Higher Deductibles Means Lower Premiums

Because HDHPs have higher premiums than standard health insurance plans, they feature much lower monthly premiums.

These lower costs can free up even more cash to contribute to your HSA, generating even more tax savings—and enabling you to increase your deductible (thus lowering your premiums even more!)

It’s a positive cycle of savings! And you can jump on board by enrolling in a qualified HDHP, or the health savings account-qualified HSA SECURE health sharing plan.

This blog will explain how this powerful combination of an HSA and a qualified high deductible health plan or HSA-qualified health sharing plan called HSA SECURE can help you save taxes, reduce net health care expenses, and even help you save for retirement!

Health Savings Accounts by the Numbers

HSAs are rapidly gaining traction, and experienced a huge increase in popularity during the COVID-19 pandemic.

30 million: The total number of HSA accounts in existence as of year-end 2021.

34.4 billion: Total HSA assets as of the end of 2021.

45 Percent: The growth in assets held in health savings accounts between the end of 2020 and 2021.

$19,224: The average HSA account balance as of 2021.

The Nuts and Bolts of HDHPs

An HDHP is a health insurance plan featuring lower monthly premiums but higher deductibles compared to conventional health insurance plans.

Here’s the central idea: HDHPs provide great coverage for low-frequency, high-cost, catastrophic medical situations. But they also incentivize you to manage your day-to-day healthcare costs effectively. That higher deductible means you keep a little bit more “skin in the game.”

Health insurance companies know that patients with higher deductibles tend to make more responsible decisions about healthcare utilization. Because you’re paying the first few thousand dollars under a high deductible plan with your own money, you will spend it more carefully, and not get unnecessary services.

Their data over millions of HDHP plan members bear this out.

In return for having more skin in the game, health insurance companies charge HDHP plan members a much lower monthly premium.

The difference can amount to thousands of dollars per year in health insurance premiums.

IRS Guidelines For HDHPs

Minimum Allowable Deductibles

According to IRS guidelines for 2024, HDHPs must have a minimum annual deductible of $1,600 for individual coverage and $3,200 for families.

That’s up from $3,850 for self-only and $7,750 and family coverage for 2023.

Maximum Out-of-Pocket Costs

For 2024, your maximum out-of-pocket medical expenses under any HDHP are limited to $8,050 for self-only coverage and $16,100 for family coverage –– (up from $7,500 for self-only coverage and $15,000 for family coverage in 2023.

That means that your total out of pocket charges for covered medical expenses, including your deductibles, co-pays, and co-insurance under the plan (but not your premiums), is limited to that amount.

The Power of Lower Premiums

One of the most compelling aspects of HDHPs is their relatively low monthly premiums.

HDHPs work particularly well if you are in generally good health, and you don’t expect to need much medical treatment or prescription drugs during the year.

The lower premiums help free up more cash for you to save or invest.

And for most people, the very best place to stash the monthly savings from switching to an HDHP is a Health Savings Account.

These are special tax-advantaged savings vehicles specifically designed to provide an incentive for taxpayers to use HDHPs, and set money aside for their own future healthcare costs.

Health Savings Accounts Offer Triple Tax Benefits

Health Savings Accounts provide even more tax benefits than a 401(k) or a traditional IRA.

This is especially true when you use them to pay qualified medical expenses, or to help supplement your retirement savings.

When paired with an HDHP, a Health Savings Account (HSA) provides an exceptional trifecta of tax benefits, making it a financial powerhouse for healthcare savings.

Here’s how:

- Pre-Tax Contributions. Money that you contribute to your HSA is deductible, effectively lowering your overall taxable income. If your employer contributes money to your HSA via payroll deduction, those contributions are pre-tax.

- Tax-Free Growth. Interest and investment returns earned in the HSA account are not subject to tax. This is a unique feature that sets HSAs apart from other investment vehicles.

- Tax-Free Withdrawals. When you use your HSA funds for qualified medical expenses, you can make withdrawals without incurring any taxes. Moreover, you can roll over unused funds year after year, providing a platform for long-term savings and investment growth.

Compare Pricing on the Best HSA Plans Available

How Much Can I Contribute to an Health Savings Account?

If you’re able, consider contributing the maximum amount the IRS allows.

Here are the maximum amounts you can contribute to your Health Savings Account for tax years 2023 and 2024:

| 2023 | 2024 | |

|---|---|---|

| Self-only coverage | $3,850 | $4,150 |

| Family coverage | $7,750 | $8,300 |

| Catch-up contribution (age 55 or older) | $1,000 | $1,000 |

There’s no income cap or limitation. Anyone covered under an HDHP or the HSA SECURE health sharing plan who’s also not covered under another plan like the VA or TRICARE can contribute these amounts to a health savings account.

Annual savings from income taxes alone can be as much as $2,905 for a family in the effective 35% income tax bracket.

Add in another $200 to $350 in potential tax savings per person age 55 and older on the plan, thanks to catch-up contributions.

Vesting Benefits

Unlike employer contributions to your 401(k), which can take up to five years to fully vest, employer contributions to your HSA are vested to you immediately.

You do not give up those funds if you leave your job.

You have immediate access to those funds to use tax free and penalty free for qualified medical expenses. However, you will have to pay income taxes on withdrawals as well as a 20% penalty for anything other than non-qualified medical expenses, until you reach age 65, when the 20% penalty goes away.

Health Savings Accounts Let You Choose Your Doctor

Many people are frustrated with traditional insurance plans like HMOs and PPOs that restrict patients’ ability to choose their own doctors and other care providers.

But your HSA has no such restriction.

Instead, you can use your HSA funds with any willing provider you choose, with no network restrictions at all. Even if your HDHP is an HMO or PPO.

With HSAs, you effectively become a cash payer, with an incentive to shop around to find the best possible value for your HSA dollars.

This helps both you and the insurance company, and goes a long way to helping keep premiums down.

It’s a win-win situation.

How Much Can I Save in Monthly Premiums By Switching to an HDHP?

High deductible health plan premiums can vary significantly depending on several factors, including geographic location, age, and the level of coverage chosen.

But they are nearly always cheaper than a comparable policy with a lower deductible.

Some general figures can offer a sense of the landscape:

According to a 2022 report from the Kaiser Family Foundation, the average annual premiums for workers in HSA-qualified HDHPs are $7,170 for single coverage and $21,079 for family coverage.

These amounts are significantly less than the average single and family premium for covered workers in plans that are not HDHP/SOs.

How Does the HSA SECURE Health Sharing Plan Work?

The HSA SECURE Plan combines the best features of health sharing plans with health savings accounts.

Health sharing plans – also called medical cost sharing plans – are not insurance policies. Rather, they are large, voluntary associations of like-minded, health-conscious people who share similar values, and who agree to help share each other’s medical expenses.

Every member contributes a certain amount each month, and the health sharing ministry organization facilitates directing their massed contributions to members who have medical expenses that month.

Coverage for pre-existing conditions is more limited with health sharing plans compared to traditional health insurance plans. They routinely impose waiting periods of up to three to five years before expenses resulting from pre-existing conditions are shareable.

While most health sharing plans do not include the ten “minimum essential coverages” that the Affordable Care Act requires of health insurance plans – such as mental health and drug addiction treatment coverage – the HSA Secure plan’s chassis does include all ten essential coverages.

The plan is designed to qualify as a high-deductible health plan, including all ten MECs required of HDHPs.

As a result, unlike other health sharing plan members, HSA SECURE members are eligible to contribute money to a health savings account. They’re also eligible to receive employer contributions made on their behalf.

Currently, the HSA SECURE plan is the only major nationally available health sharing plan that preserves members’ eligibility to contribute to health savings accounts.

There’s no open enrollment period: You can sign up for HSA SECURE at any time.

NOTE: To enroll in HSA SECURE, you must be a business owner, or have verifiable income from self-employment, such as tax returns or a 1099 form from your client or clients.

CLICK HERE TO LEARN MORE ABOUT HSA SECURE AND TO GET A FREE QUOTE.

How Much Can the HSA SECURE Plan Save Me in Premiums?

Health sharing typically saves significant money.

Specifically, monthly required sharing contributions to the HSA SECURE Plan are typically 40 or 50 percent less compared to the unsubsidized monthly premiums for a traditional health insurance plan over the Affordable Care Act Exchanges.

An Obamacare-style plan may cost $1,200 or more, pre-subsidy, for a family of four. The HSA SECURE Plan is typically around $600 to $800, depending on the plan you select and the ages of the adults in your family.

The savings therefore can amount to thousands of dollars per year per household.

This frees up money that you can use to contribute to your HSA. So if your plan has higher premiums, your increasing HSA balance will soon allow you to take them in stride.

The HSA SECURE plan works especially well if you are in reasonably good health, and don’t qualify for an Affordable Care Act subsidy, or only for a small one.

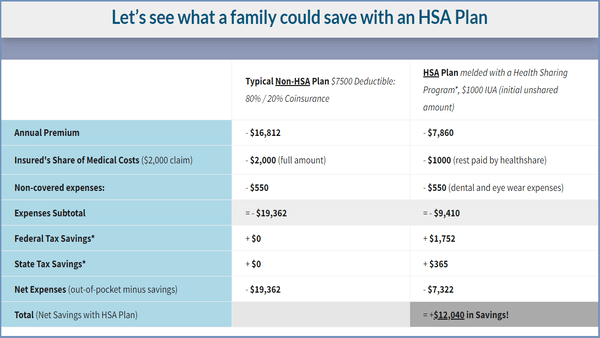

Here’s one very common scenario where combining the HSA SECURE health share plan with a health savings account can generate significant savings for a family:

How To Use Your Health Savings Account

For the most powerful possible benefit, consider taking some or all of your premium savings—either from switching to an HDHP or to the HSA SECURE health sharing plan –– and contributing as much as you can to your health savings account.

After a couple of years, you will have thousands of dollars available to help you pay deductibles, co-pays, buy prescription drugs from major discount providers, help you pay transportation expenses for health care, and any of hundreds of other qualified medical expenses—all with pre-tax dollars.

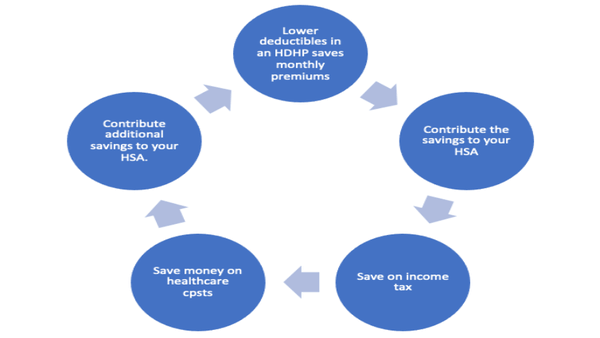

The HSA Tax Savings Power Cycle

Once you have a significant amount of money in your HSA, if you’re in good health, you can increase your annual household portion—the amount of money you must pay out of your own resources before your health sharing plan will begin sharing costs.

When you do this, you decrease your monthly health sharing contribution costs even further.

Use Your HSA to Help With Long Term Care Costs

HSAs can also play a critical role in your long-term care strategy.

The high cost of long-term care remains one of the most potentially devastating threats to Americans’ long term financial security.

Medicare doesn’t help with most long term care costs, which can now exceed $90,000 per year for a private room in a skilled nursing facility.

That’s why long-term care insurance is a vital component of a good financial plan for most people.

The good news is, you can use HSA funds to help you pay for qualified long-term care insurance premiums. And you can do it using tax-free dollars.

This is a better solution than just deducting long term care insurance costs on your tax return as a medical expense: If you go this route, you can only deduct medical expenses to the extent they exceed 10 percent of your adjusted gross income.

You also can’t take this deduction if you are better off taking the standard deduction.

But when you use an HSA, you get a tax benefit from the first dollar. And you don’t have to itemize your expenses; You can use your HSA and get a tax benefit even if you take the standard deduction.

After retirement, you can also use your HSA to help pay for long-term care and other medical costs.

If long-term care is on your horizon, HSAs offer yet another avenue to secure your future healthcare needs without breaking the bank.

Can I Use my HSA to Pay Health Insurance Premiums?

No.

You can use your HSA to pay any of hundreds of other medically necessary expenses, including long term care insurance premiums (up to certain limits based on your age), deductibles, co-pays, coinsurance, transportation, and lodging.

But you cannot use your HSA to pay health insurance premiums.

See IRS Publication 502, Medical and Dental Expenses, for full information on what constitutes a qualified medical expense.

How Your HSA Can Contribute to A Secure Retirement

Millions of people use their HSAs as their potential to contribute significantly to a secure retirement.

HSAs offer tax-deferred growth, allowing you to accumulate funds over time without incurring immediate tax obligations on your earnings—just like a traditional IRA.

You can invest your HSA money in a variety of investment options, such as mutual funds or stocks. The earnings generated through these investments are not subject to dividend, interest, or capital gains taxes, further boosting the account balance over time.

As a result, your HSA can serve as a supplementary retirement savings tool, providing an additional source of income beyond traditional retirement accounts such as 401(k)s or IRAs.

The 20% Penalty for Non-Qualified Withdrawals Goes Away at Age 65.

Once you turn 65, the 20% penalty for non-qualified withdrawals goes away.

At that point, you can withdraw funds from their HSA for any purpose without incurring the hefty penalty. Instead, you will only pay income tax on the amount withdrawn.

Your HSA effectively becomes a supplement to your retirement savings, similar to an IRA.

NO MRDs!

HSAs offer an additional important advantage over traditional retirement investment accounts, such as IRAs and 401(k)s.

Unlike these other retirement accounts, HSAs do not impose Minimum Required Distributions (MRDs) during retirement. Traditional retirement accounts, such as 401(k)s or IRAs, require individuals to withdraw a certain amount annually, once you turn age 72.

These withdrawals are taxable. You’ll have to fork over income tax on these amounts to the IRS—whether you want the money or not.

However, HSAs do not mandate these distributions. You can retain these funds in your HSA account for as long as you desire.

This lack of MRDs offers flexibility and empowers you to strategically manage their HSA funds during retirement. You can choose to use the HSA funds to cover eligible medical expenses as needed, or you can keep them invested for potential future medical costs.

The absence of forced withdrawals ensures that individuals have control over their HSA assets, providing greater security in retirement planning.

How Much Can an Health Savings Account Save Me in Income Taxes?

That depends on your effective tax bracket.

The higher your effective tax bracket, the more you can save by contributing to a health savings account.

Typically, the annual savings you can realize from income tax alone ranges from $830 for an individual in an effective income tax bracket of 20% up to $$3,441 for those with a marginal income tax bracket of 37% who are over age 50 and make their maximum allowable “catch-up contribution each year.

That’s just your tax savings on your contribution.

Another big advantage is the savings on medical expenses. When you use your HSA to pay for qualified medical expenses, you’re using tax-free dollars when you otherwise would have had to use much smaller after-tax dollars for much of these expenses.

For example, let’s say you wanted to get LASIK surgery on both eyes. You’re looking at a total price of $3,000.

But if you’re in the effective 36% tax bracket, in order to write a check for $3,000 to your medical care provider, you’d actually have to earn $4,716!

With your HSA, you just need to earn $3,000 to pay $3,000. Your money is tax free going into the HSA, and tax free coming out.

Your net savings on a $3,000 expense: $1,716.

Your tax savings will vary based on your own effective combined state and local tax bracket, as well as your Social Security/payroll tax situation. (Note: California currently does not allow taxpayers to deduct HSA contributions).

No “Use It Or Lose It” Provisions

Unlike Flexible Spending Accounts, HSAs don’t have a “use it or lose it” provision.

All your own HSA contributions and all your employer contributions to your HSA vest to you immediately and permanently.

Whether the money in your HSA is your own contribution or your employer’s contribution, any money in your HSA that you don’t need for health care continues to compound tax-deferred until you take the money out. You can take money out penalty free either to pay for health care or to supplement your retirement income after you turn 65.

Money you take out to pay for qualified medical expenses is tax and penalty free. Money you take out to supplement retirement income, or for any other purpose, after you turn age 65 is tax-free and penalty free.

However, if you’re not yet 65, then any money you take out of your HSA that’s not attributable to a qualified medical expense is subject to ordinary income tax, plus a severe penalty of 20%.

The best thing to do is to use your account for qualified medical expenses as necessary, and leave the rest alone until you turn 65.

Consider Saving the Difference Between Premiums

If your employer offers both a traditional health plan and a high-deductible health plan (HDHP), one approach might be to save the difference in premiums.

For example, let’s say the monthly premium for the traditional plan is $450 and $200 for the HDHP. Consider opting for the HDHP plan so that you can set aside the $250 difference each month in your HSA—and in a year’s time, you’ll have contributed $3,000.

That money can go a long way toward paying your deductibles, coinsurance, and copays in a high deductible health plan – effectively reducing your out-of-pocket expenses.

Tip: Save at Least the Amount of Your Deductible

You’ll be responsible for meeting your out-of-pocket deductible expenses, so consider contributing at least the amount of your deductible.

That way you can pay the bulk of your out-of-pocket medical expenses each year with tax-free dollars using your HSA.

If you think you could have health care expenses beyond your deductible—such as co-insurance costs, copays, prescription drug costs, medical transportation and lodging, costs for customizing a vehicle or your home to accommodate a disability, try to bump up your contribution to include these amounts if you can.

All these costs are qualified medical expenses. So with your HSA, you can pay for all these items with tax-free dollars.

The Adult Child Loophole for Health Savings Accounts (HSAs)

Traditionally, HSAs are tied to high-deductible health plans (HDHPs) for the individual account holder and their dependents.

This loophole enables an adult child, who is covered under a parent’s High Deductible Health Plan (HDHP), to open their own HSA and contribute up to the family maximum, as opposed to the individual limit. This is considered a loophole because normally, single individuals without dependents are only able to contribute to the individual maximum.

How It Works

Typically, the HSA contribution limit varies based on whether an individual has self-only or family coverage under an HDHP. If an adult child is still covered under a parent’s family HDHP, they can open their own HSA and contribute up to the family contribution limit, even if they are only a “single” individual from a tax standpoint. The parent can also continue to contribute up to the family maximum limit to their own HSA, effectively doubling the family’s HSA contributions.

Who Qualifies

To qualify for this loophole:

- The adult child must be covered under a parent’s family HDHP.

- The adult child must be eligible to contribute to an HSA (i.e., they do not have any disqualifying health coverage).

- The adult child should not be claimed as a dependent on another person’s tax return.

- Maximized Contributions. Both the parent and the adult child can contribute up to the family maximum, effectively doubling the pre-tax dollars available for qualified medical expenses.

- Tax Savings. Contributions are made with pre-tax income, offering substantial tax savings for the family.

- Accelerated Savings. Because both the parent and the adult child can contribute to their respective HSAs up to the family limit, they can accelerate their savings rate, which can be particularly beneficial if there are large medical expenses.

- Investment Growth. More funds in the HSA means more money to invest, and the potential for greater tax-free growth over time.

Advantages

With two family members contributing to the family maximum, there’s a risk of overfunding the accounts if there aren’t enough qualified medical expenses to utilize the funds.

What To Do Now

Health Savings Accounts are a tremendously powerful financial tool for individuals and families.

But if you don’t already have an HSA, or you aren’t enrolled in an HDHP, you need to sign up for a plan first!

Open enrollment for Affordable Care Act-qualified health insurance plans begins on November 1st, and runs through January 15th, 2023 in most states.

During this time, you have a guaranteed right to enroll in a high deductible health plan, regardless of medical history. Once you enroll, you can open an HSA and begin contribution right away.

You have until April 15th of next year to make your HSA contributions for this year, though you will only be able to contribute a prorated amount.

If you are self-employed or a business owner, you want to open an HSA, and you don’t want to wait until November, you can enroll in the HSA Secure health sharing plan at any time during the year. There is no open enrollment to worry about.

To get a free quote, and begin the process, just click here.

And for more personalized service, including a complementary analysis, recommendation, and quote, don’t hesitate to reach out to us directly by scheduling an appointment. We’re always happy to help.

Here are some additional articles on healthsharing programs: Understanding Your HSA Tax Forms | What Is an HSA Qualified Expense? | Higher 2024 HSA Contribution Limits Allow You To Save Even More on Taxes

Here are some additional pages related to this article: The HSA Secure Plan | Healthshare Plans

Compare Pricing on the Best HealthShare Plans Available

Frequently Asked Questions About Switching to a High Deductible Health Plan

What is a High Deductible Health Plan (HDHP)?

A High Deductible Health Plan (HDHP) is a type of health insurance plan that typically has lower monthly premiums but higher deductibles compared to other types of plans.

They also must meet certain other criteria under federal law.

For example, as of 2024, they must have a maximum annual total out-of-pocket exposure of.

The idea is to provide policyholders with catastrophic coverage while encouraging them to be more mindful of healthcare costs. HDHPs are often paired with Health Savings Accounts (HSAs) to help offset out-of-pocket expenses.

How does an HDHP differ from a traditional health insurance plan?

Traditional health insurance plans usually have higher premiums.

But they offer more comprehensive coverage from the start, including lower deductibles and co-pays.

HDHPs, in contrast, have lower premiums, but require you to pay more out-of-pocket before the insurance kicks in. HDHPs can be more cost-effective if you are generally healthy and do not expect to incur significant medical expenses.

How do I switch to an HDHP?

You can enroll in the HSA SECURE plan at any time during the year, provided you have self-employed income or you own a small business.

Once you’re enrolled, you can open and fund your health savings account.

If you want a traditional health insurance plan rather than a health sharing plan, you will probably need to wait until open enrollment, which runs from 1 November to January 15th in most states.

During this time, you’ll have the option to select a new health plan. Simply opt for an HDHP and follow the enrollment procedures, which may include filling out forms and providing necessary documentation.

Under some circumstances, you may qualify for a special enrollment period. For example, if you got married, became a widow(er), added or adopted a child into the family, lost your health insurance due to layoff or job change or relocation, became a citizen, or had a large change in your income, you may qualify for a 60-day enrollment period.

During this time, you may sign up for a new ADA-qualified HDHP plan with guaranteed enrollment privileges.

For free personalized assistance selecting and enrolling in a plan, make an appointment with one of our experienced Personal Benefits Managers.

Can I have an HSA without an HDHP?

Yes, if you previously opened the account.

The HSA doesn’t go away when you change out of an HDHP plan. Those contributions are yours to keep.

However, you cannot make new contributions to an HSA unless you are enrolled in an HSA-eligible HDHP.

If I leave the HDHP because I have a new employer, can I still use my HSA?

Yes.

You can still use your existing HSA funds to pay for qualified medical expenses tax and penalty-free, even if you’ve left your old HDHP. That money doesn’t go away.

However, you cannot make new contributions to an HSA unless you re-enroll in a qualified HDHP.

You may want to check with your new employer to see if they offer an HDHP among their menu of health plan options. In some cases, they will even contribute to your HSA.

Can I use HSA funds for non-medical expenses?

Yes, but with penalties.

Withdrawals for non-qualified expenses are subject to income tax, as well as and a 20% penalty if you are under the age of 65. After age 65, the 20% penalty no longer applies.

Withdrawals for non-medical purposes will still be subject to income tax, even after you turn 65, but not required minimum distributions.

What happens to my HSA if I change jobs or switch to a non-HDHP?

HSAs are portable, meaning you can take them with you if you change jobs.

If you switch to a non-HDHP, you can no longer contribute to the HSA, but you can still use the existing funds for qualified medical expenses.

Are there any disadvantages to choosing an HDHP and HSA combination?

While HDHPs and HSAs offer potential cost savings and tax advantages, they are not suitable for everyone.

If you have chronic health conditions or anticipate high medical expenses, the high deductible could result in significant out-of-pocket costs.

Additionally, some people find it challenging to save enough in their HSA to cover the deductible, leaving them financially exposed in the case of a medical emergency.

HDHP/HSAs may not work well if you have a low income or living paycheck-to-paycheck, and can’t afford to contribute to an HSA. However, even if you have a relatively low income, they can still work well if you’re in good health and your employer is contributing a significant amount to your HSA.

I’m covered under an HDHP, but my spouse and children are covered under her plan, not mine.. Can I use my HSA to help pay her medical expenses?

Yes, you can use your HSA to pay qualified medical expenses for your spouse and dependent children, even if they are not covered under your HDHP.

Does the HSA SECURE plan include pre-existing conditions?

Unlike traditional health insurance, The HSA SECURE Plan does not share costs related to most pre-existing conditions right away.

Instead, you may be subjected to a waiting period, during which the plan will not fully share expenses related to treating your pre-existing conditions.

For details, and a personalized consult, make an appointment for a FREE consultation with an HSA For America Personal Benefits Manager.

Does the HSA SECURE plan include maternity benefits?

Yes.

For pregnancies that begin at least 60 days after your effective membership date, all pregnancy and postpartum care for both mother and child are fully shareable, subject to a $1,000 initial unshareable amount (IUA) for the mother, and a $1,000 IUA for the baby.

The IUA is an amount you must pay out of pocket before sharing benefits from the health sharing plan kick in. Conceptually, the IUA functions like a deductible in a health insurance policy.

For more complete information on the HSA SECURE plan, click here.

NEED HELP?

Wiley is President of HSA for America. He believes that consumers should have choice and price transparency, so they can make the best healthcare decisions for their needs. Read more about Wiley on his Bio page.