Health Benefits for Construction Workers

In fact, small group health insurance premiums have nearly doubled in the past 10 years.

That puts a serious squeeze on small business owners in all industries. But it’s labor-intensive industries like construction that are feeling the pain the most.

Especially small employers like you.

Smaller construction companies – those with fewer than 50 employees – have a daunting challenge: to attract and retain the workers you need, you must compete in the same labor market as much larger, more established companies.

If it comes down to a cash bidding war, your small company is almost always at a significant disadvantage compared to the Big Dogs.

Compare Pricing on the Best Insurance Plans Available

Who Should Read This Article

In this article, you’ll learn about the landscape of the health benefits industry specifically as it pertains to construction firms. So you’ll know what your competition is offering workers, so you can design your benefits accordingly.

You’ll learn about several more affordable, “out-of-the-box” alternatives to traditional group health insurance products, including health sharing, health savings accounts, health reimbursement arrangements, and especially QSEHRAs – a type of health reimbursement arrangement specifically designed for small employers to provide tax-advantaged help to workers so they can purchase their own health insurance in the individual market.

You’ll learn how workers who delay or skip needed medical care because of cost in the short run present much bigger and more expensive problems in the long run.

You’ll learn how absenteeism and presenteeism due to sick or injured workers can wreak havoc on builder profitability, and put you at greater risk of workers compensation claims.

And you’ll learn how to build a suite of health benefits that’s affordable that helps your workers see a doctor when they need it. So they can get back to work safely.

Construction Group Health Insurance Facts

- The vast majority of construction companies – 74% – offer medical benefits to their employees. This is higher than the national average of 69%. But if you’re not offering a health benefit for your workers, you are in the distinct minority in the building industry.

- The average annual monthly employer premium for family coverage is $23,968, according to the Kaiser Family Foundation.

- The average premium for single coverage is $8,435 per year.

Addressing the health coverage needs of construction workers at various levels – from entry-level, unskilled and semi-skilled workers through experienced journeymen and artisans to operators and senior management – is critical for builders who want to remain competitive and grow.

Smaller Construction Firms and the Affordable Care Act

True, firms with fewer than 50 employees are exempt from the Affordable Care Act requirement to provide a group health plan for their workers.

But that doesn’t mean workers don’t demand some kind of meaningful health benefit to protect themselves and their families. If they don’t get it one way or another, they will soon go to work for a builder that does provide one, or they’ll leave the industry altogether.

Good workers have options.

Builders who want to stay in business with good, reliable employees need to offer a health plan to attract the best.

And sometimes that means a traditional group health insurance benefit.

But not always.

Small builders have several options when it comes to offering health benefits to workers and their families. To maintain competitiveness against larger firms, smart employers should think outside-the-box, and combine traditional and innovative solutions to enhance their employer value proposition and maintain competitiveness and profitability.

Address the Entire Care Spectrum

Your benefits should address the needs of a diverse workforce.

Most construction firms have a mix of young and single employees, experienced journeymen workers with families, mid-career construction managers and craftsmen, and senior management.

You may also have some office and bookkeeping staff, as well.

Each of these populations have different needs, priorities, and concerns when it comes to employee benefits.

But all face the risk of anything from minor ailments to catastrophic injuries and illnesses.

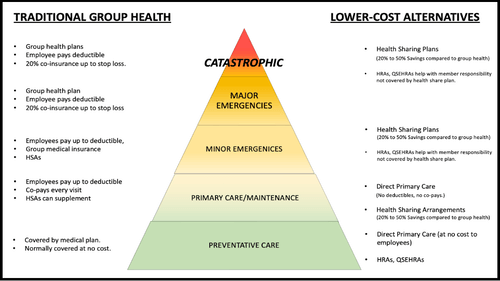

A robust employee health plan that’s inclusive to your diverse workforce should address each level of the employee health care pyramid, as shown:

The Employee Health Care Pyramid

But here’s the problem many builders face:

Traditional group insurance is often not adequate or cost-effective.

While large health insurance carriers are well-equipped to handle major emergencies, they are very poor at addressing other healthcare needs.

This is primarily because insurance is fundamentally designed to manage infrequent, unpredictable events, making it less effective for predictable, routine healthcare costs.

The High Cost of Skipping Care

High deductibles, coinsurance, and co-pay costs often cause workers to put off getting the care they need, or skip it altogether because they can’t afford to see their doctor.

This just kicks the can down the road, and causes much bigger problems later, which drives up premiums even further.

Moreover, the construction sector faces additional challenges with traditional insurance due to regulations that have layered extra costs onto these plans, driving up premiums without proportionately increasing value.

As a result, traditional group health insurance may not always offer the best solution for construction businesses.

Thinking Outside the Box

Instead, small builders need to take a more nuanced approach –, one that combines a variety of strategies and solutions.

This approach should aim to provide comprehensive coverage that addresses the full spectrum of healthcare needs in the construction industry, ensuring that employees are well-protected against unexpected high medical costs while keeping the plans affordable.

As you can see from the illustration, traditional health insurance isn’t the only solution.

On the right side of the graphic, you’ll find a variety of alternative options that may be much more cost-effective, while still providing quality protection for workers at each level of need.

Balancing Comprehensive Health Benefits and Costs

If you own a small construction business, you must find a balance between managing costs and providing your employees health benefits.

- Group Health Insurance. Offering group health insurance ensures that employees have access to essential health services. This is particularly important in construction, where workers are prone to injuries and physical strain.

- Health Sharing Plans. An alternative to traditional insurance, health sharing plans can be a cost-effective solution. These plans involve a community of members sharing medical expenses, which can be ideal for smaller construction companies.

Costs are generally much lower than those of traditional health insurance products. Up to 50% lower. - Health Savings Accounts (HSAs). These are a special type of savings account. Workers and employers can contribute tax-free dollars to the HSA. This money grows tax-deferred, and withdrawals to pay for qualified healthcare expenses are tax-free.

To be eligible for contributions, employees must be enrolled in a qualified high-deductible health plan, or HDHP.

Yes, deductibles are higher. But if employers and/or employees are contributing, the tax-free dollars in the HSA add up fast, and soon cover the higher deductibles under the HDHP and much more.

Learn more details about Health Savings Accounts.

Sick Time Off is Money Lost

Absenteeism and presenteeism (working while sick) are critical issues in the construction industry, with substantial impacts on productivity and safety.

- Impact of Health Access on Absenteeism: Construction workers lacking adequate healthcare are more prone to extended absences due to illness or injury. This not only slows project timelines but also increases labor costs.

- Presenteeism and its Risks: Many construction workers, especially in lower-wage positions, may come to work sick due to lack of access to affordable healthcare or paid sick leave. This can lead to accidents on-site, jeopardizing the safety of the entire crew.

- Financial Implications: According to industry analyses, absenteeism and presenteeism can significantly inflate operational costs. These include not just the direct costs of paid sick leave and insurance claims but also indirect costs like reduced productivity and increased accident risks.

For example, a study by the National Institute for Occupational Safety and Health (NIOSH) indicates that the construction industry is particularly vulnerable to the impacts of presenteeism, given the physical nature of the work.

Workers operating machinery or performing tasks at height while unwell pose a severe safety risk:

- Long-Term Costs: Chronic health issues and injuries, common in construction work, lead to regular absenteeism. The Centers for Disease Control and Prevention (CDC) notes that these long-term health issues significantly elevate employer costs, estimated at an average of $2,945 per worker annually. This figure encompasses the costs of medical leave, disability benefits, and decreased productivity.

- Economic Burden of Poor Health Access: Workers who cannot afford regular healthcare visits or necessary medications remain ill longer, escalating costs for employers. This extended recovery period not only affects individual workers but also impacts team efficiency and project deadlines.

In conclusion, absenteeism and presenteeism in the construction industry are not just issues of employee health but also critical factors affecting operational efficiency and safety.

Affordable Health Benefit Options for Construction Businesses

Health Sharing Plans as a Cost-Effective Solution

Health sharing plans stand out as a budget-friendly, non-insurance alternative to conventional group health insurance, particularly well-suited for the construction industry.

- What Are Health Sharing Plans? These are non-profit associations comprising health-conscious individuals who collectively cover each other’s unexpected medical costs.

- Cost Advantages. These plans are generally more affordable than traditional group health insurance, making them an excellent option for construction businesses facing high insurance premiums.

- Protection Against High Medical Costs. They offer significant protection against large and catastrophic medical expenses at a fraction of the cost of standard group health insurance.

- Growing Popularity in Construction. Many construction businesses are adopting health sharing plans as a feasible and cost-effective alternative to traditional health insurance.

Note: Health sharing plans usually don’t offer immediate benefits for pre-existing conditions, typically imposing a waiting period for such costs. They are most effective for members in good health without pre-existing conditions.

Health Reimbursement Arrangements (HRAs), QSEHRAs

For smaller construction companies, Health Reimbursement Arrangements (HRAs), particularly Qualified Small Employer HRAs (QSEHRAs), are an attractive option.

- QSEHRAs Explained: They enable small employers to provide tax-free funds to employees, who can use these monies to cover their health insurance premiums. To use a QSEHRA, you must not offer a group health insurance benefit.

- Tax Benefits and Flexibility: Contributions are tax-deductible for the business, with no minimum contribution requirement, ideal for businesses with fewer than 50 full-time employees.

- Employee Empowerment: This approach allows employees to select health plans that best meet their individual needs.

Learn more about offering an HRA in your construction business, or contact a Personal Benefits Manager for a free consultation.

Direct Primary Care (DPC) Benefits

Direct Primary Care provides a direct relationship with healthcare providers, bypassing traditional insurance.

DPC doctors don’t take insurance at all. Instead, they employ a subscription model, in which patients or their employers pay a flat monthly amount for unlimited access to the primary care physician.

Construction workers often delay healthcare due to costs. Implementing a Direct Primary Care (DPC) benefit can address this challenge.

- Understanding DPC. DPC gives employees access to primary care services for a flat, monthly fee, bypassing traditional insurance complexities.

- No Hidden Costs. With DPC, there are no deductibles, co-pays, or co-insurance.

- Benefits for Your Business. Offering DPC can decrease absenteeism and presenteeism, enhance employee retention, and contribute to your company’s profitability.

It’s great for individuals. And it’s a great employee benefit to offer as part of a Section 125 Cafeteria plan, since it allows workers to access primary care without having to worry about costs.

This helps reduce absenteeism, presenteeism, reduce health plan utilization costs, and increase productivity and profitability.

Read more here – Our Complete Guide to Direct Primary Care.

Considerations for Builder Owner/Operators and Their Families

Owner-operators of builder firms who are directly involved in day-to-day construction activities need quality health benefits for themselves and their own families.

If you’re a company principal, partner, you have several choices.

- Join Your Group Plan. This allows you to share the healthcare experience your employees enjoy, for good or for ill. Any premiums you contribute personally are tax-deductible to you on your individual tax return, which is a big plus at higher marginal income tax brackets. But total premiums can be very high.

- Join a Health Sharing Plan. This approach allows operators to share the burden of medical expenses with their peers, making healthcare more affordable. Your company can pay some or all of these costs. However, benefits are taxable to you as an individual. And your health sharing contributions are not tax-deductible.

Many people find that dropping health insurance for health sharing is still worthwhile, even without a tax deduction for sharing contributions, because the savings from health sharing compared to the unsubsidized cost of health insurance premiums is so significant.

Interested in affordable health benefits for your construction business? Contact a Personal Benefits Manager to discover how these options can support your team’s health and your business’s bottom line. Get started here.

Compare Pricing on the Best HealthShare Plans Available

Conclusion

In the construction industry, providing tailored health benefits at every level is not just a matter of compliance but a crucial aspect of workforce management. From HSA Secure plans to health sharing plans and DPC Direct, the options are varied and can be adapted to meet the unique needs of this sector.

To explore the best health coverage options for your construction company, connect with a Personal Benefits Manager today. They can guide you through the intricacies of health benefits, ensuring your team is well-protected and your company thrives.

Contact a Personal Benefits Manager to tailor health benefits that build a healthier, more resilient construction workforce.

Here are some additional articles on healthsharing programs: The Healthcare Affordability Crisis is Getting Worse. Here’s What You Can Do About It. | How Health Sharing Can Expand Healthcare Freedom

Here are some additional pages related to this article: Healthshare Plans | The HSA Secure Plan

Read More About Group Health Insurance Options in Your State