Maine Small Business Health Insurance Options

The HSA for America guide to Maine small business health insurance. This guide is aimed at companies in Maine with 30 or less employees.

The purpose of this document is to assist small businesses, independent professionals, freelancers and other business owners in providing the most effective, cost-efficient employee benefits. You can still be competitive while offering benefits and a compensation package that will keep the top talent on your team.

Maine Small Business Health Insurance Benefit Options

Maine small businesses have many options for providing employee health insurance.

The most popular, and by far the most costly, option is to use a group health plan.

The cost varies depending on age. However, according to from the Kaiser Family Foundation the average annual price of group health insurance sponsored by an employer for a family and worker in 2022 will be $21,630. This is about $250 higher than the national average.

Maine employees contribute an average of more than $6,540 dollars, or nearly $400 dollars more than the national standard, towards their health insurance.

Maine business owners have many other options available to them that will help reduce their cost. These include:

- HSAs are health-savings accounts.

- The Health Reimbursement Arrangements (HRA)

- Memberships in direct primary care

- Shared health care programs

This depends on many factors including the size of your organization, budget available, as well as age, medical needs, and other requirements for employees.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

Maine Small Business Health Insurance: A Geographic Perspective

Maine offers a diverse healthcare environment, including urbanized areas such as Bangor or Portland, but also smaller towns and rural regions like Rumford or Skowhegan.

Maine’s business owners must therefore carefully consider how they distribute their workforce throughout the state. Executives in the company’s headquarters in Portland may choose an HMO which restricts employees to only seeing doctors in its network, but many of their workers live in North Scarborough and are far from that plan.

Maine Small Business Group Health Insurance

Maine’s employers most commonly choose the traditional health group plan.

It’s also the most costly.

What’s the process?

The employer will contract with an insurance company to cover the health care of their employees, and in some cases also for their spouses.

Employers with more than 50 employees have to provide ACA-qualified insurance plans for employees who are working over 30 hours per work week.

It must provide the minimum essential coverage (MEC), as required by Affordable Care Act. They are:

- Patients can receive ambulatory services without needing to go into hospital..

- Emergency services

- Patients can receive ambulatory services without needing to go into hospital.

- The care of newborns, pregnant women, and mothers (before and after the birth).

- Treatment for substance abuse disorders, mental illness and behavioral problems (including counseling and therapy)

- Prescription drugs

- The Rehabilitation and habilitative Services and Devices (services and equipment to assist people with disabilities or injuries gain mental and physical abilities)

- Laboratory services

- Chronic disease management and prevention services

- Adult dental coverage and adult vision insurance are not considered essential health benefits.

The ACA mandates that insurance policies cover contraception and breastfeeding.

The traditional option of health insurance, while expensive for companies, has the advantage that it is guaranteed to enroll.

If the worker applies during their initial enrollment, a special period that is triggered after a life-changing event or the annual open enrollment, which begins on November 1, the insurer cannot deny them coverage because of a medical history.

Maine Small Business Employers Can Choose Not To Purchase Health Insurance

According to the Affordable Care Act (ACA), employers who have fewer than fifty employees do not need to offer any health coverage.

Maine also has no such requirement. It is not required to offer any health coverage if your company has fewer that 50 employees.

You will not be penalized.

Employers of all sizes should consider offering health benefits. That includes very small firms, because they may find it difficult to hire and keep quality employees if there is no competitive benefit.

Maine has a low unemployment rate and fierce competition among employers for talented employees.

Maine employers could save money by providing a health-sharing plan or medical cost-sharing program (more information below) and paying some of or all the employee’s costs.

HRA Alternative

You can also offer your employees a QSEHRA (Qualified Small Employer Health Reimbursement Arrangement) that allows them to pay their individual health insurance tax free.

Employers can benefit from QSEHRAs in the following ways:

1.) Contribution limits are not applicable

QSEHRAs don’t require a set minimum annual contribution, unlike pension plans. You can set up your budget and adjust it each year based on your cash flow.

You can control your budget for health care benefits with a QSEHRA.

QSEHRAs allow you to manage your healthcare budget.

2.) Flexibility

It is possible to offer different amounts depending on whether the employee has a family or if they’re married. It is possible to discriminate and offer a bigger benefit for employees with dependents than those who are not married.

3.) The tax exemption is available to both employees and employers

You can deduct your contributions as compensation expenses. Contrary to cash compensation, however, the QSEHRA will not be taxed by your employees as long as they keep a health plan which includes 10 essential benefits specified in Affordable Care Act.

In this case, a QSEHRA will be more effective than merely offering employees an amount of money to pay for their health insurance.

4.) QSEHRAs Promote Employee Choice

There are too many group health plans that limit employees to just two or three options for health coverage.

The HR department and the company’s management select these items, which are overpriced or unsuitable to workers.

A QSEHRA offers workers and families a wide range of options and gives them the power to select a health plan which is right for them.

Maine Taxed Employer Health Insurance

The premiums for health insurance you pay, as an employer, are fully deductible as business expenses under federal law and Maine’s state laws. The employee is not taxed on these premiums.

The overall cost of healthsharing plans is lower. Employees can deduct the monthly cost of these plans from their taxes. Employer assistance to pay health-sharing costs is taxable for the employee.

Maine Employer Group Medical Insurance Coverage: Advantages and Disadvantages

There are some disadvantages of traditional health care for employees and employers.

- Cost

We have already mentioned that the cost to provide health insurance is high. This can be especially true for industries with a large labor force, where costs per employee are higher than revenue.

Many workers are overburdened by the requirements and coverages mandated in health insurance plans. Washington, Augusta and other government agencies have done this.

Traditional health plans, for instance, require that the carriers price mental health benefits, drug and liquor addictions, as well as maternity coverages, even though many employees don’t want or need them.

The result is that they are much less effective and economical than needed.

- Inflexibility

Many group health insurance programs are a “one size fits all” approach that does not always meet the budgets and needs of employees. Group health insurance programs sponsored by the employer tend to be one-size fits all and may not adequately address specific employee needs or budgets.

Some workers may find it more cost-effective to purchase their own health insurance plan through the private market, taking advantage of subsidies under the Affordable Care Act.

These workers may benefit from a cheaper health sharing plan. Affordable and innovative alternatives to insurance may be the best solution for employees in good physical health who do not have pre-existing medical conditions.

More information on health share plans is discussed below.

- Administrative burden

Managing an integrated health care benefit comes with substantial administrative expenses. It includes managing documentation, compliance and auditing of plans to verify that no non-qualified employees have been enrolled in the plan. They are vital to the smooth running of a company’s insurance program.

The plans can be very burdensome for employers with a small headcount who cannot justify hiring a staff member to handle the HR plan full-time.

Alternatives include Health Reimbursement Arrangements, and health care stipends.

Alternative approaches can encourage employees to purchase their own coverage through the Affordable Care act. It may be possible to get subsidies if workers do this. This also removes the employer from the entire process, which reduces overhead and administrative expenses.

Maine has Health Sharing Plans

Maine small businesses should consider health sharing programs as a cheaper alternative to high-priced insurance.

Maine-based businesses use medical costsharing plans more and more as an alternative to group health insurance. They are a cheaper option. When switching from group health coverage to health sharing plans, businesses can typically save up to 50% on their existing premiums.

Maine small businesses may be able to save upwards of $10,000 per employee each year on family coverage.

Maine Small Businesses could potentially save over $10,000 per employee annually on coverage for a family, or more than $3500 per employee annual for coverage for a single employee.

These programs offer a modern way of funding healthcare. Companies can provide their employees with access to quality healthcare and still control costs. Shared resources are the basis of health-sharing programs.

Participants in health-sharing programs pay an amount predetermined per year, instead of the usual premiums paid to insurance providers.

Health Sharing Plans vs. Health Insurance

A health-sharing plan is different from a medical insurance.

In contrast, healthsharing ministries are non-profit associations that bring together people of similar minds to share in the costs of medical care. Contrary to most health insurance providers, who are for-profit companies, healthsharing ministries are nonprofit.

Mandatory Coverage

Health insurance plans do not have such requirements. Federal and state law require that traditional health insurance policies include many coverages for which many people are unwilling or unable to pay. Health sharing organizations are not subject to the Ten Minimum Coverage Requirements.

For example, medical cost-sharing plans do not have to pay for addiction treatment in the case of people who don’t use drugs. They don’t have to pay for injuries caused by drunken driving.

Conditional Existence

Health sharing plans can impose waiting times before sharing the cost of pre-existing medical conditions.

They also often impose waiting times for surgery, except in the case of accidents and injury that couldn’t have been anticipated before the membership.

Health sharing organizations can offer a wide range of services at a fractional cost compared to a standard group health plan that meets ACA requirements or a policy purchased on the Healthcare.gov Maine online exchange.

Please note that health sharing plans do not qualify for subsidies as part of the Affordable Care act. However, the savings are so significant that switching to health sharing is still a good option for many, even if you qualify for a government subsidy.

Maine employers often find that switching to health-sharing makes more sense, since small group plans do not qualify for a tax credit under the ACA.

Request a Group Quote for Your Company

Maine Health Sharing and Network Restrictions

Contrary to traditional managed-care plans such as PPOs and HMOs which are far more common, Health Sharing Plans often give you more choices in terms of healthcare providers.

Maine’s health sharing organizations do not typically restrict access to their providers. Members of the health sharing plans have the option to pick their own provider. Making it possible for people to select their doctors.

What Is the Right Health-Sharing Program for Your Company?

Every company is different. To choose the most suitable plan, it is important to do some research, and consider whether you want a group health plan that uses a healthsharing model or one with a more traditional approach.

Business owners can easily get an in-depth case study and recommendations tailored to their company and staff.

We’ll get the ball rolling by clicking here, to schedule an appointment with a Personal Benefits manager licensed in Maine.

A prepared employee count will be helpful.

Switching to health insurance can save you thousands per covered employee. However, health sharing might not be the best option if there are employees with pre-existing illnesses.

Maine Small Business Health Insurance is Eligible for Health Insurance Reimbursement

Employer-funded health reimbursement arrangements (HRAs), which reimburse employees tax-free for personal healthcare costs, are a type of HRA.

Maine small firms often just drop their group health coverage. In Maine, many small business owners opt to create an HRA. With the HRA they provide their employees with the funds to cover themselves on the individual insurance market using pre-tax dollars.

It allows employees to benefit from available subsidies, further reducing net costs both for employee and company.

Workers can use their HRA benefits to pay other expenses such as deductibles (if any), co-payments (if applicable), prescriptions, or durable medical equipment. HRA is tax-free.

Your employees can choose their own health care plans with an HRA, instead of having to sign up for a formal health plan.

Click here to learn more about HRAs for small businesses.

HRAs for Small Businesses

QSEHRA or Qualified Small Employee Health Reimbursement Agreement (pronounced “Cue Sarah”) is the special HRA type that small businesses can utilize.

This benefit is intended for businesses with fewer 50 full-time staff or its equivalent.

Business owners can set the maximum QSEHRA amount they wish to contribute, as long as it is within certain parameters. Maine employers may contribute $5,850 to individual employees up until 2023 (up $487.50 a month), and $11,800 to employees who have a family up $983.33.

This money is used by employees to purchase insurance on their own via an online health exchange website or Personal benefits Manager, in the family and individual health insurance market. It preserves eligibility for subsidies, something they could not receive under a company-paid health plan.

Employers can reimburse their employees either for the premiums alone or for both premiums and additional medical expenses.

QSEHRAs (Qualified Special Enrollment Health Savings Accounts) and Special Periods of Enrollment

You will have to offer your workers a special enrollment period if your HRA replaces your old health insurance. This is a period of 60 days when your employees are able to buy their own ACA insurance with guaranteed approval rights.

If you decide to replace the group insurance plan with a QSEHRA, this will make sure that none of your employees lose their coverage.

HRA Advantages

Health Reimbursement Arrangements offer many benefits.

Your employees are tax free and you can claim a full tax deduction for the HRA benefit you provide.

HRAs are not paid until workers receive them. The money is available as operating capital. The money does not have to be held by a third-party.

You have great flexibility when it comes to designing your own HRA, which includes choosing what expenses you will reimburse.

If workers leave their company or become contractors, they do not lose coverage for health care. In the QSEHRA, workers own and control their health insurance policies. It is the employee who controls their insurance policy, and not the employer.

HRA Disadvantages

Some workers may not want to be responsible for researching and choosing their own insurance plans. Some workers might need help to navigate the transition. Your HSA for America personal benefits manager is ready to assist you. No worker will be left behind. To schedule an individual appointment, have your employees Click this Link or call 1-800-913-0172.

Click on for more information about alternative health insurance options available to small Maine businesses.

The Direct Primary Healthcare Advantage

Direct Primary Plans (DPC) represent an alternative healthcare system that is growing rapidly in Maine as well as across the entire country.

This is a model based on membership: Your employees can receive as many consultations as they require, whether in-person or through telehealth, for an affordable flat monthly fee.

DPC’s monthly membership fees start at just $80 and are a viable option for people to take care of their health, without having to pay copays or insurance.

DPC offers members access to all routine, primary, chronic and prevention care.

The following are some examples of direct primary healthcare services:

Some of the most common services offered by doctors who practice Direct Primary care include:

- Preventive care. DPC doctors are committed to preventive care and offer routine screenings, immunizations and checkups.

- DPC Doctors treat injuries, illnesses, and infections such as minor skin injuries, colds or flu.

- Chronic Disease Management DPC doctors assist patients in managing chronic conditions such as hypertension, diabetes, arthritis and more. These doctors offer ongoing treatment, monitor patients, and adjust their plans of care as required.

- Comprehensive physical exams. DPC doctors provide comprehensive physical examinations in order to identify and assess risks as well as personalize health recommendations.

- Urgent care. DPC is often able to offer same-day, or the next-day, urgent care.

- Patients can receive immediate attention to non-emergency issues by making appointments.

- Diagnostic and laboratory services. DPC physicians may coordinate or offer a wide range of diagnostic and laboratory services, including blood tests, urine analyses, imaging studies, (X-rays and ultrasounds), as well as electrocardiograms.

- Management of medication. DPC doctors are able to prescribe medication, track their effectiveness and adjust as necessary. The doctors also offer education on the proper use of medications.

- Mental Health Services As part of comprehensive health care, many DPCs offer mental health services. DPC physicians may offer counseling, therapy and refer patients to specialists in mental health when needed.

- Minor procedures. Minor procedures.

- Referrals and coordination of care. DPC physicians act as advocates for patients and coordinate with other health care providers, specialists, hospitals and hospitals when necessary.

As there’s not an insurance company, no copayments, no coinsurance and no deductibles are required. All costs are covered in the subscription fee. Cash-strapped people can get immediate access to the health care they deserve. No longer will they have to wait until later because the deductible and co-pay are too high.

Patients can select supplemental plans to cover additional services, such as accident insurance, high-deductible health plans or health sharing plans. DPC members can choose to cover routine health care at a lower cost by opting for healthsharing instead of traditional insurance.

Health Savings Accounts (HSAs)

HSAs are powerful tools that help people manage their healthcare costs. They can also lower the cost of health insurance premiums.

Maine business and residents are in need of every possible tax incentive. Good news! Employer contributions into employees’ Health Savings Accounts can be fully deducted from Maine corporate tax.

HSAs are a way for individuals to put money away before tax in anticipation of future medical expenses. HSAs can be funded by both employers and employees, but there is a cap on the amount that each party may contribute. The limit changes annually to match inflation.

HSAs offer tax-deferred earnings on money that is deposited, while withdrawals for qualifying healthcare expenses are free of tax.

HSA Eligibility

Employees must be enrolled in an HDHP to qualify for a HSA or employer contributions pretax.

The IRS has defined a high-deductible health plan for 2023 as a plan that includes a minimum deductible of $1,500 per individual and $3,000 per family.

A HDHP can only have a maximum of $7,500 in annual out-of-pocket expenditures (including deductibles. copayments. and coinsurance). This limit is for individuals. For families, the total amount cannot exceed $15,000 annually. It does not include out-of network services. ).

Can I combine HSAs & health sharing?

HSA America offers only the HSA-SECURE plan.

HSA SECURE Plan provides a way for you to enjoy the advantages that come from combining a healthcare savings account and the advantages that come with sharing health costs. However, to be eligible, you must own a business, have earned income from a self-employed job, or have owned & operated a small business.

HSA SECURE will not be available for straight W-2 workers. HSA-SECURE may work for you if the employee has a side business, freelance gig or small company, is in excellent health, does not have any existing conditions and can afford to pay monthly premiums.

You and your small-business partners may find that the HSA Secure Plan is a fantastic way to save some money.

Employees would be required to sign up for HSA SECURE themselves. You can contribute pre-tax to their HSA once they enroll and establish it.

How Are Maine Small Business Health Insurance Benefits Taxed?

After you’ve learned a little bit more about all the other options that are available for small business owners in addition to health insurance as it is known today, we have compiled a short table to explain how taxed each one of them.

Plan Type Employer Workers

Traditional health insurance premiums Tax deductible. May qualify for a tax credit (see below) Non-taxable

HSA contributions Tax deductible

Pre-tax, up to certain limits. No income limitations.

Health sharing costs Tax deductible as a compensation expense Taxable as ordinary W-2 income

Health reimbursement arrangements Tax deductible Benefits are non-taxable to the employee

HSA withdrawals N/A

Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income.

A 20% penalty for non-qualified withdrawals applies up until age 65.

Direct primary care costs

Tax deductible as a compensation expense Taxable to the employee

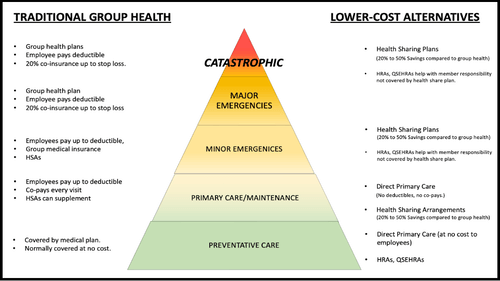

All the Care Pyramid Levels Must Be Addressed

Good employee health benefit packages should include all aspects of the Employee Healthcare Pyramid. This includes routine preventative care, primary care access, early detection of problems and maintenance, right through to catastrophic incidents.

You will find a list of common traditional insurance-based care solutions are listed on the left.

While a few alternative and more affordable ways to protect employees on each of the Pyramid levels is listed on the right.

A good plan will provide employees with solutions that are affordable at all three levels. No employee should be forced to wait or forgo care due to the cost of a coinsurance or copay.

Your Personal Benefits Manager can help you create a custom plan design for your work force that provides a solution at each level of the Care Pyramid—often at a fraction of the cost of a traditional group plan to the employer.

Maine Small Business Health Insurance Tax Credit

Small Business Health Care Tax Credit, passed with the ACA allows certain small businesses claim a federal credit up to 50% on their employees’ health insurance costs.

It is designed to provide small businesses who employ 25 or fewer workers, and are more likely to use lower-waged workers.

For-profit as well as non-profit organizations can both claim credit.

* Has fewer then 25 employees. Average salaries are around $53,000. It is not common to include owners when determining average salaries and the number of workers in an organization. The total number is calculated using “fulltime equivalents” or FTEs. The two part-time employees will equal the full-time equivalent.

Employees must be paid at least half as much in premiums.

Coverage that is eligible for the Affordable Health Care Act can be purchased on your state’s exchange. In Maine, this would be CoverME.

If an employer employs 25 people or has average wages of $53,000, the tax credit will be eliminated.

How can I get credit for my purchase?

Tax-exempt small business must submit Form 990T for tax purposes, even if they are not required to do so.

You are exempt from taxation on contributions made to your employee’s health coverage.

This year, I haven’t paid taxes on my business. Am I eligible to claim a tax credit for my business?

Yes. The tax credit may be used as a way to reduce income tax liabilities incurred in the prior year, or it can also be carried forward and offset over 20 years.

The credit can be refunded if you are a business that is exempt from taxes.

For more information on the Small Business Health Care Tax Credit, consult your tax advisor.

Maine Small Business Health Insurance Strategies

A smart decision when it comes time to maximize health coverage is to combine different insurance plans.

Many employers find that they can reduce their costs by offering a range of packages to employees, and still provide them with complete healthcare coverage.

You could combine Direct Primary Care Plans (DPCs), for the normal care of primary patients, with health plans that are low-cost and cover catastrophes.

Offering employees, the choice between signing up for a health sharing plan or purchasing an individual health insurance plan, as well as giving them the chance to fund a Health Savings Account (HSA) for those who choose an HSA-qualified HDHP plan, can give them more flexibility and possibly lower costs.

What to do Now

Contact us for a complimentary analysis of your business’ health plan analysis and recommendation.

The HSA for America Benefits Manager you are connected to will discuss with you your workforce and family, budget needs, employee contributions, as well as any existing conditions that need to be taken into consideration when creating a new program.

Many of PBMs were successful business owners or entrepreneurs themselves. These PBMs are business owners themselves and have a deep understanding of your requirements as an entrepreneur.

Can I provide both Health Insurance and Health Sharing at the same?

If you offer the options next to each other, employees can choose whichever plan is best for them.

If too many of your employees choose to opt out, then you may not be able to keep a plan in place. You can use an HRA as a reimbursement for the employee’s individual health insurance. This will cost close to the same.

Is it possible to provide both Health Insurance and Health Sharing at the same?

If you offer both, employees can choose the one that suits them best.

Please note, if you lose too many employees from a Group Health Insurance Plan, your participation rates could drop below what is required to continue a Group plan. HRAs are a great way to reimburse employees who purchase individual health plans, since they will have a similar cost.

Maine Small Business Health Insurance Frequently Answered Questions

What is the Difference Between Health Insurance and Health Sharing for Small Businesses?

A health sharing plan involves participants contributing money to an account to cover medical expenses.

Health Savings Accounts – How do they help Maine’s employees to manage their medical costs?

HSAs provide individuals with the opportunity to invest pre-tax dollars to help pay for future healthcare expenses. The contributions of both employees and employers could provide tax incentives and possible savings on healthcare expenditures.

Is it possible to deduct employer contributions for HSAs from Maine state income taxes?

Yes. Maine allows employers to deduct their contributions for employee HSAs as compensation expenses from state income taxes.

Small businesses can benefit from a cost-effective solution by combining DPC and low-cost options such as health sharing plans.

Does Maine cover the cost of maternity care under health sharing plans?

Maine has a wide range of health insurance and healthsharing plans that include coverage for prenatal care and labor as well as postnatal care. Nevertheless, certain health sharing plans might restrict cost-sharing benefits to children who are not born of a marriage.

HRAs are they compatible with health-sharing plans, individual insurance policies or health-sharing plans?

HRAs may be combined with other options of coverage. HRAs are used by some small companies to reimburse their employees for the premiums of individual health policies. HRA money can’t be used for reimbursement of employees directly on health share plan costs.

What is the best combination of cost-sharing and health insurance for a small business?

Avoid going it alone. Speak to a Personal Benefits manager. They can provide a complimentary analysis and recommendations based on the specific needs of your company, including budget and employee count, as well as any existing conditions. A Personal Benefits manager can assist in designing a customized plan for you that will maximize the benefits to your employees, while reducing costs and keeping you competitive.

Can you tell me about the waiting period for health plans that cover pre-existing conditions?

Certain healthsharing policies may require waiting periods to cover conditions that were present before. Review the plan’s guidelines for specific information or talk to your Personal Benefits Manager

Are employers allowed to contribute towards their employee’s HSAs?

The annual contribution limits established by Congress apply to employers who wish to contribute to HSAs for their employees.

What is the Small Business Health Care Tax Credit and how do I claim it?

For-profit small businesses can claim the tax credit on their annual income tax returns with IRS Forms 8941, while those that are tax exempt must submit a Forms 990-T.

HSA for America cannot provide you with tax advice. Employers can consult their own tax advisors to get full information about how the credit is claimed.

A business can still claim the Small Business Health Care Tax Credit, even if it does not owe Maine taxes.

If a company does not have any tax obligations in one year, they can use the Small Business Health Care Tax Credit as a way to pay back their income tax for the year before or carry it forward to the next 20 years.

What exactly is an HRA and how do they work?

HRAs allow employers to reimburse their employees for certain medical expenses that were not covered in the employee’s insurance policy. Employers set the criteria for what is eligible, and they contribute accordingly.

What is the maximum size for small businesses that can apply to these programs in Maine?

QSEHRA is available only to small employers (less than 50 employees). There are also other HRAs that you may be eligible for if your company has more than 50 workers or if it grows.

Additionally, you will be required by the ACA to offer a health plan that is qualified for your employees or face a fine. Speak to your Personal Benefits manager if you plan on hiring your 50th employee or the equivalent soon. This could have an impact on your plans.

Read More About Group Health Insurance Options in Your State

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.