There are healthcare strategies that can enable small businesses to offer a compelling benefits package to their employees while potentially cutting their health benefits costs in half.

Small business owners are constantly caught between two pressing priorities: On one hand, they must attract and retain the best available talent. On the other hand, they must control costs to stay competitive. Here are the most effective healthcare strategies for small businesses with less than 50 employees.

The Problem: Unaffordable Health Insurance Premiums

For most small businesses, health insurance is their second biggest expenditure, second only to wages and salaries.

According to the Kaiser Family Foundation’s 2021 Health Benefits Survey, the annual total cost of group health insurance premiums averaged $7,739 per employee for single coverage and $22,221 per employee for family plans.

That’s crazy expensive for most small employers.

But in today’s market, quality employees demand and expect at least some health benefits from their employers. Fortunately, there are now a number of innovative ways for small employers with fewer than 50 full-time equivalents to fill this need – sometimes at a fraction of the cost.

If you think you can’t afford to provide your employees with some protection against unexpected high medical costs, think again. For thousands of small businesses, these techniques and approaches can finally make getting your workers the protection they need affordable, realistic, and simple.

And if you already provide health benefits, these strategies can potentially cut your current health benefits costs in half – while still providing great coverage!

Principles of Healthcare Strategy for Small Business

Multiple studies show that offering a competitive benefits package is a powerful factor in recruiting and retention. Furthermore, access to health services when employees need it – including preventative care – is effective at reducing absenteeism, presenteeism, and reducing healthcare utilization costs.

This means lower health-related costs for your business and your employees alike, and increased competitiveness for your firm.

Here are the principles to keep in mind as you design your own benefits package for your own small business:

- Something is better than nothing.

Even if you can’t afford to provide a gold-plated health insurance plan like a FORTUNE 500 company, even offering an interim plan, some voluntary (employee-paid) benefits, or a lower-cost health insurance alternative can go a long way in protecting employees from the risk of high healthcare costs, and in demonstrating that you care about their well-being.

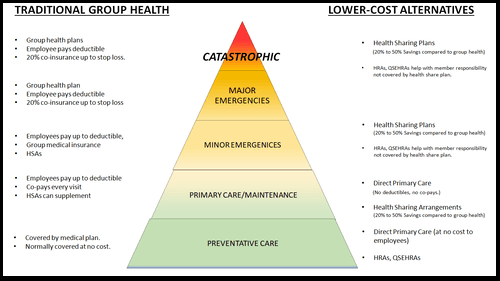

2. Address all levels of the care pyramid.

A good employee health benefits package should address all levels of the Employee Healthcare Pyramid – from routine preventive care, through primary care access for maintenance and early detection of health problems, all the way through catastrophic incidents, as shown below:

On the left, we list common traditional insurance-based solutions that address each level of the Care Pyramid.

On the right, we list a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level of the Pyramid.

Without careful plan design, traditional insurance solutions still leave employees exposed to massive out of pocket costs. Even with insurance, a child who breaks a leg roller skating can generate thousands of dollars in out-of-pocket expenses.

This is because the combination of a deductible and a standard coinsurance of 20% plan still leaves workers with significant exposure. Studies show that about half of U.S. households don’t have the cash on hand to handle a $1,000 emergency. But the average group family health insurance plan deductible is over three times that amount, or $3,722!

The lack of adequate protection against high healthcare costs is a major issue facing workers. The fear of out-of-pocket expenses leads many workers to avoid needed care – leading to worse expenses down the road.

3. If you can’t afford a full-fledged group health insurance plan, help workers buy their own coverage.

If you have fewer than 50 full-time equivalent employees, you can do this on a tax-advantaged basis with a health reimbursement arrangement (HRA). Under an HRA, you would reimburse your employees for some or all of the cost of their individual or family health insurance. You can also cap the benefit at a fixed dollar

By letting employees get their own health insurance, you avoid the hassle and administrative cost of signing up everyone for a single group plan. More on these innovative and increasingly popular employee benefits below.

4. Make it easy to access primary care.

Chronic and preventable health conditions are a major source of healthcare expenses for both large and small businesses. Access to primary care is proven to reduce these expenses, on average, resulting in reduced business costs and increased productivity.

But studies show that even with health insurance coverage, too many people skip going to their doctor to manage chronic conditions because of high deductibles and copays.

You can address this issue in several ways:

- Contribute to employee HSAs, or health savings accounts. You can make employer contributions to their HSA if they bought their HDHP in the individual insurance market, or if they are part of the company’s group plan.

- Offer Direct Primary Care (DPC) as an employee benefit. DPC practices cover all of a person’s direct medical needs, including routine doctor visits, checkups, and preventive care – all for one low monthly price.

Affordable Healthcare Strategies for Small Businesses

Small Business Healthcare Strategy 1: Health Reimbursement Arrangements

Rather than purchasing a group health insurance policy, many small businesses find that a Health Reimbursement Arrangement works better.

An HRA is an employer-paid benefit that reimburses employees for the cost of individual health insurance as a tax-free benefit. With an HRA, employees get to choose their own plan – one that is totally portable and could go with them if they ever leave the business.

HRAs can also function similarly to health savings accounts: They can help employees pay medical expenses that would otherwise come out of pocket. The employer can choose to make funds available for deductibles, co-pays, prescriptions, durable medical equipment, and other medical necessities that the health plan doesn’t cover.

In medical insurance, one size does not fit all. Using an HRA to reimburse some or all of the cost of private medical insurance allows your workers to select the plan that’s best for them and their own families, and provides greater flexibility for the business owner.

Meanwhile, all company contributions to HRAs are 100% tax deductible to the employer, and tax free to the employee.

No Commitments

There are no plan minimum contributions or forward commitments. You can design your HRA to suit your budget. Unlike traditional health insurance, HRA programs are completely owned and defined by the employer.

You alone decide how much money to allocate to your HRA program every year. Not some third party regulator or entity that doesn’t know your employees’ needs.

Furthermore, you don’t even need to pre-fund your HRA in advance. You don’t commit any funds until an employee actually presents a qualified medical expense for reimbursement. This helps preserve cash flow for business operations.

Small Business Healthcare Strategy 2: Health Sharing Plans

Health Sharing Plans (HSPs) are an increasingly popular low-cost alternative to traditional health insurance. They can provide employers with a more efficient and affordable way to offer health benefits to workers and their families.

How Health Sharing Plans Work

Employers and employees contribute to the health sharing pool. In return, the health sharing organization facilitates the cost sharing process across the membership.

The chief advantage of health sharing plans for employers and employees alike is their reduced cost: they are generally between 20% and 50% less expensive than traditional major medical insurance.

Unlike HMO and PPO health insurance plans, there are often no ‘in-network’ restrictions or ‘out-of-network’ penalties. With many health sharing plans, employees are free to choose their own doctors.

The primary disadvantage is that unlike major group medical plans, HSPs may impose significant waiting periods before they will reimburse expenses arising from pre-existing conditions.

One possible strategy: Some employees who don’t have pre-existing medical issues could join the low-cost health share membership. Meanwhile, you could offer your employees who do have pre-existing medical conditions in their families an HRA to reimburse them for the costs of buying their own individual or family health insurance plan.

Compare Pricing on the Best HealthShare Plans Available

The Strategic Approach: Combining Concepts

Using these benefits and approaches in combination can help small businesses provide multi-layered protection for employees – addressing all levels of the Care Pyramid at lower cost, providing a wide range of protection for employees, while saving your business time and money.

Example: Offering a robust DPC benefit bypasses insurance companies altogether for primary care. This means this part of the Care Pyramid is handled at a fraction of the cost per employee. The savings generated may allow you to reduce your premiums or contributions elsewhere (e.g., switching to a high-deductible health plan or health sharing arrangement.)

How Come My Agent Hasn’t Told Me About These Options?

They aren’t paid to. In the traditional insurance model, agents are paid based on total premiums. They don’t have an incentive to meaningfully reduce the premiums you pay for employee health benefits.

Sometimes the agent doesn’t even know about some of these alternatives.

That’s why it’s a good idea to work with a personal benefits manager who specifically deals with these innovative and cost-saving alternatives to traditional medical insurance, rather than a traditional insurance agent.

Request a Group Quote for Your Small Business

Frequently Asked Questions

What is an HRA?

An HRA, or Health Reimbursement Arrangement, is an employer-funded plan that reimburses workers for qualified healthcare expenses up to a maximum dollar amount, and allows unused amounts to be carried forward each year.

What expenses are eligible for HSA reimbursement?

HSA plans can reimburse employees for a wide range of healthcare-related expenses, including deductibles, health insurance premiums, co-insurance payments, copays, prescription drugs, physician’s fees, lab fees, and durable medical equipment.

A full list of HRA reimbursement-eligible expenses is available in IRS Publication 502 – Medical and Dental Expenses.

To be eligible for reimbursement, these expenses must have been incurred during the HRA’s plan year.

How does an Individual Coverage HRA work?

Individual Coverage HRAs reimburse workers for medical expenses for themselves and, for some plans, their families, as well. The employer sets a maximum dollar amount available for each employee for each plan year.

Meanwhile, workers must maintain qualifying individual health insurance or (or be enrolled in Medicare) for each month they are covered under their employer’s HRA.

I’m an employer. Can I choose to offer HRA benefits only to certain employees? Or do I have to offer them to everybody?

You’re asking about discrimination provisions for HRAs. The general rule is, you can discriminate between classes of employees. But you must offer HRAs consistently for all employees within a given class.

Specifically, you can discriminate between:

- Full-time and part-time employees,

- Seasonal vs. permanent employees,

- Employees under a collective bargaining agreement vs. other employees

- Employees who are still in a ‘waiting period’

- Exempt vs. non-exempt workers

You can also offer a higher HRA benefit for older employees than you do for younger employees, as well as offer a more generous HRA for employees with larger families.

However, you cannot offer an Individual Coverage HRA to anyone to whom you offer a traditional group health insurance plan.

What happens to unused HRA money?

Unlike flexible spending accounts (FSAs), HRAs don’t require employers to ‘pre-fund’ their plans. Employers can retain funds as operating capital until an employee actually has an eligible reimbursable expense. So funds don’t accumulate in HRA accounts.

Employers can set plan rules to allow unused HRA benefits to roll over each year for each employee, but are not required to do so. If an employee retires or otherwise leaves the company, the employee doesn’t take HRA money with them.

How are HRAs taxed?

HRA reimbursements for qualified healthcare expenses are generally not taxable to the employee. Employer contributions to reimbursements are normally fully tax-deductible as business expenses, as long as they meet certain qualifications. If the HRA is fully compliant, reimbursements are free of payroll tax as well as ordinary income tax, and tax deductible to the employer.

However, some HRA plans can generate a tax liability for the employee. For example, if an HRA rewards employees for ‘unused benefits’ at the end of the plan year, or allows unused money to be used toward another benefit, that reward may be taxable as income.

Can I contribute money to an HRA as an employee?

No, unless you are self-employed. Only employers can make HRA contributions or tax-advantaged HRA reimbursements to employees. However, if you are enrolled in a high-deductible health plan (HDHP), you can contribute to a health savings account (HSA). As of 2024, the maximum HRA contribution is $4,150 ($4,300 for 2025) for plans that cover a single person only, and $8,300 ($8,550 for 2025) for family plans.

How is health sharing different from health insurance?

Health sharing is not health insurance. It is a lower-cost alternative to health insurance in which groups of people share certain health-related expenses. Health sharing organizations are regulated differently than health insurance companies. They are also not required to cover all ten minimum essential coverage elements as health insurers are required to under the Affordable Care Act.

Health Sharing plans may impose more stringent restrictions on pre-existing conditions compared to health insurance plans.

Is Direct Primary Care the same as concierge medicine?

No, though the two concepts have some common elements. In concierge medicine, patients pay doctors a retainer fee of $1,200 to $5,000 per year to see their doctor. This is in addition to their medical insurance premium that they already pay.

Since the doctor still takes medical insurance, there is no savings from not having to run an extensive insurance billing bureaucracy. The patient may enjoy more access to the doctor, since the doctor does not need to take on the same large patient load as they do without a retainer. But the patient doesn’t get the benefit of cost savings.

In Direct Primary Care, doctors normally do not accept health insurance. So they can run a very streamlined billing operation, and generate significant savings compared to traditional practices.

Patients don’t need traditional medical insurance, but instead pay a monthly enrollment or subscription fee to their DPC plan.

The DPC plan pays the primary care physician, and the primary care physician provides basic examination, diagnostic, immunization, and preventive care services free or at a substantially reduced cost compared to traditional models.

Summary

There’s no single perfect or ideal healthcare strategy that applies across the board to all businesses. Employers should consider not just their own available budgets, but also the budgets and needs of your employees.

In most cases, the best way to address all levels of the Care Pyramid is to use multiple tools and products to create a multi-layered system of protection for your employees.

These plans are very easy to set up. Our expert team of Personal Benefits Managers can help you design a suite of health benefits especially tailored to meet the needs of your workforce.

To schedule a consult, click here.

For Further Reading:

- Health Insurance Plans for Small Businesses with 2 to 10 Employees – 2025 Guide

- Best Health Insurance for Small Business Owners: 5 Plans for Self-Employed Entrepreneurs in 2025

- Who Should Pay the HSA Contribution – The Business, or the Employee?

- Best Practices for Small Businesses Offering an HSA Benefit to Employees

Here are some additional pages related to this article:

Read More About Group Health Insurance Options in Your State

Wiley is President of HSA for America. He believes that consumers should have choice and price transparency, so they can make the best healthcare decisions for their needs. Read more about Wiley on his Bio page.