Alaska Small Business Health Insurance Options

The Complete Alaska Small Business Health Insurance Guide (2026 Edition)

Welcome to the essential guide to health insurance for Alaska small businesses, brought to you by HSA for America.

This comprehensive guide is designed for self-employed people, independent contractors, and small businesses, in Alaska – particularly those with 50 or fewer employees, whether based in the state or employing Alaskans.

In Alaska, where the landscape is vast and many reside far from urban centers, accessing affordable healthcare poses unique challenges for small business owners, freelancers, and independent professionals.

The high costs and complex array of options can make finding the right plan seem like navigating uncharted territory.

Our essential guide to health sharing and health plans for Alaska’s small businesses is designed to be a resource for all small enterprises, freelancers, and independent workers.

We aim to empower you with the knowledge to make informed choices for yourself, your family, and your employees, ensuring everyone’s healthcare needs are met, no matter where in the vast Alaskan wilderness they may be.

In this guide, we delve into the specific healthcare considerations for small businesses in Alaska, providing you with the tools and information needed to secure the best possible health plan options.

Topics will include:

- The high cost of traditional group health insurance

- Health sharing—a more affordable alternative

- Health reimbursement arrangements (HRAs)

- Health savings accounts (HSAs)

- Direct primary care (DPC) plans

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

The Problem

As a small business owner, freelancer, or independent pro, you understand the value of good health insurance for your team.

In today’s market, a quality health plan also helps draw and keep the best people.

But thousands of Alaskan small businesses have been essentially frozen out of traditional health insurance solutions, thanks to continually escalating premiums.

The problem is especially acute for smaller businesses that don’t have access to large amounts of capital, and for independent contractors and self-employed individuals who don’t qualify for a subsidy under the Affordable Care Act to help them pay for health insurance.

Traditional Health Insurance Coverage is Increasingly Out of Reach

The high cost of living in Alaska is no secret, and health insurance is just one of the many expenses that can put a strain on small businesses.

In fact, Alaska is the most expensive state in the union when it comes to health insurance costs. According to data from the Kaiser Family Foundation, it costs $25,892 to insure just one employee and his or her family, as of 2022.

Out of that, Alaska employees typically contribute $6,807 on average toward their health insurance, with employers covering the remaining $19,085 on average

A self-employed or business owner-operator in Alaska must pay both parts of his or her own health insurance costs – putting traditional health insurance solutions even further out of their grasp.

There has to be a better way.

Why is Health Insurance in Alaska so expensive?

Health insurance is expensive in Alaska for a number of reasons, including:

- High demand for health care: Alaska has a high demand for health care, which also contributes to the high cost of health insurance. The state has a large population of uninsured and underinsured residents, which puts a strain on the healthcare system as a whole and drives up the cost of care.

- Government regulations: The federal government and the state of Alaska have a number of laws and regulations that contribute to the high cost of health insurance. These regulations require health insurance plans to cover a wide range of services, including mental health and substance abuse treatment, maternity care, and preventive care. This can drive up the cost of health insurance premiums for small businesses, as they are required to offer these comprehensive benefits to their employees.

- Adverse selection: Adverse selection occurs when people who are more likely to use health care services are the ones who buy health insurance. This can lead to higher premiums for everyone, as insurers need to charge more to cover the costs of these high-risk individuals.

- Insurance company profits: Insurance companies are for-profit businesses, and they need to make a profit in order to stay in business. This profit is reflected in the cost of health insurance premiums.

The high cost of health insurance is a significant challenge for small businesses in Alaska. It can make it difficult for small businesses to attract and retain employees, and it can put a strain on their bottom lines.

Fortunately, there are a number of things that Alaska small businesses can do to try to reduce their health insurance costs.

Thinking Beyond Traditional Health Insurance

For Alaska small businesses – those with 50 employees or less – there’s no law that says you need to offer traditional health insurance.

The Affordable Care Act only requires that for companies with 50 full-time workers or more. For everyone else, there’s no mandate whatsoever.

That doesn’t mean you shouldn’t provide a health benefit. After all, you still need to attract and retain quality talent. If you don’t provide the benefits good workers need, they won’t stay long.

But that doesn’t mean you have to use overpriced, bloated traditional group health insurance policies to do it.

In fact, traditional health insurance is the costliest by far, except for certain individuals, sole proprietors, independent contractors and others who receive a subsidy under the Affordable Care Act.

The good news is that you have several other potential solutions to the problem of providing affordable access to quality healthcare for you and your employees and their families – all at a much lower cost compared to unsubsidized health insurance premiums.

These options include:

- Health sharing plans

- Hybrid health sharing and HSA-qualified plans

- Health reimbursement arrangements (HRAs)

- Direct primary care plans

The best health insurance strategy for your small business will depend on a variety of factors, including the size of your company, the age and life stage of your employees, your budget, and any pre-existing conditions that your employees or their dependents may have.

Good plan design takes all of these factors into consideration and often uses a combination of strategies, products, and solutions to provide a fuller spectrum of healthcare benefits.

Learn More: The Complete Guide To Small Business Healthcare Plans.

You Can Drop Overpriced Group Insurance And Choose Health Sharing Instead

Under the Affordable Care Act, employers with fewer than 50 workers are not required to offer health insurance at all.

This is also true for Alaska businesses.

If you are smaller than 50 employees, there’s no penalty for not sponsoring a health insurance plan for your workers

But you can still offer a meaningful benefit to your workers, and even purchase it for yourself and your family, at a fraction of the cost of an unsubsidized traditional health insurance product.

You can offer a health sharing plan, and pay some or all of the costs for your employees. This has the advantage of lower costs for your business—even if you pay the entire cost of your employee’s health sharing plan. However, the disadvantage is that any money you provide to your employees to pay the cost of the health sharing plan is a taxable benefit for your workers.

Or you can offer a health reimbursement arrangement, and help your employees pay their health insurance premiums, and possibly other medical costs, as well.

Taxation of Employer Health Coverage in Alaska

Health insurance premiums you pay as an employer are fully deductible as a business expense under both federal and Alaska state law.

The same is true of health sharing costs, and all other compensation costs: aAll of them are fully deductible to the employer as a business expense.

They are also not taxable to the employee.

Health Sharing plans feature lower overall costs compared to traditional health insurance. Their monthly costs are also tax-deductible to the employee. However, employer assistance for paying health sharing costs are taxable to the employee.

Employer Health Benefits and Tax Treatment in Alaska

| Health Benefit | Tax Treatment for Employer | Tax Treatment for Employee | Reduces Employer Payroll Taxes? |

|---|---|---|---|

| Cash Stipends for Health Benefits | Deductible as a business expense. | Taxed as income. | No |

| Health Insurance Plans | Premiums are deductible as a business expense; not subject to payroll taxes. | Premiums paid by the employer are not taxable income; employee-paid premiums can be pre-tax if through a Section 125 plan. | Yes, if offered through a Section 125 plan. |

| Health Sharing Plans | Not typically deductible as a business expense since they're not considered insurance; depends on the structure. | Contributions are usually after-tax and not deductible. | No |

| HSAs (Health Savings Accounts) | Contributions are deductible as a business expense; not subject to payroll taxes if made through a Section 125 plan. | Contributions are pre-tax if made through payroll deduction; tax-deductible if made directly, and withdrawals for qualified expenses are tax-free. | Yes, if contributions are made through a Section 125 plan. |

| QSEHRAs | Reimbursements are deductible as a business expense; not subject to payroll taxes. | Reimbursements for qualified medical expenses are tax-free. | Yes |

| ICHRAs (Individual Coverage HRAs) | Reimbursements are deductible as a business expense; not subject to payroll taxes. | Reimbursements for qualified medical expenses are tax-free. | Yes |

| Section 125 Cafeteria Plan Benefits | Contributions are deductible as a business expense; not subject to payroll taxes. | Contributions are pre-tax, reducing taxable income; benefits received are generally tax-free if used for qualified expenses. | Yes |

| FSAs (Flexible Spending Accounts) | Contributions are deductible as a business expense; not subject to payroll taxes if made through a Section 125 plan. | Contributions are pre-tax, reducing taxable income; withdrawals for qualified expenses are tax-free. | Yes, if contributions are made through a Section 125 plan. |

| Direct Primary Care Plan Memberships | Deductibility as a business expense can vary; not typically subject to payroll taxes if structured as a health plan benefit. | Tax treatment varies; may be considered a qualified medical expense and paid with pre-tax dollars through an HSA, FSA, or HRA. | Depends on the structure and if offered as part of a Section 105 or 125 plan. |

It is important to note that these are general rules, and the specific tax treatment of a health benefit may vary depending on the specific plan design and the circumstances of the employer and employee.

Alaska Traditional Group Health Insurance Disadvantages

Traditional health insurance can work out well for those with ACA subsidies, and people with existing health issues who need their plans to fully cover them from day one.

However, many in Alaska don’t get a subsidy of any kind. They have to pay “full boat.”

Premiums are hefty, and plans often include mandated coverages like addiction services, mental health, and maternity care, which may not be relevant for all employees.

For example, it’s illogical for individuals who don’t engage in substance use to pay extra for rehab services they’ll never use.

But Big Government insurance mandates include these coverages, pushing premiums ever higher.

Traditional plans also lack customizability. They force policyholders to accept overly broad coverage that might not suit every employee’s needs.

And most of them on the market these days restrict plan members to their approved doctors and hospitals.

The good news is: Alaskan small businesses have alternatives like health sharing plans and HRAs to help them save money while still providing workers and their families with powerful health benefits.

These solutions often offer tremendous cost savings, greater flexibility, and reduced administrative and compliance hassle compared to ERISA group health insurance plans.

Health Sharing Plans in Alaska

Health sharing plans are a revolutionary way to cut costs without sacrificing quality.

Thousands of Alaska residents who’ve been left out of the Affordable Care Act subsidies as well as small businesses are saving up to 50% on premiums just by dropping traditional health insurance products and switching to health sharing.

That means you could save more than $10,000 per year for your own household or per employee for family coverage, and more than $3,500 for your own household or for each enrolled employee per year for single coverage.

Health sharing programs work by pooling resources from a group of people or organizations. When someone in the group gets sick, the costs are shared among everyone. This means that you can get the high-quality care you need without breaking the bank.

If you’re a small business owner in Alaska, consider switching to a health sharing plan. It’s a smart way to save money and provide your employees with the healthcare they deserve.

Learn More: How Much Can Health Sharing Save?

Health Sharing vs. Health Insurance

Health sharing plans are not the same thing as health insurance.

Instead, health sharing organizations are voluntary associations of like-minded people who agree to help share the medical expenses of other members. In contrast to health insurance companies, which are usually for-profit corporations, health sharing ministries are non-profit organizations.

Health sharing programs work by pooling resources from a group of people or organizations. When someone in the group gets sick, the costs are shared among everyone. This means that you can get the high-quality care you need without breaking the bank.

In addition to saving money, health sharing plans offer several other benefits for small businesses in Alaska

- They can provide access to high-quality healthcare. Health sharing plans typically have broad networks of providers, so you can be sure that your employees will have access to the care they need.

- They are portable. Employees can take their health sharing plan with them if they change jobs.

- They are flexible. Health sharing plans offer a variety of options to meet the needs of different businesses and employees.

Mandated Coverages

While federal and state laws require traditional health insurance policies to include coverage for many things that many people don’t want or need, health insurance plans have no such requirements.

The 10 Minimum Essential Coverage requirements don’t apply to health sharing organizations.

Medical cost-sharing plans are not required to cover the cost of addictions treatment for people who never use drugs, for example. And they don’t need to cover the cost of treating injuries as a result of the members’ drunk driving.

Health Sharing, Pre-Existing Conditions, and Surgeries

One of the main differences between health sharing plans and traditional health insurance plans is the way in which they handle pre-existing conditions.

With traditional health insurance plans, pre-existing conditions are typically covered after a waiting period. However, health sharing plans may impose waiting periods before they will share the costs of treating pre-existing conditions.

This is because health sharing plans are designed to be used by healthy people who are unlikely to have pre-existing conditions. The waiting periods help to protect the health sharing pool from being overwhelmed by people with pre-existing conditions.

Surgeries

Another difference between health sharing plans and traditional health insurance plans is the way in which they handle surgeries.

Health sharing plans often impose waiting periods on surgeries, except for injuries and accidents that could not have been foreseen prior to the member’s enrollment. A 90-day waiting period on non-emergency surgeries is common.

Despite these differences, health sharing plans can still be a good option for small businesses in Alaska. They offer many of the same benefits as traditional health insurance plans, but at a fraction of the cost. And, with the high cost of traditional health insurance, small businesses may find that the savings offered by health sharing plans outweigh the potential drawbacks.

Health Sharing Lets You Choose Your Own Doctor

At HSA for America, we believe healthcare freedom should be a priority, not an afterthought.

Preserving healthcare freedom is one of our core values, and at the forefront of everything we do.

That’s why we are the leading independent health benefits broker firm in the country when it comes to health sharing: Health sharing plans put you back in control of choosing your doctor, nationwide.

Unlike the health maintenance organizations (HMOs) and preferred provider organizations (PPOs) that dominate the Obamacare exchanges, health sharing organizations in Washington, D.C. generally do not restrict patients to in-network providers.

Instead, health sharing plan members have much greater freedom to choose their own doctors and providers.

Is Health Sharing Right for Your Business?

Every business is different.

Choosing the best possible plan, whether it’s a healthsharing approach or a traditional group health insurance plan, take some careful analysis.

The good news is, it’s easy for business owners in Alaska to get a full case analysis and recommendation specific to your organization and workforce.

Just click here to set an appointment with one of our experienced Personal Benefits Managers licensed in California, and we’ll start the process.

In most cases, switching to health insurance will save thousands of dollars per covered employee. But health sharing may not be indicated if you have workers with pre-existing conditions.

The consultation and analysis is always free.

HRAs, HSAs, and DPCs – Other Cost-lowering Options for

Alaska Small Businesses

In addition to health sharing plans, there are a few other alternative health insurance options for small businesses in Washington, D.C. These include:

- Health reimbursement arrangements (HRAs) HRAs are employer-funded accounts that employees can use to pay for health care expenses.

- HRAs are a tax-free way for employees to save money on their health care costs.

- Health savings accounts (HSAs) HSAs are tax-advantaged accounts that allow individuals to save money for future medical expenses.

- Direct primary care (DPC) plans DPC plans are a type of healthcare delivery model that emphasizes primary care and preventive care.

HSAs can be used to pay for deductibles, copays, and other out-of-pocket costs.

DPC plans typically offer lower costs than traditional health insurance plans and may provide better access to care.

It is important to weigh the pros and cons of each option carefully before choosing the best health insurance plan for your small business.

About Health Reimbursement Arrangements

HRAs allow employers to allocate funds for employee premiums.

These allocations are tax deductible to employers, and tax-free for employees. HRAs enable them to purchase individual health insurance coverage on their own.

Depending on the plan, employers can structure their HRAs to also reimburse employees for out-of-pocket health care costs, such as deductibles, copays, and co-insurance costs.

The types of HRAs most relevant to Alaska employers are Qualified Small Business HRAs (QSEHRAs) – which are only available to companies that do not offer a health sharing plan – and Individual Coverage (ICHRAs)

Why Use Health Reimbursement Arrangements?

Health Reimbursement Arrangements (HRAs) offer a number of benefits for small businesses and their employees.

- Tax advantages. HRA contributions are fully tax-deductible for employers, and the money is tax-free to employees when they use it to reimburse qualified medical expenses.

- Cash flow benefits. HRA funds are controlled by the employer until they are disbursed to employees. You don’t have to send HRA funds are off to an escrow account or to a third-party. Instead, you can retain the funds as operating capital until you actually need to reimburse employees.

- Flexibility. Employers have a great deal of flexibility in designing their HRA programs, including the specific benefits that they offer and the eligibility criteria for employees.

- Portability. HRAs do not jeopardize employee health insurance coverage if they leave the company or change jobs. With a QSEHRA, the employee owns the health insurance policy and maintains control, not the employer.

This helps small businesses preserve critical cash flow and liquidity, while still providing an attractive benefit to employees.

| HRA Type | Tax Treatment | Limitations |

|---|---|---|

| Section 105 HRA | Employer-funded account that reimburses employees for eligible medical expenses. | - Must be used for qualified medical expenses. - Funds are not subject to income tax, payroll taxes, or FICA taxes. |

| Non-Section 105 HRA | HRA established by an employer that is not subject to Section 105 of the Internal Revenue Code. | - May be used for any purpose. - Funds are subject to income tax, payroll taxes, and FICA taxes. |

| QSEHRA | HRA offered by a small employer that allows employees to contribute pre-tax dollars to an account that can be used for qualified medical expenses. | - Must be used for qualified medical expenses. - Funds are not subject to income tax, payroll taxes, or FICA taxes for employees. - Employers may be subject to an excise tax if they do not make a sufficient contribution to the employee’s QSEHRA. |

| ICHRA | HRA that allows an individual to contribute their own money to an account that can be used for qualified medical expenses. | - Must be used for qualified medical expenses. - Funds are not subject to income tax, payroll taxes, or FICA taxes for individuals. |

QSEHRAs—The HRA for Alaska Small Businesses

If you’re a small business owner in Alaska with fewer than 50 full-time employees, you may be eligible for a special program called the Qualified Small Employer Health Reimbursement Arrangement, or QSEHRA.

This program can help you provide health insurance options for your employees without having to offer an expensive traditional group health insurance plan.

With a QSEHRA, you essentially “get out of the health insurance game completely.” Instead, you reimburse your workers up to a cap to buy their own qualified health plan.

To start a QSEHRA plan, you must not currently offer a qualified group health insurance plan to your employees, or you must cancel your current group insurance plan when you implement the HRA.

Once you cancel your health insurance plan and replace it with an HRA, your employees will qualify for a Special Enrollment Period. This is a 60-day window during which your workers can purchase their own ACA-qualified insurance plan with guaranteed issue rights, without going through medical underwriting.

This helps ensure your employees don’t face a break in coverage when you drop your group health insurance plan altogether and replace it with a QSEHRA.

QSEHRAs are a great option for small businesses in Alaska looking to provide health insurance options for their employees without the high cost and hassle of traditional group health insurance plans.

With a QSEHRA, businesses can set their own contribution limits,

For 2024, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) limits are as follows:

- Single Coverage: Employers can reimburse up to $5,850 per year for employees with individual coverage.

- Family Coverage: For employees with family coverage, the reimbursement limit is up to $11,800 per year.

These limits are adjusted for inflation, and they’re designed to give small employers a flexible way to offer health benefits to their workers.

After an employee receives their QSEHRA funds, they can use them to purchase health insurance on their own through Healthcare.gov or a private broker. This preserves their eligibility for subsidies that they would not receive if they were covered under an employer-sponsored group health insurance plan.

As an employer, you have the option to reimburse your employees for their health insurance premium only, or for their premiums plus additional medical expenses.

ICHRAs – Unlimited Benefits, and More Flexibility

ICHRA stands for Individual Coverage Health Reimbursement Arrangement.

Like the QSEHRA, the ICHRA It is a medical expense reimbursement plan (MERP) that allows employees to choose their own health insurance coverage and receive reimbursement from their employer for their premiums and other qualified expenses.

ICHRAs are a great option for small businesses because they offer flexibility and cost-effectiveness.

There is no one-size-fits-all approach to ICHRAs, so businesses can design a plan that meets their specific needs and budget. Some of the benefits of ICHRAs include:

Cost-effectiveness: ICHRAs can save businesses money on health care costs because employees are able to choose the most cost-effective health insurance plans for their needs.

- Flexibility: ICHRAs offer businesses flexibility in terms of how they design their plans and how they reimburse employees for their expenses.

- Employee satisfaction. ICHRAs can improve employee satisfaction because employees have more control over their health care choices and are able to use their reimbursement funds for the care they need.

If you are a small business owner, ICHRAs may be a good option for you. They offer a number of benefits that can help you save money, improve your bottom line, and provide your employees with the health care coverage they need

Direct Primary Care (DPC)

Direct primary care (DPC) is a patient-centered healthcare model that provides unlimited primary care appointments and services for a set monthly subscription, like a health club membership.

DPC eliminates the need for insurance for primary care, therefore, there are no deductibles, copays, or coinsurance costs for DPC services.

DPC doctors generally do not take insurance at all.

This is because DPC is a much more efficient way to deliver primary care than fee-for-service clinics that rely on insurance billing. Without the need to bill insurance companies, DPC practices can focus on providing high-quality care to their patients.

DPC is a good option for patients who want affordable, high-quality primary care. It is also a good option for patients who have chronic conditions or who need frequent medical care. DPC can save patients money on their healthcare costs, and it can also improve their quality of care.

Some other advantages of DPC include:

- House calls (in some cases)

- Email access to doctors

- Greater access to physicians

- More personalized health care

- No additional cost sharing

- Shorter or non-existent wait times

- Easy access to doctors via telemedicine

- More preventive services

What Services do DPC Physicians Provide?

Direct primary care (DPC) doctors provide a range of services, including:

- Wellness guidance

- Unlimited office visits

- In-office procedures

- Preventive care

- Basic pediatric services

- Treatment for acute illnesses

- Chronic disease management

- Telehealth and mental health services

- DPC doctors may also offer extended appointment times and 24/7 access

DPC doctors may also offer extended appointment times and 24/7 access.

Some services that DPC doctors typically do not cover include:

- Emergency care

- Hospitalization

- Specialist care

- Prescription drugs

For this reason, DPC memberships should not be a stand-alone solution.

Members or employee plan beneficiaries should always have a health sharing plan or traditional health insurance plan, or access to Medicare or VA care, in addition to a DPC membership to handle major and catastrophic healthcare costs.

However, If you are looking for a more affordable and convenient way to access healthcare, DPC may be a good option for you.

Learn More: Why Smart Employers Are Dropping Health Insurance for Individual HRAs + DPC

Level Up: Combine DPC With Health Sharing

Combining DPC and health sharing can save you money because you won’t have to pay twice for the same service.

Health sharing plans don’t cover routine primary care, but they do cover the costs of more expensive care, like specialist visits, surgeries, and hospitalizations. DPC plans, on the other hand, offer comprehensive primary care coverage.

By pairing the two, you can get the best of both worlds: high-quality primary care and affordable coverage for more expensive care.

LEARN MORE: The DPC DIRECT Health Sharing Plan Is Designed Specifically for Direct Primary Care Patients

The Health Savings Accounts (HSAs)

Health Savings Accounts, or HSAs, can be a valuable tool for employees to save money on their medical expenses.

HSAs allow individuals to set aside money from their paychecks before taxes are taken out. This money can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. HSAs can also be used to pay for some health insurance premiums.

Employers may also contribute to their employees’ HSAs. These contributions are also tax-deductible for the employer. In Alaska, employer contributions to employees’ HSAs are fully deductible under federal income tax. However, Alaska does not allow HSA deductions for state income tax purposes.

HSAs can be a great way for employees to save money on their medical expenses and can help to lower the cost of employer-sponsored health insurance plans. If you are an employee who is eligible for an HSA, it is a good idea to talk to your employer about contributing to an HSA. HSAs are a great option for Alaska residents and businesses looking for ways to save money on health care costs.

Can I combine HSAs with health sharing?

The HSA SECURE plan is a specially-structured health sharing plan that preserves an employee’s eligibility for pre-tax contributions to a health savings account.

This is a great way to combine the tax and healthcare advantages of a health savings account with the cost-saving advantages of health sharing.

However, in order to enroll in the HSA SECURE plan, your employees must have some self-employed or small business income or ownership.

If your employee or their spouse has any small business, freelance work, or side hustle of their own, and they are in good health with no preexisting conditions that need ongoing care, the HSA SECURE plan could be a great option.

The HSA SECURE pPlan may also be a great money-saving option for you and your partners as a small business owner.

Your employees would have to enroll in HSA SECURE on their own, but once they’ve enrolled and established an HSA, you can make pre-tax contributions to it on their behalf, up to the annual limit Congress establishes each year.

For HSA SECURE to work well in a group context, however, you will need to offer some additional options for workers who don’t have self-employment or independent contractor income.

If this is a strategy you’re interested in, it’s a good idea to schedule a free consultation with an HSA for America Personal Benefits Manager to discuss plan design and alternatives.

Click here to learn more about HSA SECURE

Plan Design: Address All Levels of the Care Pyramid

A comprehensive employee health benefits package should provide coverage for all aspects of healthcare, as represented by the Employee Healthcare Pyramid.

The pyramid illustrates the range of care that employees need, from basic preventive services to primary care for ongoing health maintenance and early detection of potential issues, to catastrophic coverage in the event of a serious illness or injury.

This ensures that employees have access to the care they need when they need it, without having to worry about the cost. It also helps to protect employees from financial ruin in the event of a major health emergency.

Employers who offer comprehensive employee health benefits packages are not only providing their employees with peace of mind, but they are also setting themselves apart as a desirable employer in a competitive job market.

The Employee Healthcare Pyramid

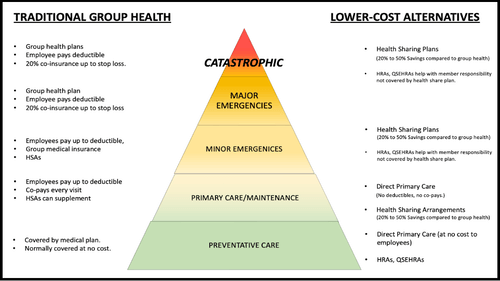

As shown in the below diagram, a good employee health benefit package should cover all levels of the Employee Healthcare Pyramid, from routine preventive health care to primary care for maintenance, early detection of health issues, and catastrophic incidents.

The Employee Healthcare Pyramid illustrates the range of care that employees need, from basic preventive services to primary care for ongoing health maintenance and early detection of potential issues, to catastrophic coverage in the event of a serious illness or injury.

A good employee health benefits package should provide coverage for all aspects of healthcare, as represented by the Employee Healthcare Pyramid.

On the left side of the pyramid, you’ll find common traditional insurance-based solutions that address each level of the pyramid. These solutions are typically designed to cover the costs of doctor’s visits, hospital stays, prescription drugs, and other medical expenses.

On the right side of the pyramid, you’ll find a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level. These options may include health sharing plans, health reimbursement arrangements (HRAs), and direct primary care (DPC) plans.

It’s important to have a good plan design that provides employees with affordable solutions at each of these levels. This helps ensure that no employee has to delay or go without care because they can’t afford a premium, coinsurance, or copay.

Your Personal Benefits Manager can help you create a custom plan design for your workforce that provides a solution at each level of the Care Pyramid—often at a fraction of the cost of a traditional group plan to the employer.

Get More Help

The best course of action is to gather your employee census and contact HSA for America to receive a free, no-obligation business health plan analysis and recommendation.

The process is easy, low-stress, and hassle-free.

Our team of experienced Personal Benefits Managers will work with you to understand your workforce, budget, needs, and any preexisting conditions to design a plan that meets the unique needs of your company.

We’ll help you stay competitive and attract top talent while providing your employees with the quality care they deserve.

For Further Reading

HRA For America Saves Small Businesses Thousands in Healthcare Costs

How To Compare Health Sharing Programs and Limitations: A Comprehensive Guide

Health Sharing for Small Businesses: What Business Owners Need to Know

Read More About Group Health Insurance Options in Your State

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.