New Hampshire Small Business Health Insurance Options

The Complete New Hampshire Small Business Health Insurance Guide (2026 Edition)

The HSA for America complete health plan guide for New Hampshire Small Businesses. This guide is for New Hampshire-based companies that have 30 employees or less.

The purpose of this document is to assist small businesses, independent professionals, and freelancers in providing the most effective, cost-efficient employee benefits. You can still be competitive while offering benefits and a compensation package that will keep the top talent on your team.

New Hampshire Small Business Health Insurance Options for Health Benefits

When it comes to offering health benefits, small business owners in New Hampshire can choose from a variety of options.

One of the most cost-effective, yet most commonly used, options is to adopt a standard group health insurance program.

Prices can vary depending on age. However, according to information from the Kaiser Family Foundation in 2022, an employer sponsored group health plan covering both a worker’s family and a worker was expected to cost $24,297 per year, or about $3,000 above the national average.

New Hampshire employee’s typically contribute about $30 extra, on average, to cover their insurance costs.

New Hampshire firms also have an array of options to choose from that may help them reduce their costs. These options include:

- Health Savings Accounts

- Health reimbursement arrangements

- Direct Primary Care Memberships

- Health Sharing Programs

The right strategy for small businesses is determined by a variety of variables. This includes the size of the business, available budgets, age of workers and their dependents, as well medical and health requirements.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

New Hampshire Small Business Health Insurance and Geographic Considerations

New Hampshire is a state with a very unique health care environment. This includes not only the busy areas of Nashua, Concord, Manchester but also more rural parts around Claremont and Littleton.

New Hampshire businesses should carefully examine how the work force in their state is divided. For example, it is not wise for the executives at company headquarters in Manchester to select an HMO plan that only allows workers and their dependents to see doctors within its network when many employees and their families reside and work in Riverdale.

New Hampshire Small Business Group Health Insurance

New Hampshire’s employers most commonly choose the traditional health group plan.

Also, it’s the most costly.

What’s the process?

Third-party health insurers, which are usually for-profit corporations, provide benefits to employees as well as their families if they so desire.

According to the Affordable Care act, employers with at least 50 workers must provide ACA health insurance coverage that meets the requirements of this law for any employee who works more than 30 hours a week.

Under the Affordable Care Act, the insurance plan must have the following ten essential minimum coverages. These include:

- Patients can receive ambulatory services without needing to go into hospital.

- Emergency Services.

- Hospitalization can include overnight hospitalizations and surgery.

- The care of newborns, pregnant women, and mothers (before and after the birth).

- Treatment for substance abuse disorders, mental illness and behavioral problems (including counseling and therapy)

- Prescription drugs

- The Rehabilitation and habilitative Services and Devices (services and equipment to assist people with disabilities or injuries gain mental and physical abilities)

- Laboratory services

- Chronic disease management and prevention services

- Adult dental coverage and adult vision insurance are not considered essential health benefits.

In addition, the ACA mandates that insurance policies cover contraception and breastfeeding.

Although traditional health insurance may be the most expensive choice for your business, you will have guaranteed enrollment.

In the event the worker applies for insurance during an initial period, when they are first eligible, during a specific enrollment period, such as a qualified life event, and/or during the general enrollment period, beginning in November of every year, their insurer will not be able to deny or increase the cost of coverage due to medical conditions.

Small Business in New Hampshire Do Not Need Health Insurance

In accordance with the Affordable Care Act employers employing fewer 50 people are not obliged to offer insurance.

New Hampshire does not have a similar requirement. The state of New Hampshire does not require employers with fewer 50 workers to offer any type of health insurance.

The penalty is not applicable to you.

It’s important for all employers to provide health benefits, even small ones. This is because it will be more difficult for them to attract and retain good employees without a health plan that offers a high level of competition.

New Hampshire has a low unemployment rate and employers are fiercely competing for the best talent.

New Hampshire employers could save thousands of dollars by offering an employee-paid medical plan.

HRA Alternative

You can help your employees purchase individual health coverage on an incredibly tax-free level by offering a QSEHRA, or a Qualified Small Employee Health Reimbursement Agreement.

QSEHRAs provide employers with the following benefits:

1.) Minimum contribution limit is not set

QSEHRA allows you to avoid being tied down by a fixed contribution amount each year. It is up to you as an employer to decide how much money will be allocated for HRA benefits. This budget can change every year, depending on the cash flow of your company.

QSEHRAs give you control over your health benefit budget.

2.) Flexibility

If you want to discriminate, then offer a higher or lower amount depending on the marital status of your employees. If you want to discriminate, then give a larger benefit to single employees or employees with dependents. This reflects the actual costs of buying health insurance.

3.) Employers and employees both enjoy tax-free status

As a result, your employer’s contributions can be deducted as an expense. But unlike cash, employees who receive QSEHRAs will not pay any tax as long as they have a plan with the minimum coverages required by the Affordable Care Act.

It is for this reason that a QSEHRA can be a better option than simply providing a health care stipend to the employees. They could use it to purchase health insurance, or pay other costs.

4.) QSEHRAs support employee choice

Many traditional group insurance plans limit the options available to employees who are in many different situations.

They are usually overpriced, and not suitable for employees, because HR and management choose them, and not the workers.

The QSEHRA gives workers and their family a much wider range of choices and allows them to choose the best health care plan for themselves.

New Hampshire Taxes Employer-Sponsored Health Insurance

As an employer, you can deduct the full amount of health insurance premiums paid as part of your business costs under federal law as well as New Hampshire’s state law. Also, they are not taxed to employees.

Overall, health sharing plans have lower costs. The employee can also deduct their monthly cost. Employees are taxed on employer-paid health costs.

New Hampshire Employer-Group Health Insurance: Its Disadvantages

There are some disadvantages of traditional health care for employees and employers.

- The Cost

We have already mentioned that the cost to provide health insurance is high. This can be especially true for industries with a large labor force, where costs per employee are higher than revenue.

Some of the reasons why health insurance is so expensive are due to overkill. Washington, Concord and other government agencies have added requirements and mandatory coverages into health policies. This makes little sense for a lot of workers.

You can find out more about the benefits of traditional health care by clicking here.

As a result, they’re less efficient and more expensive than you need them to be.

- Inflexibility

Many group health insurance programs are a one size fits all strategy. This may not be able to adequately meet the budgets and needs of individual employees. Group health insurance programs sponsored by the employer tend to be one-size fits all and may not adequately address specific employee needs or budgets.

Some workers may find it more cost-effective to purchase their own health insurance plan through the private market, taking advantage of subsidies under the Affordable Care Act

A less expensive plan of health sharing, as discussed in the following paragraphs, may suit them better. The innovative, affordable, and flexible alternatives to traditional health insurance are a good solution, especially for healthy workers without pre-existing medical conditions.

The following sections will discuss in detail health sharing plans.

- Administrative burden

Administrative costs are high when managing a comprehensive health plan. It involves managing documents and compliance, auditing the plans to make sure employees are not enrolling non-qualified individuals into the plan and answering questions from staff. This is essential for a health insurance plan to run smoothly within an organization.

They are a burden for very small companies who do not have enough employees to support a full time HR team to manage the plan.

Business owners may also use strategies like Health Reimbursement Arrangements or health care stipends.

They encourage them to take out their own policies through Affordable Care. This could help employees to benefit from subsidies. The process also eliminates the need for the employer to be involved, thus reducing administrative and overhead expenses.

New Hampshire Health Sharing Plans

New Hampshire’s small business can find health sharing plans to be a cost-effective and affordable alternative to the expensive coverage of traditional insurance.

New Hampshire companies are turning to medical cost sharing programs as a cheaper alternative for group health insurance. Switching from group health insurance plans to medical cost sharing can often save companies up to half on the premiums.

Small businesses in New Hampshire could potentially save upwards of $10,000 per annum per employee, for family insurance, or $3,500 annually for single-coverage.

These innovative programs allow employers to offer employees high-quality health care, while still controlling costs. These programs are based on the idea of sharing resources with a large group of individuals or organizations.

As an alternative to traditional health insurance which requires paying premiums, Health Sharing Programs allow participants to make a set amount of cash per year.

Health Sharing Plans vs. Health Insurance

It is important to note that health share plans and insurance are two different things.

Instead, they are groups of individuals who have agreed to assist in paying for the medical bills of others. As opposed to for-profit health insurers, health sharing ministry is a non-profit organization.

Mandatory Coverages

Health insurance plans are not required to meet these requirements. Health sharing organizations are exempt from the ten minimum essential coverage requirements.

The cost of treatment for drug addiction is not covered by medical cost sharing plans for those who do never take drugs. The plans do not have to cover injuries that result from drunken driving

Pre Existing Conditions

Health sharing plans are different from traditional insurance policies in that they may require waiting periods to share costs for pre-existing condition treatment.

Many also place waiting periods in front of surgeries. These are usually only applicable to accidents and injury which were unforeseeable at the moment a member enrolled.

They also help to reduce adverse selection. These waiting periods are a good way for Health Sharing Organizations to provide a comprehensive set of benefits, at a fraction on the cost of a subsidized ACA-qualified health insurance group policy.

The Affordable Care Act does not provide subsidies for health sharing plans. The price difference is significant enough that switching to health sharing can still be beneficial for many, regardless of whether they qualify for subsidies.

New Hampshire employers are often better off switching to a health sharing program, as small-group health plans no longer qualify for ACA premium subsidy.

Request a Group Quote for Your Company

Health Sharing and Network Restrictions in New Hampshire

In contrast to managed care arrangements such as PPOs and HMOs, the majority of employer sponsored health plans provide more options when selecting healthcare providers.

New Hampshire’s health sharing organizations do not typically restrict access to network providers. As a result, the members of a health-sharing plan are free to choose any physician or specialist they wish. The freedom of choice for people to choose their doctors.

Do You Need Health Insurance for Your Employees?

Every business has its own unique characteristics. The best plan to use, be it a traditional health insurance group plan or the health sharing option, requires careful evaluation.

Good news! It is easy to obtain a case study and specific recommendations for your business and staff in New Hampshire.

We’ll get started by clicking here, to schedule an appointment with a Personal Benefits Manager licensed in New Hampshire.

A prepared employee count will be helpful.

Switching to health insurance can save you thousands per employee. However, health sharing might not be the best option if there are employees with pre-existing illnesses.

You can always consult with us and get an analysis for free.

Small Businesses In New Hampshire Can Get Health Insurance Reimbursement

Employees can receive a tax-free reimbursement of healthcare costs through Health Reimbursement Arrangements.

New Hampshire’s small businesses often simply do without the health care benefit. Instead of establishing an HRA, small businesses in New Hampshire use it to offer their workers money for purchasing individual health insurance using pre-tax dollars.

It allows employees to benefit from available subsidies, further reducing net costs both for the company as well as the employee.

Workers can access their HRA benefits if any money remains after they pay the premium. This includes deductibles for prescriptions as well as durable medical equipment, co-pays and prescriptions. HRA is tax-free.

An HRA is a great alternative to formal group health insurance because it allows your employees to pick the plans they prefer.

Click to read more about HRAs and small businesses

HRA for Small Businesses – QSEHRAs

QSEHRA, or the Qualified small employer health reimbursement arrangement (pronounced “Cue Sarah”) is a type of HRA that can be used by small businesses.

The plan is intended for businesses with less than or equal to 50 full-time staff members, who are not covered by a standard group health care insurance.

Business owners can set the maximum QSEHRA amount they wish to contribute, as long as it is within certain parameters. New Hampshire employers are allowed to make contributions up until 2023 of up $5,850 (up $487.50 each month for an individual employee) and up $11,800 (up $983.33 monthly for employees who have a family).

These employees can then use their money to pay for insurance themselves via an Health Insurance Exchange site, or via a Benefits Manager . In this way, employees can keep their subsidy eligibility.

The employer can decide to pay the employee’s premiums for health insurance only or also reimburse them for any extra medical costs.

Special Enrollment Periods and QSEHRAs

Your employees are eligible for Special Enrollment when you replace your existing health plan with HRA. This 60-day period allows your employees to purchase their own ACA qualified insurance plans with guaranteed issue without having to go through medical underwriting.

HRA Advantages

Health Reimbursement Arrangements offer many advantages

Your employees are not taxed on the amount you spent for HRA benefits.

HRAs are not paid to the workers until you give them control. The money is available as operating capital. The money does not have to be held by a third-party.

The HRA benefit can be designed by employers in a way that suits their needs, and includes what costs you’re willing to cover.

When workers change status from employee to contractor, their coverage of health insurance isn’t affected. With QSEHRA’s approach, each worker is the owner of his or her own insurance policy and can control it. Not the employer.

HRA Disadvantages

Workers may not be interested in the idea of choosing and researching their own health plan. Some workers could need some extra assistance in navigating this transition.

Your HSA for America personal benefits manager is ready to assist you. No worker will be left behind.

To schedule an individual appointment, have your employees Click this Link or call 1-800-913-0172.

Click here to learn more about alternatives to employer-sponsored health insurance for New Hampshire small businesses.

Direct Primary Care Benefit

Direct Primary Plans (DPCs) represent an alternative healthcare system that is becoming increasingly popular in New Hampshire, and throughout the United States.

A membership model works: for a fixed, monthly, affordable fee, just like an gym membership, employees are able to receive as much care as they want, either by phone or in person.

DPC is a great option that allows individuals to focus on their health with a low monthly cost.

DPC plan members have unlimited access primary, chronic, and preventive care.

Some of the services that are commonly offered by primary direct care include:

The following are some medical services provided by direct primary care doctors.

- Preventive care. DPC’s doctors focus on preventive medicine. They offer services including routine health checks, vaccinations, and screenings.

- DPC’s doctors provide acute care for minor injuries and illnesses such as infection, colds, influenza, minor skin disorders, and minor injuries.

- Chronic Disease Management DPC physicians help their patients to manage chronic illnesses such as diabetes, hypertension or asthma. Patients receive ongoing monitoring and treatment adjustments as necessary.

- Comprehensive physical exams. DPC Doctors offer thorough physical exams that assess your overall health and identify any potential health risks. They also provide you with personalized health advice.

- Urgent care. DPC’s doctors can often provide urgent care the same day or even next day.

- Appointments allow patients to get prompt medical attention when they have non-emergency problems.

- Lab and diagnostic services. DPC doctors can offer or coordinate laboratory testing, such as bloodwork, urine analysis and imaging tests (X-rays and ultrasounds) along with electrocardiograms.

- Medicine management. DPC physicians can prescribe medications and monitor their efficacy, making adjustments if necessary. Also, they provide counseling and education about medication use.

- Mental health services Mental health is often included in DPC care. DPC doctors can provide therapy, counseling and even refer you to mental specialists when required.

- Minor Procedures. DPC doctors can perform some minor procedures at their offices, including suturing wounds, skin lesion removal, injections of joints, etc.

- Care coordination and referrals. DPC doctors are patient advocates who coordinate care and refer patients to specialists, hospitals, or other providers of healthcare when needed.

There are also no co-pays or co-insurances because there’s not an insurance company. Monthly subscriptions cover everything. It allows workers who are strapped for cash to receive the medical care they need immediately. Patients no longer need to postpone their doctor’s appointments because of a high deductible or copay.

In order to get coverage for services that DPC does not cover, patients may choose additional plans like high-deductible plans, accident insurance or health sharing plans. DPC’s membership already includes routine health services, so patients are able to choose more affordable coverage, like health sharing, than traditional health insurance.

HSA Eligibility

The HSA (Health Savings accounts) is a powerful tool that can assist workers in managing their health care costs and also help to keep the premiums of workplace health insurance lower.

New Hampshire citizens and businesses are desperate for any kind of tax reduction. As compensation, New Hampshire’s corporate income tax allows employers to deduct their contributions towards employees’ Health Savings Accounts.

HSA SECURE plans are not offered to employees who receive a W-2. HSA Secure is available to employees who are self-employed, have side businesses, do freelance work or own a business. If they’re in good health and don’t need any ongoing medical care due to preexisting conditions, this plan may be the best option.

You and your small-business partners may find that the HSA Secure Plan is a fantastic way to save some money.

HSA SECURE is only available to employees who enroll on their own. If they already have an HSA established, then you can still make pretax contributions on their behalf up to the limit Congress sets each year.

Click here to learn more about HSA SECURE.

How Are New Hampshire Small Business Health Insurance Benefits Taxed?

After you’ve learned a little bit more about all the other options that are available for small business owners in addition to health insurance as it is known today, we have compiled a short table to explain how taxed each one of them.

Plan Type Employer Workers

Traditional health insurance premiums Tax deductible. May qualify for a tax credit (see below) Non-taxable

HSA contributions Tax deductible

Pre-tax, up to certain limits. No income limitations.

Health sharing costs Tax deductible as a compensation expense Taxable as ordinary W-2 income

Health reimbursement arrangements Tax deductible Benefits are non-taxable to the employee

HSA withdrawals N/A

Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income.

A 20% penalty for non-qualified withdrawals applies up until age 65.

Direct primary care costs

Tax deductible as a compensation expense Taxable to the employee

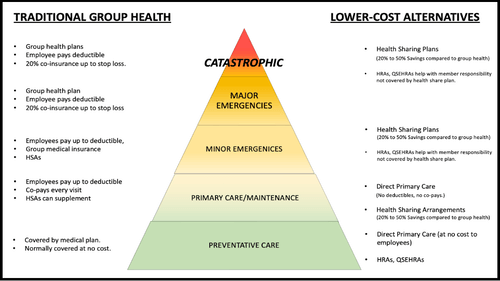

The Care Pyramid: Addressing All Levels

Employee health benefit packages should include all aspects of the Employee Healthcare Pyramid. This includes routine preventive healthcare, primary care access, early detection of problems and maintenance, right through to catastrophic incidents.

We list the most common insurance solutions for each of the levels in the Care Pyramid on the left. and on the right a variety of alternatives, which are more cost-effective, to provide meaningful protection for the employees in each level of the Pyramid.

Plan design that is good will offer employees affordable solutions on each of these levels. The plan should ensure that none of the employees are forced to postpone or skip care simply because they don’t want to pay a higher premium, coinsurance fee, or copay.

The Personal Benefits Coordinator can create for you a unique plan which provides solutions to each of the levels of the Care Pyramid. In many cases, this is at a fractional cost of an employer’s traditional group insurance plan.

New Hampshire Small Business Health Insurance Tax Credit

Small Business Health Care Tax Credit introduced with the ACA allows certain small businesses to receive a federal credit equal to up to half of employee health care costs.

Small businesses, with 25 workers and fewer who are more likely to employ lower-wage employees can take advantage of this program.

Businesses that are for-profit or non-profit can claim the tax credit.

* Employ fewer than 25 people and pay an average salary of $53,000 (excluding all owner salaries). Owners are generally not considered when calculating the average salary and number of employees for a business. The number of employees are also based on the “full-time equals”. Two half-time workers would be equal to one full-time worker.

*Paying at least 50% of employee premiums;

*You can offer coverage that meets the requirements of the Affordable Care Act on your state exchange. In New Hampshire this is Healthcare.gov (the federal website for online insurance marketplaces).

Tax credits will no longer be available to employers who have 25 or more employees or average wages of at least $53,000.

The IRS Form 8941, which is required for small tax-exempt companies to file their tax return, must be attached to your tax return.

The contributions that you make to their insurance are tax-free.

What if I do not owe any tax this year? Do I have to pay taxes?

Yes. You can carry back the tax credit to use it to offset the income tax you owed the year before or forward to offset the tax you owe over the next twenty years.

This credit is refundable for businesses that are exempted from paying taxes.

To learn all about the Small Business Health Care Tax Credit consult with a tax professional.

Combine New Hampshire Small Business Health Insurance Plan Strategies

When it comes to maximizing your coverage, combining different programs is a wise move.

Employers often find that they can reduce their costs by bundling a range of different healthcare plans while still providing full coverage to employees.

Combining a Direct Primary Care Plan (DPC), which covers normal primary care, with a low cost health sharing program that includes catastrophic events is one way to achieve cost savings.

This strategy is more cost-effective for both your business and your employees.

Employees can be given more options and lower costs by allowing them to choose between a Health Sharing Plan or an Individual Health Insurance plan. They may also have the option of funding a Health Savings Account for HDHP plans that qualify for HSAs.

Now What To Do?

The best way to proceed is by putting together a business health plan.

The HSA for America Benefits Manager you are connected to will discuss with you your workforce and family, budget needs, employee contributions, as well as any existing conditions that need to be taken into consideration when creating a new program.

Our PBMs include many successful entrepreneurs. These PBMs are business owners themselves and have a deep understanding of your requirements as an entrepreneur.

What if I offer both health insurance and health sharing?

You can provide both plans side-by-side, so that employees have the option to select which one best suits their requirements.

Please note that if a large number of employees decide to leave a group medical insurance plan you might not meet the participation requirements required to continue a policy. HRA reimbursements can be used to reimburse individual insurance costs, which are close in price.

FAQs About New Hampshire Small Business Health Insurance

Health sharing and health insurance: What’s the difference?

In the traditional insurance industry, health sharing consists of members pooling their funds together to cover one another’s medical costs.

What are the waiting periods on pre-existing condition plans?

There may be a waiting period for certain health sharing plans before the coverage is provided. You should review plan guidelines or speak to a Personal Benefits manager for additional information.

Health Savings Accounts – How do they help New Hampshire’s employees to manage medical costs?

HSAs provide individuals with the opportunity to invest pre-tax dollars to help pay for future healthcare expenses. The contributions of both employees and employers could provide tax incentives and possible savings for healthcare expenses.

New Hampshire allows employers to contribute towards their employee’s HSAs.

There are annual limits that Congress has set for employers’ contributions to HSAs.

How can I get the Small Business Health Care Tax Credit (SBHCTC)?

Tax credit claims can be made on Form 8941 of the IRS for businesses that make a profit, whereas tax-exempt businesses are required to file Form 990T.

HSA for America cannot provide you with tax advice. Employers can consult their own tax advisors to get full information about the credit.

Do health-sharing plans cover maternity benefits in New Hampshire

In New Hampshire, maternity benefits, including prenatal, postnatal, and labor care, are included in many health insurance plans and health sharing programs. Some health sharing plans restrict the cost-sharing for children born outside marriage.

What is the best combination of cost-sharing and health insurance for my New Hampshire small business?

Do not go alone. Speak to a Personal Benefits manager. They can provide a complimentary analysis and recommendations based on the specifics of your needs, including budget and employee count, as well as any existing conditions. The Personal Benefits Manager can design a plan to maximize value while minimizing costs.

New Hampshire allows employers to deduct contributions made by them towards HSAs when calculating state income tax?

Yes. New Hampshire deducts employer contributions made to HSAs for employees as part of their compensation.

Offer Direct Primary Care Plan (DPC) along with other Coverage Options for Small Businesses in New Hampshire?

Combining DPC plans with lower-cost health coverage, like Health Share Plans, provides comprehensive and affordable healthcare solutions for both small businesses and their staff.

Is it possible for a New Hampshire-based business to still receive the Small Business Health Care Tax Credit even if there are no taxes due?

You can carry the Small Business Health Care Tax Credit backwards to offset your income tax liabilities from previous years or forward up to twenty years.

HRAs are they compatible with health-sharing plans, individual insurance policies or health sharing plans?

Yes. HRAs and other coverage options can be used together. HRAs have been used to reimburse the employees of group insurance policies by many small businesses. HRA funds can not be used by employees to pay for their health share plans.

What is an HRA?

HRAs reimburse employees’ qualified medical expenses that are not covered under their health insurance plans. The employer determines which expenses are covered and how much money they will contribute.

Do these programs have any restrictions regarding the size of a business that is eligible in New Hampshire for them?

QSEHRAs (Qualified Small-Employer Health Reimbursement Arrangement) are available exclusively to employers with fewer that 50 employees. Other HRAs are available if the company you work for has over 50 employees.

As part of the ACA, you’ll be required to either provide a qualified plan of health insurance for your employees or pay a fee. You should speak to your Personal Benefits Coordinator if your company is about to or plans on hiring its 50th full time worker, or equivalent, in the next few months. Your plan could be affected.

Read More About Group Health Insurance Options in Your State

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.