | No | Not taxable to the employee |

| Health sharing | Fully deductible as a business expense | No | Not taxable to the employee |

| Section 125 benefits | Fully deductible as a business expense | Yes | Tax-free to the employee |

| Section 105 benefits | Tax-free to the employee | No | Not taxable to the employee |

| HRAs | Fully deductible as a business expense | No | Tax-free to the employee |

| QSEHRAs | Fully deductible as a business expense | No | Tax-free to the employee |

| ICHRAs | Fully deductible as a business expense | No | Tax-free to the employee |

North Dakota Traditional Group Health Insurance Disadvantages

While traditional health insurance is a great option for many people, it doesn’t work for everyone.

Health insurance works best for individuals who have pre-existing conditions, or who get a subsidy from the government, or who have employers paying premiums for them.

In this latter case, it’s the employer who takes the brunt of inflated, bloated traditional group health insurance premiums. So the cost doesn’t go away, by any means; it’s just shifted to the employer.

Many are left out of subsidies

But since many small businesses can’t afford the escalating costs of health insurance for employees and remain competitive, this is a major problem that gets more acute every year.

But freelancers, independent contractors, and self-employed workers don’t have employers to help them pay for health insurance premiums at any rate. And many of them don’t get an Obamacare subsidy to help them pay for health insurance premiums at all.

If this is you, you know that health insurance is extremely expensive.

Inappropriate mandated coverages

It’s made more expensive by increasing coverage mandates that the government places on traditional insurance companies.

For example, it makes no sense for someone who does not use drugs to have to pay for addiction treatment coverage. They aren’t a risk to the insurer.

Narrow care networks

Traditional health insurance HMOs and PPOs also typically restrict plan members to using approved doctors and hospitals, which can make it difficult for people to access the care they need.

That’s why North Dakota employers, independents, freelancers, and other self-employed people have

Health sharing plans and HRAs can provide small businesses with significant cost savings, greater flexibility, and reduced administrative hassle.

These plans can offer access to high-quality healthcare, portability, and a variety of other benefits. If you are a small business owner in North Dakota, you should consider whether a health sharing plan or HRA is right for you..

Health Sharing Plans in North Dakota

Health sharing plans are a revolutionary way to cut costs without sacrificing quality.

Thousands of North Dakota residents who’ve been left out of the Affordable Care Act subsidies as well as small businesses are saving up to 50% on premiums just by dropping traditional health insurance products and switching to health sharing.

That means you could save more than $10,000 per year for your own household or per employee for family coverage, and more than $3,500 for your own household or for each enrolled employee per year for single coverage.

Health sharing programs work by pooling resources from a group of people or organizations. When someone in the group gets sick, the costs are shared among everyone. This means that you can get the high-quality care you need without breaking the bank.

If you’re a small business owner in North Dakota, consider switching to a health sharing plan. It’s a smart way to save money and provide your employees with the healthcare they deserve.

Learn More: How Much Can Health Sharing Save?

Health Sharing vs. Health Insurance

Health sharing plans are not like traditional health insurance.

They are not insurance policies at all. Instead, they are a way for people to pool their resources to share the cost of healthcare.

Health sharing plans are like a giant group of people who agree to help each other pay for medical expenses. When someone in the group gets sick, the costs are shared among everyone. This means that you can get the high-quality care you need without breaking the bank.

In addition to saving money, health sharing plans offer several other benefits for small businesses in North Dakota.

- No limited care networks. Unlike HMOs, EPOs, and PPOs, Most health sharing plans don’t limit you to narrow networks of authorized providers. You generally have much more freedom to choose your own doctor.

- Portability. Employees can take their health sharing plan with them if they change jobs.

- Flexibility. Health sharing plans offer a variety of plan tiers and pricing options to meet the needs of different businesses and employees.

Health Sharing, Pre-Existing Conditions, and Surgeries

Traditional health insurance policies are required by law to cover pre-existing conditions immediately upon enrollment.

Health sharing plans, in contrast, typically impose a waiting period of up to five years before they will share costs related to pre-existing conditions.

In many cases, sharing benefits for pre-existing conditions are phased in over several years. Eventually, health sharing plans will share up to 100% of the costs of treating pre-existing conditions once the waiting period is over.

If you have a pre-existing condition, it’s important to talk to a health sharing plan representative before you join to find out how they will share costs for your condition.

Surgeries

Unlike traditional health insurance plans, health sharing plans often impose waiting periods on surgeries.

90 days for non-emergency surgeries is common, except for injuries and accidents that could not have been foreseen prior to the member’s enrollment.

Despite these differences, health sharing plans can still be a good option for small businesses in North Dakota. They offer many of the same benefits as traditional health insurance plans, but at a fraction of the cost.

With the high cost of traditional health insurance, small businesses may find that the savings offered by health sharing plans outweigh the potential drawbacks.

Healthcare Freedom Means the Freedom to Choose Your Own Doctor

At HSA for America, healthcare freedom is one of our core values.

It’s not an afterthought for us; healthcare freedom, privacy, and liberty is at the core of our business practice.

That’s why we are the leading independent health benefits broker firm in the country when it comes to health sharing: The ability to choose your own doctor, and use your benefits with any doctor you choose is a central pillar of healthcare freedom.

Is Health Sharing Right for Your Business?

Choosing the best health insurance plan for your small business is important, and it will depend on your specific needs and budget.

Whether you’re considering a health sharing approach or a traditional group health insurance plan, it’s important to do your research and compare your options.

If you’re a business owner in North Dakota, reach out to us to get a free full case analysis and recommendation.

One of our experienced Personal Benefits Managers will help you determine the best option for your business.

In most cases, switching to health sharing will save thousands of dollars per covered employee. However, it’s important to note that health sharing may not be the best option for businesses with employees who have pre-existing conditions.

About Health Reimbursement Arrangements

HRAs allow employers to allocate funds for employee premiums.

These allocations are tax deductible to employers, and tax-free for employees. HRAs enable them to purchase individual health insurance coverage on their own.

Depending on the plan, employers can structure their HRAs to also reimburse employees for out-of-pocket health care costs, such as deductibles, copays, and co-insurance costs.

The types of HRAs most relevant to North Dakota employers are Qualified Small Business HRAs (QSEHRAs) – which are only available to companies that do not offer a health sharing plan – and Individual Coverage (ICHRAs),

Why Use Health Reimbursement Arrangements?

Health Reimbursement Arrangements (HRAs) offer a number of benefits for small businesses and their employees.

Health reimbursement arrangements, or HRAs, are employer-funded accounts that employees can use to pay for health care expenses tax free. Depending on the employee’s tax bracket, they can save anywhere from 17% to 45% on medical expenses included in the employer’s HRA plan.

HRAs offer a number of benefits for employers:

- Tax advantages. HRA contributions are fully tax-deductible for employers, and the money is tax-free to employees when they use it to reimburse qualified medical expenses. This can save small businesses money on their overall health care costs.

- Cash flow benefits. HRA funds are controlled by the employer until they are disbursed to employees. This allows small businesses to retain the funds as operating capital, which can help improve cash flow and liquidity.

- Flexibility. Employers have a great deal of flexibility in designing their HRA programs, including the specific benefits that they offer and the eligibility criteria for employees. This allows small businesses to tailor HRAs to meet their specific needs and the needs of their employee

- Portability. HRAs do not jeopardize employee health insurance coverage if they leave the company or change jobs. With a QSEHRA, the employee owns the health insurance policy and maintains control, not the employer. This can give employees peace of mind knowing that they will have access to health insurance coverage if they leave their job.

Popular Small Business HRAs and Section 105 Plans

| Plan | Tax Treatment | Benefits | Limitations |

|---|---|---|---|

ICHRA | Tax-free to employees on contributions and use, and tax-deductible for employers | Funds can be used for qualified medical expenses, including premiums, deductibles, copays, and coinsurance. | Employees must have individual health insurance coverage. |

| QSEHRA | Tax-free to employees on contributions and use, and tax-deductible for employers | Funds can be used for qualified medical expenses, including premiums, deductibles, copays, and coinsurance. | Available only to small businesses with fewer than 50 full-time employees that do not offer a group health plan. 2024 contributions are capped at $5,250 for employees with single coverage and $10,500. These amounts are updated annually . |

| Section 105 plans | Tax-free to employees on contributions and use, and tax-deductible for employers | Funds can be used for qualified medical expenses, including premiums, deductibles, copays, and coinsurance. | Employers can set up a variety of different plans with different rules and benefits. |

| HRAs outside of a Section 105 plan | Tax-free to employees on contributions and use, and tax-deductible for employers | Funds can be used for qualified medical expenses, including premiums, deductibles, copays, and coinsurance. | Not as many tax advantages as other options. |

QSEHRAs—The HRA for North Dakota Small Businesses

Small business owners in North Dakota who have fewer than 50 full-time employees and who don’t offer a health insurance plan of their own can set up a Qualified Small Employer Health Reimbursement Arrangement, or QSEHRA.

This program can help businesses provide healthcare benefits for their employees without having to offer an expensive traditional group health insurance plan.

With a QSEHRA, the employer skips the hassle and expense of offering their own health plan entirely

Instead, the employer reimburses employees who purchase their own health insurance plan.

Employees benefit because they can choose from among dozens of health plans offered in their state. So they are free to choose the plan that best fits their needs and resources. This is vastly preferable to the “one-size-fits-all” approach of group health insurance plans, which are often not a match for diverse workforces.

Employers are liberated from the costs and potential liabilities of running a full-fledged ERISA health plan, for which they need to take on fiduciary responsibility.

HRAs are easier to administer, and represent less legal risk for employers than sponsoring a group health insurance plan.

Implementing a QSEHRA

To start a QSEHRA plan, the employer must not currently offer a qualified group health insurance plan or they must cancel their current group insurance plan when they implement the QSEHRA.

Once the employer cancels their health insurance plan and replaces it with an HRA, their employees will qualify for a Special Enrollment Period.

This is a 60-day window during which employees can purchase their own ACA-qualified insurance plan with guaranteed issue rights, without going through medical underwriting.

This helps ensure that employees do not experience a break in coverage when the employer switches from a group health insurance plan to a QSEHRA.

QSEHRAs are a great option for small businesses in North Dakota that want to provide health insurance options for their employees without the high cost and hassle of traditional group health insurance plans. With a QSEHRA, businesses can set their own contribution limits,

For 2024, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) limits are as follows:

- Single Coverage: Employers can reimburse up to $5,850 per year for employees with individual coverage.

- Family Coverage: For employees with family coverage, the reimbursement limit is up to $11,800 per year.

QSEHRA contribution limits are adjusted for inflation, so small businesses can offer their employees a flexible and affordable health benefits package.

After an employee receives their QSEHRA funds, they can use them to purchase health insurance on their own on the individual market, choosing any qualified health plan they like.

As an employer, you have the option to reimburse your employees for their health insurance premium only, or for their premiums plus additional medical expenses. This gives you the flexibility to design a health benefits package that meets the needs of your employees and your company.

ICHRAs

ICHRA stands for Individual Coverage Health Reimbursement Arrangement.

It is a medical expense reimbursement plan that allows employees to choose their own health insurance coverage and receive reimbursement from their employer for their premiums and other qualified expenses.

ICHRAs are a great option for small businesses because they offer flexibility and cost-effectiveness. There is no one-size-fits-all approach to ICHRAs, so businesses can design a plan that meets their specific needs and budget

ICHRAs vs. QSEHRAs

| Feature | ICHRA | QSEHRA |

|---|---|---|

| Eligible Employers | Any size, no limit on the number of employees. | Small employers with fewer than 50 full-time equivalent (FTE) employees. |

| Eligible Employees | All employees can be included, but employers can set eligibility criteria based on job-based categories. | All employees must be offered the benefit, with some exceptions such as part-time or seasonal employees. |

| Contribution Limits | No maximum contribution limits set by the IRS. Employers have the flexibility to set their own limits. | Contribution limits for 2024 are $5,850 for individual coverage and $11,800 for family coverage. |

| Insurance Requirement | Employees must be enrolled in individual health insurance coverage or Medicare to participate. | Employees must have minimum essential coverage (MEC) to participate. |

| Allowance of Premium Tax Credits | Employees can opt out of the ICHRA to claim premium tax credits for ACA marketplace plans, but they cannot use both. | Employees cannot use QSEHRA funds and claim premium tax credits for the same months. However, QSEHRA benefits can reduce the premium tax credit amount. |

| Benefit Design Flexibility | Offers more flexibility in designing benefits, allowing employers to vary contributions based on age, family size, and job categories. | Offers less flexibility compared to ICHRAs. The benefit must be offered on the same terms to all eligible employees. |

| Employee Classes | Employers can offer ICHRAs to specific classes of employees and not to others, or offer different allowance amounts to different classes. | No employee classes. Employers cannot discriminate. The benefit must be uniformly provided to all eligible employees. |

| Use for Premiums and Medical Expenses | Can be used to reimburse premiums for individual health insurance and Medicare, as well as other qualified medical expenses. | Can be used to reimburse premiums for individual health insurance and other qualified medical expenses, but not for group health plan premiums. |

Direct Primary Care (DPC)

Direct primary care (DPC) is a healthcare model that provides patients with a monthly subscription that covers unlimited primary care visits and services.

DPC eliminates the need for insurance for primary care, so there are no deductibles, copays, or coinsurance costs.

DPC doctors generally do not take insurance at all because it is more efficient for them to focus on providing high-quality care to their patients without the administrative burden of billing insurance companies.

DPC is a good option for patients who want affordable, high-quality primary care. It is also a good option for patients who have chronic conditions or who need frequent medical care. DPC can save patients money on their healthcare costs, and it can also improve their quality of care.

Some other advantages of DPC include:

- Email access to doctors

- No deductibles to meet

- No per-visit copays

- No coinsurance

- As many visits as necessary with no additional cost

- More face time with your doctor

- Shorter or non-existent wait times

- Easy access to doctors via telemedicine

Note: DPC memberships aren’t meant to be a single-solution employee benefit. They don’t include hospitalization costs, trauma care, ER care, surgery costs or specialist treatment. They are not a substitute for a good health sharing plan or health insurance policy.

However, If you are looking for a more affordable and convenient way to access primary care, and you need to see your doctor regularly, or you just want a better overall healthcare experience, direct primary care may be a good option for you.

Learn More: Why Smart Employers Are Dropping Health Insurance for Individual HRAs + DPC

Combining Health Sharing Plans With Direct Primary Care

Joining DPC and health sharing can lead to significant savings because you won’t have to duplicate coverage for the same services.

Health sharing plans don’t cover primary care, but they do cover the costs of more expensive services like specialist visits, surgeries, and hospitalizations. DPC plans, on the other hand, provide comprehensive primary care coverage.

By pairing these two options, you can have the best of both worlds: affordable coverage for expensive care and high-quality primary care.

LEARN MORE: The DPC DIRECT Health Sharing Plan Is Designed Specifically for Direct Primary Care Patients

Max Your Tax Savings With Health Savings Accounts (HSAs)

Health Savings Accounts, or HSAs, can be a valuable tool for freelancers, independent contractors, and self-employed workers to save money on their medical expenses.

In fact, HSAs may be the most powerful single tool in an individual taxpayer’s arsenal. They provide a unique triple tax advantage that is unrivaled by any other tax-favored account the law allows:

- Contributions are tax-deductible. This means that you can save money on your taxes now by putting money into your HSA.

- The money in your HSA grows tax-deferred. This means that your money can grow over time without being taxed.

- Withdrawals are tax-free for qualified medical expenses. This means that you can use the money in your HSA to pay for qualified medical expenses without having to pay taxes on it.

HSAs are a great way to save money on your health care costs and can be a valuable asset for self-employed individuals and small business owners.

HSAs allow individuals to set aside money from their earnings before taxes are taken out. This money can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. HSAs can also be used to pay for some health insurance premiums.

Employers may also contribute to their employees’ HSAs. In North Dakota, employer contributions to employees’ HSAs are fully deductible under federal income tax. They also reduce employer payroll taxes as well.

HSAs can be a great way for self-employed individuals and small business owners to reduce their income tax liability and save money on your medical expenses.

If you are self-employed or a small business owner, it is a good idea to talk to your accountant about contributing to an HSA. HSAs are a great option for North Dakota residents looking for ways to save money on health care costs.

How To Combine Health Sharing With an HSA

The HSA SECURE plan is a unique health sharing plan that maintains an employee’s eligibility for making pre-tax contributions to a health savings account.

This is an excellent way to combine the tax and healthcare benefits of a health savings account with the cost-saving benefits of health sharing.

The catch: to enroll in HSA SECURE, you must be a business owner, independent contractor with 1099 income, or have verifiable income from self-employment.

HSA SECURE is a great affordable alternative for freelancers and independent creatives consultants, and contractors.

For employers, with HSA SECURE may work as an option for your employees who also have side hustles or independent income. It may also be a great money-saving option for you and your partners as small business owners.

It won’t work for straight W-2 employees, though. For HSA SECURE to work well in a group setting, you will need to offer some additional options for workers who do not have self-employment or independent contractor income.

Plan Design: Address All Levels of the Care Pyramid

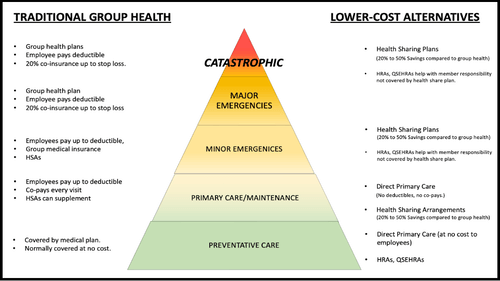

A comprehensive employee health benefits package should provide coverage for each level of the Employee Healthcare Pyramid, illustrated below.

The pyramid represents the full spectrum of care that individuals need, from basic preventive services to primary care for ongoing health maintenance and early detection of potential issues, to catastrophic coverage in the event of a serious illness or injury.

This ensures that employees have access to the care they need when they need it, without having to worry about the cost. It also helps to protect employees from financial ruin in the event of a major health emergency.

The same is, of course, true for independent contractors, freelancers, and anyone without an employer to pay your health insurance, health sharing, or other benefit costs. You’ll just need to line up these various types of benefits on your own.

The Employee Healthcare Pyramid

As shown in the below diagram, a good employee health benefit package should cover all levels of the Employee Healthcare Pyramid, from routine preventive health care to primary care for maintenance, early detection of health issues, and catastrophic incidents.

On the left of the illustration, you’ll find common traditional insurance-based solutions that address each level of the Employee Healthcare Pyramid.

These solutions are typically designed to cover the costs of doctor’s visits, hospital stays, prescription drugs, and other medical expenses.

On the right side, you’ll find a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level. These options may include health sharing plans, health reimbursement arrangements (HRAs), and direct primary care (DPC) plans.

It’s important to have a good plan design that provides employees with affordable solutions at each of these levels. This helps ensure that no employee has to delay or go without care because they can’t afford a premium, coinsurance, or copay.

Your Personal Benefits Manager can help you create a custom plan design for your workforce that provides a solution at each level of the Care Pyramid — often at a fraction of the cost of a traditional group plan to the employer.

Need Help?

Are you ready to take action to reduce your overall healthcare cost and take back control of your money and your healthcare?

Contact HSA for America to receive a free, no-obligation business health plan analysis and recommendation.

We can help you find some creative and affordable alternatives to overpriced conventional insurance strategies, give you and any employees more freedom to choose your own doctor, and save up 30% to 50% compared to the unsubsidized cost of traditional health insurance policies.

For Further Reading

HRA For America Saves Small Businesses Thousands in Healthcare Costs

How To Compare Health Sharing Programs and Limitations: A Comprehensive Guide

Health Sharing for Small Businesses: What Business Owners Need to Know

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | About Us | Contact Us | Agents Needed

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

Telephone: 800-913-0172

[email protected] | © 2024 - All Rights Reserved

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of actual price is subject to Carriers.