Hawaii Small Business Health Insurance Options

Aloha! And mahalo for visiting the HSA for America complete guide to Hawaii health plans for independent contractors, self-employed workers, and small businesses.

This guide focuses specifically on companies with 30 employees or fewer, headquartered anywhere in Hawaii.

Who is This Guide For?

This guidebook is for any and all independent contractors, self-employed individuals, and small business owners who want to reduce needless expenditures on health benefits, while still providing significant protection and offering the benefits and compensation that you need to attract and retain akamai talent.

Overview of Hawaii Small Business Health Insurance Benefits Options

Small businesses in Hawaii have multiple options when it comes to providing health benefits to employees.

Option one, the most common, but the most expensive by far, is health insurance.

But as we all know, Hawaii is among the most expensive states to buy almost anything – and health insurance is no exception.

Fortunately, traditional health insurance is just one of multiple options for a health plan in Hawaii.

According to the most recent available data from the Kaiser Family Foundation, the average annual cost of employer-sponsored group health insurance covering a worker and family in 2021 was $21,804.

Out of that, Hawaii employees typically contribute $4,931 on average toward their health insurance, with employers covering the remaining $15,873.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

Geographic Considerations for Hawaii Small Businesses Health Insurance

It’s also crucial to take into account the unique healthcare environment of Hawaii State, which includes both busy cities like Honolulu and Pearl City as well as more rural areas around places like Makaha and Hana.

For this reason, Hawaii business owners should think carefully about how their work force is distributed around the state. It does little good for executives in company headquarters located in downtown Honolulu to choose an HMO that restricts workers and their families to seeing in-network doctors who all happen to be on Oahu when a large chunk of their employees and families live and work in Wailuku and Kaunakakai.

Health Sharing Plans in Hawaii

Health sharing plans are a viable and economical alternative to overpriced health insurance coverage for independent contractors, creative professionals, solo business owners, and Mom and Pop businesses throughout Hawaii.

That’s why health sharing is becoming increasingly popular in the Islands:

By switching from health insurance to health sharing, individuals and families who don’t get health insurance from an employer or government plan can frequently save up to 50% compared to the unsubsidized cost of traditional health insurance health insurance premiums.

And they’ll have much more freedom to choose their own doctor: health share members aren’t limited to doctors in the Kaiser Permanente network, for example.

That means Hawaii residents could potentially save more than $10,000 per year for family coverage, and upwards of $3,500 per year for single coverage.

Request a Group Quote for Your Company

How Does Health Sharing Work?

Health sharing programs work under the premise of sharing resources among a group of people or organizations.

Health sharing plans are not the same thing as health insurance policies.

Instead, health sharing organizations are non-profit associations of like-minded people who agree to help share the medical expenses of other members.

In contrast to health insurance companies, which are usually for-profit corporations, health sharing ministries are all non-profit 501(c)(3) organizations.

A Natural Pricing Advantage

While federal and state laws require traditional health insurance policies to include coverage for things that many people don’t want or need, health insurance plans have no such requirements.

For example, health sharing plans are not required to share costs for addictions treatment for people who never use drugs, for example. And they don’t need to cover the cost of treating injuries as a result of the members’ drunk driving.

Health Sharing and Pre-Existing Conditions

Unlike traditional health insurance plans, health sharing plans may impose waiting periods before they will share the costs of treating pre-existing conditions.

They often also impose waiting periods on surgeries, except for injuries and accidents that could not have been foreseen prior to the member’s enrollment.

These waiting periods eliminate a great deal of adverse selection, and help health sharing organizations provide a terrific set of benefits at just a fraction of the cost of an unsubsidized ACA-qualified group health insurance policy or one purchased via the Hawaii Health Connector state online exchange.

Note: Health sharing plans don’t qualify for subsidies under the Affordable Care Act. But the price savings is so great that many people still benefit from switching to health sharing, even if they do qualify for a federal subsidy, depending on their circumstance

Is Health Sharing Right for You?

Every situation is unique. Deciding which health sharing plan is best, or whether a traditional health insurance plan is more suitable for you, is highly dependent on your personal circumstances.

The good news is, it’s easy for independent professionals, contractors, and self-employed people in Hawaii to get a full analysis and recommendation, free of charge.

Just click here to schedule an appointment with one of our experienced Personal Benefits Managers, and we’ll start the process.

In most cases, switching to health sharing will save thousands of dollars per year for both self-only and family plans.

But if you receive a significant subsidy under the Affordable Care Act, or you have access to an employer or government plan paid for by others, and you don’t mind seeing doctors in the network that the plan sponsors have selected for you, then you may be better off sticking with traditional health insurance products.

The Direct Primary Care Advantage

Direct Primary Care plans (DPC) present an alternative healthcare model that’s rapidly gaining a foothold in Hawaii and across the country.

DPC plans provide members with unlimited access to routine primary, preventive, and chronic care services.

They’re based on a membership/subscription-type business model, similar to a health club.

In return for a flat, affordable monthly fee, you can get as many primary care visits as you need, either in person or via telehealth. There are no additional deductibles, co-pays, or co-insurance costs: Everything normally done in a primary care doctor’s office is included in the prescription.

With monthly membership costs as low as $100, DPC provides an attractive and viable approach for individuals to prioritize their health without the burden of copays or coinsurance.

DPC patients find that they have a much better healthcare experience than they do with HMOs and PPOs in Hawaii.

This is because DPC doctors don’t need to run a massive billing operation to deal with insurance companies.

Therefore, they don’t need to carry a massive load of thousands of patients per primary care doctor, as traditional fee-for-service and managed care system doctors are forced to do.

With Direct Primary Care, it’s easier to get appointments. Same-day appointments are frequently available, and next-day appointments are common – even routine for DPC practices.

And because of their smaller caseloads, doctors can spend much more time with you at each appointment.

And they work very well with health sharing plans, rather than traditional insurance, since you don’t wind up having to pay twice for access to primary care.

Most health sharing plans don’t include most primary care visits, but federal law requires it for traditional health insurance, driving up insurance premiums while providing little real insurance value.

What Do Direct Primary Care Doctors Do?

Direct primary care doctors provide a range of services, including:

- Routine checkups

- Vaccinations

- Treatment for minor illnesses and injuries

- Management of chronic conditions

- Prescription refills

- Well-woman and well-baby visits

- Sports physicals

- Telemedicine services

- Weight loss counseling

Direct primary care doctors also focus on preventive care and patient education.

They work to build relationships with their patients and understand their individual needs. This allows them to provide more personalized care and improve the overall health of their patients.

Can I combine HSAs with health sharing?

Currently, only one major health sharing plan preserves an employee’s eligibility for pre-tax contributions to a health savings account: the HSA SECURE plan, which is available through HSA for America.

The HSA SECURE plan is an excellent way to combine the tax and healthcare advantages of a health savings account with the cost saving advantages of health sharing.

However, in order to enroll in this plan, your employees MUST have some self-employed or small business income or ownership.

HSA SECURE is not available to straight W-2 employees. But if your employee or their spouse has any small business, freelance work, or side hustle of their own, and they are in good health with no preexisting conditions that need ongoing care, the HSA SECURE plan could be a great match.

And, of course, the HSA SECURE plan may also be a great money-saving option for you and your partners as a small business owner.

Your employees would have to enroll in HSA SECURE on their own. But once they’ve enrolled and established an HSA, you can make pre-tax contributions to it on their behalf, up to the annual limit Congress establishes each year.

How to Combine Multiple Hawaii Alternative Health Insurance Strategies

Combining various programs can be a smart move when it comes to protecting yourself against high healthcare costs – especially when you don’t have an employer plan, and you’re on your own for finding a health plan.

To get the broadest available protection at the lowest possible monthly cost, consider combining a Direct Primary Care (DPC) plan for normal primary care with a low-cost health sharing plan that covers major and catastrophic occurrences.

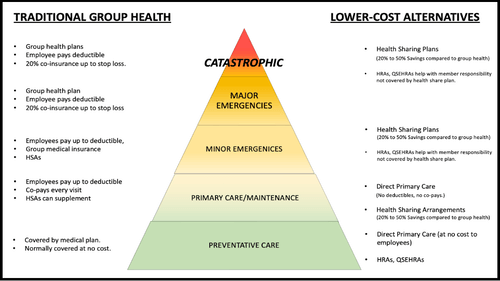

Address All Levels of the Care Pyramid

A good health plan should address all levels of the Healthcare Pyramid below—from routine preventive care, through primary care access for maintenance and early detection of health problems, all the way through catastrophic incidents, as shown below:

On the left, we list common traditional insurance-based solutions that address each level of the Care Pyramid.

On the right, we list a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level of the Pyramid.

Good plan design provides you with an affordable solution at each of these levels.

So that you never have to delay or go without care because they can’t afford a premium, coinsurance, or copay.

What to Do Now

The best course of action is to put together an employee census and Contact Us for a free, complementary business health plan analysis and recommendation.

You’ll be connected with an experienced HSA for America Personal Benefits Manager who will go over your situation with you, including a discussion of any pre-existing conditions you may have that may affect your decision.

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | About Us | Contact Us | Agents Needed

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

Telephone: 800-913-0172

[email protected] | © 2024 - All Rights Reserved

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of actual price is subject to Carriers.