GA Small Business Health Insurance Options

HSA Guide Complete for GA Small Business Health Insurance. This guide is targeted at Georgia small businesses with less than 30 employees.

This document will help independent professionals and small business owners provide their staff with health care benefits that are cost effective. To remain competitive you must offer benefits that are attractive to the talent you want and the package of compensation necessary to retain them.

GA Small Business Health Insurance Benefits Options

There are many options available to small businesses in Georgia when it comes time to provide health insurance to their employees.

The most popular, and by far the most costly, option is to use a group health plan.

The cost of group health insurance sponsored by employers for a family and worker varies depending on age. According to from the Kaiser Family Foundation the average cost in 2021 will be $22,282, which is about $900 higher than the national average.

Georgian employees contribute an average of $6,387 to their insurance, which is a bit more than $200 above the national average.

Georgia businesses can also reduce their expenses by utilizing a number of options. This includes:

- Health savings Accounts (HSAs)

- HRAs are health reimbursement plans.

- Direct Primary Care (DPC), memberships

- Programs for health sharing

Depending on the type of business you have, how much money is available to spend, and what your employees’ medical conditions and age are, there will be many variables that determine which strategy works best for your small company.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

GA Small Business Health Insurance: Geographical Considerations

Georgia has a unique healthcare system that includes not only the busy metropolises of Macon, Atlanta, and Savannah but also more rural regions around Hinton, Sparta, and other places.

Georgia employers should consider how to distribute their employees throughout the entire state. The executives of a company headquartered in Savannah may be tempted to select an HMO which restricts their employees to only seeing doctors within the network. However, many of these workers live and work outside of this network in Riceboro.

GA Small Business Group Health Insurance

Georgia’s employers most commonly choose the traditional group health plan.

It is also one of the most pricey.

The following is an explanation of how the system works:

-

A third-party insurer, usually a corporation that makes money from insurance policies, is contracted by an employer to provide health benefits for its employees. If the employer so desires, they can also include their dependents.

-

All employers that have at least 50 employees are required to offer ACA-qualified insurance plans for employees that work over 30 hours each week. If they don’t, then there is a fine.

Health insurance plans must include the 10 minimum essential coverages required by the Affordable Care Act. The ten essential coverages (MEC) are as follows:

- Ambulatory Patient Services (outpatient services you receive without having to be admitted into a hospital).

- Emergency services

- Hospitalization is a term used to describe a hospital stay (such as surgery or overnight stays).

- Care of the newborn, both before and after delivery, as well as pregnancy, maternity and newborn care

- An ambulatory service is an outpatient treatment that you can get without going to the hospital.

- Services related to mental health, substance abuse disorder and behavioral health (such as psychotherapy and counseling)

- Prescription drugs

- Rehabilitative devices and services (devices that assist people with chronic illnesses, injuries or disabilities to gain mental and physical skills.

- Laboratory services

- Prevention and Wellness Services and Chronic Disease Management

- Dental and Vision coverage for adults isn’t an essential benefit.

The ACA also requires that health insurance cover birth control and breast-feeding.

Traditional health insurance for business is expensive, but it has the benefit of guaranteed enrollment.

The insurance company can’t deny coverage or raise the premiums if the employee enrolls in the initial enrollment phase when they qualify, during a period of special enrollment triggered by an event that qualifies, or at the open enrollment beginning on November 1st each year.

GA Small Businesses Can Choose to Offer Health Insurance

According to the Affordable Care Act (ACA), employers who have fewer than fifty employees do not need to offer any health coverage.

Georgian law has no such requirement. It is not mandatory to offer any health coverage if your company has fewer 50 employees.

The penalty is not applicable to you.

But it is a good idea to offer health care benefits to all companies, including small ones. Without them it could be very difficult to find and retain employees.

Georgia has a low unemployment rate and fierce competition between employers to find talent.

Georgia employers have the potential to save lots of money through a Medical Cost Sharing or Health Share Plan (read more below) where you pay some, or all, of your employee’s medical costs.

The HRA Alternative

If you prefer, your small business can provide a Qualified Small Employee Health Reimbursement Agreement (QSEHRA) to help employees purchase their own personal health insurance. This arrangement is tax-free.

QSEHRAs offer the following advantages to employers:

1.) There are no minimum contributions

QSEHRAs do not require you to make a certain minimum amount every year like pension plans. Employers can choose their own HRA budget, which they may change each year depending on cash flow.

QSEHRAs allow you to manage your healthcare budget.

2.) Flexibility.

It is possible to offer different amounts to employees depending on their marital and family status. It is possible to discriminate and offer a bigger benefit for employees with children than those who do not have any.

3.) The tax exemption is available to both employees and employers.

You can deduct your contributions as compensation expenses. Contrary to cash compensation, however, the QSEHRA will not be taxed by your employees as long as they keep a health plan which includes 10 essential benefits specified under the Affordable Care Act.

In this case, a QSEHRA would be a better option than just offering health insurance to employees. They can then use the money for other purposes or even purchase health insurance.

4.) QSEHRAs are designed to support the employee’s choice

In many cases, traditional health insurance group plans are designed to limit employees with a variety of circumstances and backgrounds into one or only two insurance choices.

These products are frequently overpriced and unsuitable because the HR team and managers choose these, not workers.

QSEHRAs give workers, their families and employers a greater range of health plans to choose from.

GA taxed employer health coverage

Under federal and Georgia laws, the health insurance premiums paid by employers are fully deductible as a business cost. Also, they are not taxable by the employee.

The overall cost of health-sharing plans is lower. Employees can deduct the monthly costs. Employer assistance to pay health-sharing costs is taxable for the employee.

GA Employer Group Health Insurance: Disadvantages

The traditional group employer health insurance is not without its disadvantages, both for the employers and their employees.

- The Cost is much higher

Overkill is a major factor in the high cost of traditional health insurance. Washington and Atlanta government officials have loaded policies up with coverages and requirements which make no sense to many employees.

Typical health plans include benefits such as mental and drug addiction coverage. They also cover maternity. But many employees don’t require or want these.

The result is that they are much less effective and economical than needed.

- Inflexibility

Many group health insurance programs are a one size fits all strategy. This may not be able to adequately meet the budget and needs of each employee. Group health insurance programs sponsored by the employer tend to be one-size fits all and may not adequately address specific employee needs or budgets.

Some workers may find it more cost-effective to purchase their own health insurance plan through the private market, taking advantage of subsidies under the Affordable Care Act.

Below are some alternatives to health insurance that may be less costly. They can also be an excellent solution for those who have no health conditions and are otherwise in good health.

Below, we discuss health sharing plans in greater detail.

- Administrative burden

Administrative costs are high when managing a comprehensive health plan. It involves managing documents and compliance, auditing the plans to make sure employees are not enrolling non-qualified individuals into the plan and answering questions from staff. This is essential for a health insurance plan to run smoothly within an organization.

They are a burden for very small companies who do not have enough employees to support a full time HR team to manage the plan.

They encourage them to take out their own policies through Affordable Health Care Act. This could help employees to benefit from subsidies. The process also eliminates the need for the employer to be involved, thus reducing administrative and overhead costs.

Georgia has Health Sharing Plans

Georgia’s small businesses have an alternative that is more affordable than expensive health insurance.

Georgian companies are increasingly using medical cost share plans to replace traditional group health care plans. These plans offer an economical alternative. When switching from health coverage to health sharing, businesses can typically save up to 50% on their premiums.

Georgia Small Businesses could potentially save over $10,000 per annum per employee, for family coverage and over $3,500 annually for single coverage.

These innovative programs allow employers to offer employees high-quality health care, while still controlling costs. These programs are based on the idea of sharing resources with a large group of individuals or organizations.

As an alternative to traditional health insurance that involves payment of premiums, the participants in a Health Sharing Program make a set amount per year.

Health Sharing Plans vs. Health Insurance

It is important to note that health share plans and insurance are two different things.

Health sharing associations are not insurance companies, but voluntary groups of individuals who have agreed to pay for the medical bills of others. As opposed to for-profit health insurers, health sharing ministry is a non-profit organization.

The Mandated Coverages

Health insurance plans are not required to meet these requirements. The health sharing organization is not covered by the ten minimum essential coverage requirements.

The cost of treatment for drug addiction is not covered by medical cost sharing plans for those who do never take drugs. The plans do not have to pay the costs of injuries caused by drunk driving.

What about pre-existing conditions?

The waiting period for certain surgeries is often very long, except in cases of injuries or accidents which were unforeseeable at the time of enrollment.

This waiting period helps eliminate a large amount of adverse selection. It also allows the health sharing organization to provide a wonderful set of health benefits at a fraction of what it would cost for a group insurance policy that is not subsidized and meets the requirements of the Affordable Care Act or a plan purchased through the Healthcare.gov exchange online in Georgia.

Please note that health sharing plans do not qualify for subsidies as part of the Affordable Care act. However, the savings are so significant that switching to a health sharing plan is still beneficial for many, regardless of whether they qualify for an Affordable Care Act subsidy.

Georgia employers may find that switching to health-sharing is even more beneficial, since small group plans do not qualify for a tax credit under the ACA.

Request a Group Quote for Your Company

Health Sharing and Network Restrictions In Georgia

Health sharing plans can offer greater choice in healthcare providers compared to traditional managed-care plans. HMOs and the PPO are two of the most popular employer sponsored group health insurance programs.

In Georgia, most health sharing organizations do not require patients to use providers within their network. Members of the health sharing plans have the option to pick their own provider. Having the option to choose their own doctor is important.

Does your business need to offer health sharing?

Each business is unique. It takes careful consideration to choose the right plan for your business, regardless of whether you’re using a health sharing plan or traditional group insurance.

It’s simple for Georgia business owners to receive a complete case analysis with recommendations specific to their organization and employees.

Just click here and make an appointment to meet with one of the experienced personal benefits managers licensed in Georgia.

Prepare a list of employees.

Most often, switching employees to a health plan can result in savings of thousands of dollars. It may be that health sharing would not make sense if employees are pre-existing.

You can always consult with us and get an analysis for free.

GA Small Business Health Insurance Health Reimbursement Programs

The Health Reimbursement Arrangements, or HRAs as they are also known, is a benefit funded by the employer that allows employees to receive tax-free reimbursement for healthcare expenses.

Georgia small businesses often simply do away with the benefit of group health insurance. Instead of establishing an HRA, the small businesses use it to give their workers cash so they can buy individual insurance with money pre-taxed.

Workers can then take advantage of the subsidies available, which further reduces the cost net for both employee and company.

The HRA can be used to pay out of pocket costs like prescriptions, copays, deductibles and durable equipment. HRAs are also tax-free.

When you offer an HRA as a replacement for formal group health coverage, employees have the option to pick and choose health insurance that meets their individual needs.

Click here to learn more about HRAs for small businesses.

QSEHRA—HRA for Small Businesses

QSEHRA, or the Qualified small employer health reimbursement arrangement (pronounced “Cue Sarah”) is a type of HRA that can be used by small businesses.

The benefit is for employers with less than 50 employees full-time or equivalent and those who do not offer any traditional group health plan.

Within certain limitations, businesses are allowed to determine their own QSEHRA maximum allowances. Georgia employers will be able to contribute as much as $5,850 per employee (upto $487.50 per monthly) in 2023.

The employees use this money to buy their own health insurance through the online exchange or a Personal Benefits Manager on the market for individual and family insurance. The employee retains the right to a subsidy that they wouldn’t get if their employer paid for group health insurance.

You can choose to reimburse employees’ health insurance premiums only or their premiums and any additional medical costs.

QSEHRAs, Special Enrollment periods and the Qualified Self-Employed Health Reimbursement Account

Employees will be eligible for a Special Registration Period if you choose to cancel your insurance and replace it by an HRA. It’s a 60 day window in which your employees are able purchase their ACA-qualified health insurance with guaranteed-issue rights without going through any medical underwriting.

If you choose to switch from a group health care plan entirely to a QSEHRA, your employees won’t be affected by the change.

HRA Advantages

Health Reimbursement Arrangements have many benefits.

You can deduct the money that you spend for HRA benefits, and your employees will not pay any tax on it.

HRA is your money, and you retain it until the funds are actually distributed to employees. This money remains in your account as an operating capital. No third parties are required.

HRAs are designed with a lot of flexibility by the employer, including which expenses they will cover.

Employees don’t lose their health insurance coverage when they quit the company or switch to contractor status. The QSEHRA gives the worker control over his/her insurance plan. Employer not.

HRA Disadvantages

Not all workers want the responsibility of having to research and choose their own health insurance plan. Some workers may need extra help navigating the transition.

The Personal Benefits manager at HSA for America is available to provide assistance. Then no employee will get left behind.

Simply have your workers select this link and make an appointment or call 800-913-0172.

Click here if you want to know more about Georgia small-business health insurance alternatives.

Direct Primary Care: The Advantage

Direct Primary Care plans are a new alternative to traditional healthcare that is gaining popularity across Georgia.

Membership-based: For a monthly flat fee that is affordable, just like gym memberships, you can provide your employees with as many appointments as needed, in person or by telehealth.

DPC offers a monthly membership cost of only $80 for those who want to prioritize their health and avoid the copays and coinsurance.

DPC Plans provide unlimited access to primary care, chronic and preventive services.

Direct primary care services include the following:

These are the services that Direct Primary Care physicians commonly provide:

- Preventive care. DPC doctors are committed to preventive care and offer routine screenings, immunizations and checkups.

- DPC Doctors treat injuries and illnesses that are acute, including infections, colds, influenza, minor injuries, skin conditions, and more.

- Chronic disease management. DPC doctors assist patients in managing chronic conditions such as hypertension, diabetes, arthritis and more. These doctors offer ongoing treatment, monitor patients, and adjust their plans of care as required.

- Comprehensive physical exams. DPC Doctors offer a thorough physical exam to assess your overall health and identify any potential health risks. They also provide personalized health advice.

- Urgent care. DPC’s doctors can often provide urgent care the same day or even next day.

- Patients can receive immediate attention to non-emergency issues by making appointments.

- Diagnostic and laboratory services. DPC physicians may coordinate or offer a wide range of diagnostic and laboratory services, including blood tests, urine analyses, imaging studies, (X-rays, ultrasounds), electrocardiograms, etc.

- Management of medication. DPC doctors are able to prescribe medication, track their effectiveness and adjust as necessary. The doctors also offer education on the proper use of medications.

- Mental Health Services As part of comprehensive health care, many DPCs offer mental health services. DPC physicians may offer counseling, therapy and refer patients to specialists in mental health when needed.

- Minor procedures. DPCs are equipped to carry out minor surgeries in their own offices.

- Care coordination and/or referral. DPC’s doctors coordinate and advocate for their patients, coordinating with specialist physicians, hospitals, and healthcare providers to ensure that referrals can be made when they are required.

No insurance companies are involved so there is nothing to worry you about in terms of co-payments. A monthly subscription will cover all costs. So, workers with limited funds can receive immediate medical attention. Never again will workers have to avoid seeing their doctors because they cannot afford the deductible and co-payment.

In order to get coverage for services that DPC does not cover, patients may choose from supplementary plans like high-deductible plans, accident insurance or health sharing plans. DPC’s membership already includes routine care, so patients are able to choose more affordable coverage, like health sharing, than traditional health insurance.

Health Savings Accounts (HSAs)

HSAs (Health Savings Accounts) can be very powerful tools to help workers manage their medical costs, as well as to help keep premiums lower for workplace health insurance plans.

Georgia businesses and residents need all the tax breaks they can receive. It’s good to know that employer contributions made by employees into their Health Savings Accounts are fully deductible from Georgia corporate income taxes as compensation expenses.

HSAs allow individuals to set money aside before taxes in order to pay for medical expenses down the road. HSAs are open to both employees and employers, subject to a limit set by Congress to reflect the rising cost of living.

HSAs offer tax-deferred earnings on money that is deposited, while withdrawals for qualifying healthcare expenses are free of tax.

HSA Qualification

To qualify to participate in an HSA as well as to benefit from employer-paid pretax contributions towards the HSAs, you must have a high-deductible health plan.

IRS definition of a High Deductible Health Plan for 2023 is any plan having a deductable at least $1,000 for a single person or $3,000 for family.

HDHPs cannot have an annual total of out-of-pocket expenses that exceeds $7,500 or $15,000. These limits do not apply for services rendered outside the HDHP network).

How can I combine HSAs and health sharing plans?

Only one health-sharing plan, the HSA SECURE, is currently available from HSA for America.

HSA SECURE Plan allows you to take advantage of the health-saving benefits and tax savings that come with a health saving account, while also combining them with those of health sharing.

You must be a self-employed business owner or have earned some income as a sole proprietor to qualify for the plan.

HSA SECURE cannot be used by employees with a straight W-2. HSA SECURE could work well for your employee or spouse if they have their own small business, side gig, freelance or other type of employment, are healthy, and do not suffer from any pre-existing medical conditions.

HSA SECURE Plans are also an excellent way for small business owners to save on expenses.

HSA SECURE would require your employees to register on their behalf. After they’ve established their HSAs, you are able to make pre-tax payments on behalf of your employees, subject to the limits set by Congress each year.

GA Small Business Health Insurance Benefits Taxation Rules

After you’ve learned a little bit more about all the other options that are available for small business owners in addition to health insurance as it is known today, we have a short table showing how they will be taxed.

Plan Type Employer Workers

Traditional health insurance premiums Tax deductible. May qualify for a tax credit (see below) Non-taxable

HSA contributions Tax deductible

Pre-tax, up to certain limits. No income limitations.

Health sharing costs Tax deductible as a compensation expense Taxable as ordinary W-2 income

Health reimbursement arrangements Tax deductible Benefits are non-taxable to the employee

HSA withdrawals N/A

Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income.

A 20% penalty for non-qualified withdrawals applies up until age 65.

Direct primary care costs

Tax deductible as a compensation expense Taxable to the employee

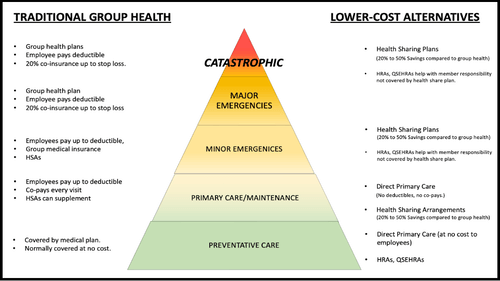

Care Pyramid for GA Small Business Health Insurance

A good employee health benefits package should address all levels of the Employee Healthcare Pyramid – from routine preventive care, through primary care access for maintenance and early detection of health problems, all the way through catastrophic incidents, as shown below:

On the left, you will find a list of common solutions based on traditional insurance that can be used to address the different levels of the Care Pyramid.

The right side of this page lists a few alternatives that are more cost-effective and provide meaningful protection to employees on each individual level.

Plan design that is good provides solutions to employees on each of these levels. It is important that there are no employees who have to go without or delay treatment because they simply cannot afford premiums, coinsurances or copays.

You can work with your Personal Benefits Manager to create a customized plan for each employee that addresses the Care Pyramid at the appropriate level. These plans are often a fraction of what a standard group plan would cost the employer.

GA Small Business Health Insurance Tax Credit

Small Business Health Care Tax Credit enacted along with ACA is a credit that allows for some small businesses up to 50% federal tax credits on employee health insurance.

It is meant for businesses who employ fewer than 25 people and are more likely to use lower-wage employees.

Both for-profits and non-profits can generally claim this credit.

* Less than 25 employees with an average annual salary around $53,000, excluding salaries for all the owners. The average number of employees is calculated without including the owners. The “full time equivalents” are used to determine the total number of workers. This means that two employees working half time would equal a full-time employee.

* You must pay at least half the premiums of your employees.

The Affordable Care act-qualified insurance coverage is available through the Georgia state exchange.

Once an employer has 25, employees, or if the average salary is $53,000 or more

What is the process for claiming credit?

This tax credit can be claimed on your income tax returns with IRS Form 8941 attached (tax-exempt businesses are required to submit a Form990-T to make a claim even though they do not have to).

Taxes on your contributions to employee health care aren’t applicable.

It’s not true that I owe tax for my company this year. Can I still claim a credit for tax?

Yes. It is possible to carry this tax credit back to offset tax owed in the preceding year.

This credit is refundable for businesses that are exempted from paying taxes.

For more information on the Small Business Health Care Tax Credit, consult your tax advisor.

Combine GA Small Business Health Insurance Strategies

When it comes to maximizing your coverage, combining different programs is a wise move.

Employers often find that by combining several different healthcare packages, they can control their healthcare costs as well as provide full coverage to all of their employees.

Combining a Direct Primary Care Plan (DPC), which covers normal primary care, with a low cost health sharing program that includes catastrophic events is one way to achieve a cost effective solution.

This alternative to traditional group health insurance can make it more affordable, either for the company or for employees.

Giving employees the opportunity to select between an HDHP HDSA plan and a health-sharing plan as well as the ability to contribute money into a Health Savings Account can provide them with more flexibility.

You Have to Do Something Now

Contact us to receive a complementary, complimentary business health plan assessment and recommendation.

An experienced HSA for America persona Benefits Coordinator will connect you with an expert who can discuss the needs of your company, employees, their ability to contribute to the plan, and preexisting medical conditions.

Many of PBMs were successful business owners themselves. Since they have been business owners, our PBMs know how important it is to hire and retain talent that will help your company remain competitive.

GA Small Business Health Insurance Frequently Answered Questions

Do I have to offer health insurance and health sharing together?

It is possible to offer the two options together, and let employees choose what plan best fits their needs.

You may fall short of the required minimum rate of participation if you have too few employees participating in a health plan. HRAs can be used to reimburse employees for their individual health coverage, which is close to that cost.

Does health sharing have a waiting period on conditions pre-existing?

Certain health sharing policies may require waiting periods to cover conditions that were present before. Review the plan’s guidelines for specific information or talk to your Personal Benefits Manager.

Is it possible to deduct employer contributions for HSAs from Georgia state income taxes?

Yes. Georgia allows employers to deduct their contributions for employee HSAs as compensation expenses from state income taxes.

How do you claim the Small Business Health Care Tax Credit ?

Businesses that earn a profit can claim a tax credit with IRS form 8941. However, small businesses who are not tax exempt will need to file Form 990T.

HSA for America cannot provide you with tax advice. Employers can consult their own tax advisors to get full details of the credit.

In Georgia, are maternity benefits included in health sharing plans?

Georgian health plans that offer health coverage and share costs often include maternity care benefits. These cover prenatal care and care during labor and delivery, as well as postnatal care. However, certain health sharing plans have limitations on the costs-sharing benefits of children who are not born to married couples.

Does Georgia have a limit on the size of the small business eligible to receive these programs?

Only employers with fewer than fifty employees are eligible for the Qualified Small Employee Health Reimbursement Arrangement. If you employ more than fifty employees or your business grows beyond 50 employees, you can choose from other HRAs.

ACA requires that you provide a health plan to your employees or face a fine. Speak to your Personal Benefits manager if you plan on hiring your 50th employee or the equivalent soon. This could have an impact on your plans.

The difference between Health Sharing and Insurance for Small Business

While health insurance plans are offered by traditional insurers, health sharing involves a group of people contributing money into a common fund for the purpose of covering each other’s medical bills.

Health Savings Accounts – How do they help Georgians manage medical expenses?

HSAs provide individuals with the opportunity to invest pre-tax dollars to help pay for future healthcare expenses. The contributions of both employees and employers could provide tax advantages as well savings on medical expenses.

Employers in Georgia can contribute to HSAs for their employees.

The annual contribution limits established by Congress apply to employers who wish to contribute to HSAs for their employees.

Offer Direct Primary Care Plan (DPC) along with other cover options for Georgia Small Businesses?

Combining DPC plans with other low-cost health coverage, such as Health Sharing Plans, can offer comprehensive and affordable healthcare solutions to both small businesses and their staff.

Does a Georgia-based business that does not have any tax debts be able to claim the Small Business Health Care Tax Credit for their small businesses?

Even if the business does not owe any taxes for a given year, it can still carry back the Small Business Health Care Tax Credit to offset the income tax liability of the previous year.

How does an HRA work?

HRAs are employer-funded accounts that reimburse employees for medical costs not covered by insurance. Employers decide what medical expenses qualify and then contribute money accordingly

HRAs can be combined with other options for coverage, such as health sharing plans and individual health insurance policies.

HRAs are compatible with other insurance options. HRAs can be used to reimburse employee premiums on individual policies. HRA funds cannot be used directly to reimburse employees for the costs of health sharing plans.

How can I determine which combination of health insurance and cost-sharing options is best for my small business in Georgia?

Avoid going it alone. You can contact a Personal Employee Benefits Manager for a no-cost analysis and recommendation. This will be based off your unique needs, current employee statistics, budgetary constraints, and existing health conditions. It is possible to create a program that provides the most value for employees at the lowest cost, and helps you stay competitive.

Read More About Group Health Insurance Options in Your State

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | About Us | Contact Us | Agents Needed

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

Telephone: 800-913-0172

[email protected] | © 2024 - All Rights Reserved

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of actual price is subject to Carriers.