Massachusetts Small Business Health Insurance Options

The Complete Massachusetts Small Business Health Insurance Guide – 2026 Edition

The HSA-for-America Complete Massachusetts Small Business Health Insurance Guide. This guide focuses on Massachusetts-based companies with 30 workers or less. This document was created to guide small businesses, freelancers, and independent professionals in providing their employees with health care benefits that are cost effective. It is possible to stay competitive without sacrificing the overall benefits package and compensation you offer.

Massachusetts Small Business Health Insurance Benefit Options

Massachusetts’ small business owners have a variety of options to choose from when providing benefits for their employees.

One of the most cost-effective, yet most commonly used, options is to adopt a standard group health insurance program.

According to information from the Kaiser Family Foundation and based on age-related differences, in 2021 the cost for employer sponsored group health coverage covering an employee and their family was nearly $800 above the average.

Massachusetts workers typically pay more than $5976 on average towards their health care costs.

Massachusetts companies also have other options that can reduce costs significantly. They include:

- Health Savings Accounts (HSAs)

- Health reimbursement agreements (HRAs)

- Direct primary care (DPC), memberships

- Health Sharing Programs

Your small business’s best strategy depends on a number of factors, such as the size and budget of your company, along with your employees and dependents.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

Massachusetts Small Business Health Insurance and Geographical Issues

Take into consideration the special healthcare environment that exists in Massachusetts. That includes cities like Lowell or Boston, but also rural communities like Wendell & Plympton.

Massachusetts business owners need to be careful about the way their workers are distributed throughout the State. For executives at the Worcester headquarters of the company to pick an HMO restricting workers and their family to see only in-network doctor’s is not a good idea when they have many employees who live and are employed in Rochdale.

Massachusetts Small Business Group Health Insurance

The most popular choice of group health coverage for Massachusetts employers is traditional insurance. It is also very pricey.

This is how it works:

A third-party insurer, usually a corporation that makes money from insurance policies, is contracted by an employer to provide health benefits to workers. If the employer so desires, they can also include their family.

The Affordable Care Act requires that employers who have 50 employees or more offer a health plan approved by the ACA to employees working more than 30 hour per week. Otherwise, they will be penalized.

Health insurance plans must include the 10 minimum essential coverages required by the Affordable Care Act. The ten essential coverages (MEC) are as follows:

- Ambulatory Patient Services (outpatient services you receive without having to be admitted into a hospital).

- Emergency Services

- Hospitalization is a term used to describe a hospitalization that includes surgery, overnight stay and other types of care.

- Care of the newborn, both before and after delivery, as well as pregnancy, maternity and newborn care.

- Services for mental health disorders and addictions, such as counseling and psychotherapy.

- Prescription drugs

- Services and Devices for Rehabilitation and Habilitative (Services and Devices to Help People with Injuries, Disabilities, and Chronic Conditions Gain or Recover Mental and Physical Skills)

- Laboratory services

- Services for prevention and wellness and management of chronic diseases

- Children’s services including dental and eye care are covered (adult dental and visual coverage is not essential).

The ACA also requires that health insurance cover birth control and breast-feeding.

As long as the worker enrolls during his or her initial enrollment period when they first qualify for coverage, during a special enrollment period triggered by a qualifying life event, or during the general open enrollment period beginning November 1st of each year, the insurance company cannot turn them down or charge a higher premium because of their medical history.

Massachusetts Small Business Health Insurance Not Needed

According to the Affordable Care Act (ACA), employers who have fewer than fifty employees do not need to offer any health coverage.

Massachusetts’ state law also doesn’t have a requirement. It is not mandatory to offer any health coverage if your company has fewer 50 employees.

No penalty will be charged.

Even small businesses should offer competitive health insurance, as it can be difficult to retain and recruit quality staff without it.

Massachusetts is a good example, as the unemployment rate is low in general and employers are keen to hire talent.

Massachusetts employers have the potential to save lots of money through a Medical Cost Sharing or Health Share Plan (see more below) where they pay for some or even all costs of their employees.

HRA Alternative

Alternatively, for small employers you may want to offer the QSEHRA. This allows your staff to buy their own personal insurance and pay it tax free.

QSEHRAs can provide the following benefits to employers.

1.) Minimum contribution limit is not set

QSEHRAs allow you to set your own budget for HRA benefits and change it as needed each year, based on the cash flow in your business. It is up to you as an employer to decide how much money will be allocated for HRA benefits. This budget can change every year depending on your company’s cash flow.

QSEHRAs give you control over your health benefit budget.

2.) Flexibility

Offer employees different benefits based on marital or familial status. Employees with dependents can receive a better benefit than employees who don’t have children or are single.

3.) Employees and employers are both eligible to receive tax-free treatment

Employer contributions are fully deductible by the IRS as compensation costs. Your employees, on the other hand, will not have to pay any tax if their health insurance includes all 10 of the essential coverages as specified by the Affordable Care Act.

This is why offering employees a QSEHRA can be better than offering them a health insurance subsidy that they could use for health insurance purchases or to cover other costs.

4.) QSEHRAs support employee choice

Many traditional group insurance plans limit the options available to employees who are in wide-ranging situations

They are usually overpriced, and not suitable for employees, because HR and management choose them, and not the workers.

The QSEHRA gives workers and their family a much wider range of choices and allows them to choose the best health care plan for themselves.

Massachusetts Small Business Health Insurance Benefits Are Taxed

As an employer you can deduct all health insurance premiums as part of your business costs under Massachusetts and federal laws. Additionally, the premiums paid by employers are tax-free for employees.

The overall cost of health sharing plans is lower. Employees can deduct the monthly cost of these plans from their taxes. Employer assistance to pay health-sharing costs is taxable for the employee.

Massachusetts Small Business Health Insurance: The Disadvantages

Both employers and workers have important advantages to traditional employer group health coverage.

- Cost

As mentioned above, providing health insurance at a monthly price can be prohibitive.

Some of the reasons why traditional health care insurance is so expensive are due to overkill. Washington and Boston regulators have packed health policies with mandated coverages, and requirements that do not make sense to most employees.

Traditional health plans, for instance, require that the carriers price mental health benefits, drug and liquor addictions, as well as maternity coverage. Many workers simply don’t want or need these.

The result is that they are much less effective and economical than needed.

- Inflexibility

Many group health insurance programs are based on a single-size-fits all strategy which does not always meet the budget or needs of employees. Group health insurance programs sponsored by the employer tend to be one-size fits all and may not adequately address specific employee needs or budgets.

Some workers may find it more cost-effective to purchase their own health insurance plan through the private market, taking advantage of subsidies under the Affordable Care Act.

It may also make sense to opt for a health-sharing plan that is less costly. Innovative and affordable health insurance alternatives can provide a solution, especially to workers in excellent health with no existing conditions.

Here’s a more detailed look at health-sharing plans.

- Administrative burden

Manage a full-fledged healthcare benefit comes with substantial administrative costs. It includes managing documentation, ensuring compliance with plans, auditing them to make sure that no non-qualified persons are enrolled, and responding directly to staff questions. This is essential for ensuring the health insurance program in an organization runs smoothly.

These plans are expensive for small employers, who may not be able to afford a dedicated HR person to oversee the program.

However, they are an enormous burden on very small businesses who lack the manpower to hire a HR department to administer the plan.

Businesses can also employ other strategies, such as the Health Reimbursement Arrangements (HRA) and health care stipends.

The Affordable Care Act offers alternative ways to encourage people to get their own health insurance. The workers may benefit from the available subsidies. The employer is also removed from the whole process.

Health Sharing Plans in Massachusetts

Massachusetts businesses that are small can find health sharing programs to be a cost-effective and affordable alternative to the expensive coverage of traditional insurance.

Massachusetts-based businesses increasingly use medical cost sharing as a cheaper alternative to the traditional health insurance for groups. When switching from traditional group health coverage to health sharing plans, businesses can typically save as much as 50% in premiums.

That means Massachusetts small businesses could potentially save more than $10,000 per year per employee for family coverage, and more than $3,500 per employee per year for single coverage.

The programs are a new way to fund healthcare. They allow companies to provide employees with high-quality care while keeping costs down. The premise behind health sharing programs is to share resources between a group or organization.

The participants of health sharing programs make a certain amount of money each year, instead of the usual insurance that involves payment of premiums.

Health Sharing Plans vs. Health Insurance

It is important to note that health sharing plans and insurance are two different things.

Health sharing associations are not insurance companies, but voluntary groups of individuals who have agreed to pay for the medical bills of others. As opposed to for-profit health insurers, health sharing ministry is a non-profit organization.

Mandatory Coverage

Health insurance plans are not required to comply with federal or state requirements that require coverage of many items many people would prefer not to have. These requirements do not apply to health-sharing organizations.

For people who are never drug users, the medical cost-sharing plan is not required to cover addiction treatment costs. One example is that they are not required to cover costs of addiction treatment for people who never use drugs.

Prior Existing Conditions

The health sharing plan may have a waiting period before it will cover the treatment of existing conditions.

While they often impose waiting times for surgery, this is usually only for accidents or injuries which could not be anticipated prior to enrolling the member.

Health sharing organizations can offer a wide range of health benefits, at a fraction of what it would cost to purchase a non-subsidized ACA group health plan.

Under the Affordable Care act, health sharing doesn’t qualify to receive subsidies. Although the cost savings can be so large, switching to a health sharing Plan is still a good option for most people, regardless of their eligibility for subsidies.

Massachusetts employers can benefit from health sharing even more because the ACA does not provide a subsidy to small-group health insurance.

Request a Group Quote for Your Company

Massachusetts Health Sharing and Network Restrictions

Health sharing plans offer more choices when choosing healthcare providers than traditional managed care plans like HMOs or PPOs. These are the two most popular employer sponsored group health insurance policies.

Healthsharing organizations in Massachusetts don’t restrict their patients to providers in the network in most cases. Health sharing members can choose any doctor they want. Choosing the doctor of your choice is a right that people should have.

Do You Need Health Insurance for Your Employees?

Every company is different. The best plan to use, be it a group health plan with a health sharing approach, or the traditional plan that includes health insurance, requires careful evaluation.

You can get full analysis and specific recommendations for your company and staff in Massachusetts.

To begin the process, click on this link for an appointment.

If you’ve prepared a census of your employees, it will make things easier.

In many cases, switching over to health care insurance saves thousands of pounds per employee. It may not make sense to share health insurance with workers who already have preexisting conditions.

You can always consult with us and get an analysis for free.

Massachusetts Small Business Health Insurance Health Reimbursement Program

The Health Reimbursement Arrangements, or HRAs as they are also known, is a benefit funded by the employer that allows employees to receive tax-free reimbursement for healthcare expenses.

Many Massachusetts small business owners simply do away with the benefit of group health insurance. Instead of establishing an HRA, small businesses in Massachusetts use it to give their workers cash that they can spend on individual insurance.

Workers can then take advantage of the subsidies available, which further reduces the cost to the company.

The HRA can be used to pay other expenses such as prescriptions, copays, deductibles and durable equipment. HRAs are also tax-free.

When you offer an HRA as an alternative to a formal plan for group health coverage, employees have the option of choosing the insurance that meets their specific needs.

Learn more about the HRAs available for small businesses.

HRAs for Massachusetts Small Business Health Insurance

QSEHRA (pronounced as “Cue Sarah”), a specific type of HRA designed for small employers can be utilized by them.

It is available to companies that have fewer than fifty full-time workers or an equivalent number, but do not provide a group health insurance program.

The QSEHRA allows businesses to choose their maximum QSEHRA contribution, subject to certain restrictions. Massachusetts employers are allowed to make contributions up to $5.850 (upwards to $487.50 monthly) for individuals and up to $11,800 (upwards to $983.33 monthly) for families.

This money is used by employees to purchase insurance on their own via an online health exchange website or via a Individual Benefits Manager. It preserves eligibility for subsidies, something they could not receive under a group insurance plan paid by their employers.

The employer can decide to pay the health insurance premiums of their employees and not any other medical expenses, or to pay both.

QSEHRAs & Special Enrollment periods

You will have to offer your workers a Special Registration Period when you change your plan from health insurance to HRA. This 60 day window is when your workers are able to buy an ACA qualified plan, with guaranteed-issue rights without going through underwriting.

If you decide to replace the group insurance plan with a QSEHRA, this will make sure that none of your employees lose their coverage.

HRA Advantages

Health Reimbursement Arrangements offer many benefits.

Your employees are not taxed on the amount you spent for HRA-related benefits.

HRAs are not paid to the workers until you give them control. The money is available as operating capital. The money does not have to be held by a third-party.

HRAs are designed with a lot of flexibility by the employer, including which expenses they will cover.

Employees don’t lose their health coverage when they quit the company or switch to contractor status. This approach allows workers to own and manage their own insurance. Employer not.

HRA Disadvantages

It is not the desire of all employees to have to choose and research their own plan. Some workers will need additional help to make the switch.

You can get help from your HSA for America Benefits Manager if this happens. This ensures that no worker gets left behind.

Simply have your workers select this link and make an appointment or call 800-913-0172.

Click on here to find out more about the alternatives offered by Massachusetts’ small business to health insurance sponsored by their employers.

Direct Primary Care: The Advantage

Direct Primary Care plans are a new alternative health care model becoming increasingly popular in Massachusetts.

Membership-based: For a monthly flat fee that is affordable, just like gym memberships, you can provide your employees with as many appointments as needed, in person or by telehealth.

DPC offers a monthly membership cost of only $80 for those who want to prioritise their health and avoid the copay or coinsurance burden.

DPC Plans provide unlimited access to primary care, chronic and preventive services.

Direct primary care services include the following:

Here are some of the medical services commonly provided by Direct Primary Care doctors:

- Preventive care. DPC physicians emphasize prevention medicine, providing services like routine checks-ups and immunizations as well as screenings and tests for different conditions.

- DPC Doctors treat injuries and illness that are acute, such as minor skin injuries, infections, colds, influenza, and minor illnesses.

- Chronic disease management. DPC doctors assist patients in managing chronic conditions such as hypertension, diabetes, arthritis and more. These doctors offer ongoing treatment, monitor patients, and adjust their plans of care as required.

- Comprehensive physical exams. DPC Doctors offer thorough physical exams that assess your overall health and identify any potential health risks. They also provide you with personalized health advice.

- Urgent care. DPC physicians are available to provide same-day and next-day emergency care.

- Patients can receive immediate attention to non-emergency issues by making appointments.

- Diagnostic and laboratory services. DPC physicians may coordinate or offer a wide range of diagnostic and laboratory services, including blood tests, urine analyses, imaging studies, (X-rays and ultrasounds), as well as electrocardiograms.

- Medicine management. DPC physicians can prescribe medications and monitor their efficacy, making adjustments as required. Also, they provide counseling and education about medication use.

- Mental health services Mental health is often included in DPC care. DPC doctors can provide therapy, counseling and even refer you to mental specialists when required.

- Minor procedures. DPC physicians are sometimes trained to do minor procedures right in the office. These include suturing lacerations and removing skin lesions or moles. They can also perform joint injections.

- Care coordination, referrals. DPC doctors serve as advocates of patients, coordinating care between specialists, hospital staff, and other healthcare professionals when referrals to them are needed.

There are also no co-payments, coinsurances or deductibles because there isn’t an insurance company. Monthly subscriptions cover everything. It allows workers who are strapped for cash to receive the medical care they need immediately. Patients no longer need to postpone their doctor’s appointments because of a high deductible or a co-pay.

If patients need additional coverage, they can opt for supplemental plans that include high-deductible health plans, accident plans or healthsharing plans. DPC offers routine healthcare as part of membership. Patients can select more cost effective coverage such as healthsharing plans instead of traditional health insurance.

Health Savings Accounts (HSAs)

HSAs are powerful tools that help people manage their healthcare costs. They can also lower the cost of health insurance premiums.

Massachusetts’ residents and business need any tax incentives they can find. Good news! Employer contributions into employees’ Health Savings Accounts can be fully deducted from Massachusetts corporate tax.

HSAs let individuals set aside money before tax to help pay future medical bills. HSAs may be contributed to by employees as well as employers. However, the limit is set each year by Congress to adjust it to inflation.

HSA money grows at a tax-deferred rate, while withdrawals for qualifying healthcare expenses are free of tax.

How to Qualify for HSA

To be eligible to receive pretax employer contributions into an HSA and to make a contribution to one, the employee must have a qualified high-deductible health plan.

In 2023, an IRS-defined high-deductible healthcare plan will be any health insurance plan which has a minimum $1,500 deductible for an individual, or $3,000 deductible for a family.

Total annual HDHP out – of pocket costs (including deductibles copayments coinsurance and other expenses) cannot be higher than $7500 for an individual. The limit is not applicable to outside-of-network providers.)

How can I combine HSAs and health sharing plans?

Only one health-sharing plan, the HSA SECURE, is currently available from HSA for America

HSA SECURE Plan combines the benefits of tax-savings and health insurance of a Health Savings Account with cost savings of health sharing.

To be eligible for this plan, employees must have self-employment or business ownership income.

HSA SECURE plans are not offered to employees who receive a W-2. HSA Secure is available to employees who are self-employed, have side businesses, do freelance work or own a business. If they’re in good health and don’t need any ongoing medical care due to preexisting conditions, this plan may be the best option.

You and your small-business partners may find that the HSA Secure Plan is a fantastic way to save some money.

Employees would be required to sign up for HSA SECURE themselves. You can contribute pre-tax to their HSA once they enroll and establish it.

Massachusetts Small Business Health Insurance Taxation Rules

This table will help you understand how to tax each alternative strategy that is available to small companies in addition the traditional health insurance.

| Plan Type | Employer | Workers |

|---|---|---|

| Traditional health insurance premiums | Tax deductible. May qualify for a tax credit (see below) | Non-taxable |

| HSA contributions | Tax deductible | Pre-tax, up to certain limits. No income limitations. |

| Health sharing costs | Tax deductible as a compensation expense | Taxable as ordinary W-2 income |

| Health reimbursement arrangements | Tax deductible | Benefits are non-taxable to the employee |

| HSA withdrawals | N/A | Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income. A 20% penalty for non-qualified withdrawals applies up until age 65. |

| Direct primary care costs | Tax deductible as a compensation expense | Taxable to the employee |

Massachusetts Small Business Health Insurance: Addressing All Levels of Care

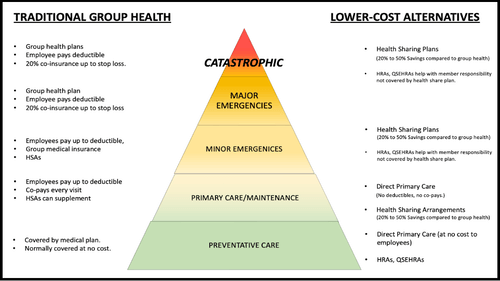

As shown in the below diagram, a good package of employee benefits should cover all of the levels of the Employee Healthcare Pyramid, from preventive health care to primary care for early detection and maintenance of health issues, up until catastrophic events.

The left side of this graphic lists the common traditional insurance-based solution that addresses each level in the Care Pyramid.

While the right side of this graphic, you will find a list of more affordable alternatives to offer meaningful protection at every level of Pyramid.

A good plan will provide employees with solutions that are affordable at all three levels. No employee should be forced to wait or forgo care due to the cost of a copay, premium or coinsurance.

It is possible to design a personalized plan with the help of your personal benefits manager. These plans can be designed for employees at different levels in the Care Pyramid and are often a fraction cheaper than a traditional employer group plan.

Massachusetts Small Business Health Insurance Tax Credit

Small Business Health Care Tax Credit was passed alongside the ACA and allows small business to claim a tax credit for up to 50 percent of employee health care costs.

The program was designed to help small businesses that have 25 employees or fewer, and hire workers who are paid lower wages.

The credit is available to both for-profit companies and nonprofits.

* You have fewer that 25 employees, and the average salary is around $53,000. (excluding owner’s salaries). When determining the number and average salaries of the employees in a company, the owner is generally excluded. Also, employees are counted as “full-time counterparts” (FTEs). It means that 2 half-time employees are equal to 1 full-time employee

* Employers must cover at least half the costs of insurance premiums.

* Offer Affordable Care Act-qualified coverage available on the state exchange, in Massachusetts’s case, on The Massachusetts Health Connector.

When an employer has at least 25 employees and/or a wage of about $53,000 per employee, then the tax credit disappears.

How do I claim my credit?

The IRS Form 8941, which is required for small tax-exempt companies to file their tax returns, must be attached to your tax return.

You are exempt from taxation on contributions made to your employee’s health coverage.

This year, I haven’t paid taxes on my business. Am I still eligible to claim the credit?

Yes. The tax credit may be used as a way to reduce income tax liabilities incurred in the prior year, or it can also be carried forward and offset over 20 years.

This credit is refundable for businesses that are exempted from paying taxes.

To learn all about the Small Business Health Care Tax Credit consult your tax professional.

Combining Massachusetts Small Business Health Insurance Strategies

If you want to maximize your insurance coverage, it can make sense to combine different plans.

Employers often find that by combining several healthcare packages, they can control their healthcare costs as well as provide full coverage to all of their employees.

One cost-effective approach is to combine a Direct Primary Care plan (DPC) that provides normal primary health care with an affordable health sharing plan covering catastrophic incidents.

Comparing this to the conventional health care insurance for groups, it can save money for you, your company or your employees.

Employees can be given more options and lower costs by allowing them to choose between a Health Sharing Plan or an Individual Health Insurance plan. They may also have the option of funding a Health Savings Account for HDHP plans that qualify for HSAs.

How to Proceed?

The best way to proceed is by putting together a business health plan and contacting us.

A Personal Benefits manager from HSA for America will be assigned to you. This persona benefits manager will talk to you about your staff and their families, discuss your needs and budget, assess your employees’ contributions, and consider any preexisting medical conditions.

Our PBMs include many successful entrepreneurs. These PBMs are business owners themselves and have a deep understanding of your requirements as an entrepreneur.

Can I provide both Health Insurance and Health Sharing at the same?

If you offer both, employees can choose the one that suits them best.

Please note, if a large number of employees decide to leave a group medical insurance plan you might not meet the minimum required participation rate for maintaining a collective plan. HRA’s allow you to reimburse employee costs for personal health insurance.

Massachusetts Small Business Health Insurance Frequently Asked Questions

What is the Difference Between Health Insurance and health sharing for Small Businesses?

The traditional health insurance plan is offered by the insurance company, whereas health sharing is when members contribute to a fund to pay for each other’s healthcare expenses.

Do health-sharing plans have waiting periods for conditions that preexist?

Some health sharing plans do have waiting periods before they cover pre-existing medical conditions. For more details on specific plans, it’s best to consult the plan guidelines.

Would it make sense to provide a Direct Primary Care Plan (DPC) along with other coverage options for Massachusetts-based small businesses?

Combining DPC coverage with lower-cost plans like health-sharing plans, can offer comprehensive and cost-effective healthcare solutions to small businesses and their workers.

Massachusetts allows employer contributions for HSAs to be deducted when calculating state income taxes.?

Yes. Massachusetts treats employer contributions toward employee HSAs in the same way as other compensation costs.

Is it possible for a small business to still receive the Small Business Health Care Tax Credit even if there are no taxes owed in Massachusetts?

You can carry the Small Business Health Care Tax Credit backwards to offset your income tax liabilities from previous years or forwards for up to twenty years.

What is an HRA (Health Reimbursement Arrangement) and how does it work?

HRAs allow employers to reimburse their employees for certain medical expenses, which aren’t covered by the employee’s insurance. Employers contribute to the account based on what expenses they determine are eligible.

HRAs work with individual and health sharing plans as well as other types of coverage.

HRAs do work with other plans. HRAs have been used by small business owners to pay for employee policies and cancel their group insurance. HRAs cannot reimburse health insurance costs directly.

How can Health Savings Accounts HSAs help manage medical costs for employees in Massachusetts?

HSAs are a way for individuals to put money aside before taxes to pay future medical expenses. Employees and employers can both contribute to HSAs, allowing for tax benefits and savings on future healthcare costs.

Massachusetts allows employers to contribute towards their employee’s HSAs.

You can make contributions into your employees’ HSAs. However, there are limits that Congress sets annually.

What is the Small Business Health Care Tax Credit and how do I claim it?

For-profit small businesses can claim the tax credit on their annual income tax returns with IRS Forms 8941, but tax-exempt businesses will need to file Form 990T.

HSA for America is not a tax advisor. For more information, employers should contact their tax advisor.

What health insurance plans offer maternity coverage in Massachusetts?

Massachusetts’ health sharing plans and policies often include coverage for prenatal care, labour, and postnatal health care. It is possible that some health sharing plans have limitations on the costs-sharing benefits available for children who are not born to married parents.

Does Massachusetts have a limit on the size of small companies eligible for this program?

QSEHRA is available only to small employers (less than 50 workers). There are also other HRAs that you can choose from if your company has more than 50 workers or if it grows. You’ll also be required by the ACA to offer a qualified plan of health insurance for your workers, or you will have to pay a fee. Talk to your personal benefits manager about your future plans if you’re planning on or are close to hiring 50 full-time workers or an equivalent number.

How can I decide which option of health insurance with cost-sharing is right for my Massachusetts small business?

It doesn’t have to be a solo trip. Call a Benefits Coordinator You can get a free consultation and analysis based upon your unique needs, the budget you have, any prior conditions, or employee data. It is possible to create a customized plan which maximizes value while controlling cost and keeping you competitive.

Read More About Group Health Insurance Options in Your State

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.