If you’re running a business with 30 employees or fewer, you’re in the right place.

We know balancing quality health benefits with your budget can feel like a tightrope walk. This guide will help you simplify that process.

Whether you’re a small business owner, freelancer, or independent professional, we’ll show you how to offer affordable, competitive health benefits that attract top talent — and keep them on board.

Let’s find the right plan for your Montana business and your team!

Compare Pricing on the Best Insurance Plans Available

Overview of Montana Health Benefits Options for Small Businesses

Small businesses in Montana have multiple options when it comes to providing health benefits to employees.

Option one, the most common, but the most expensive by far, is to implement a traditional group health insurance plan.

Prices vary by age, but according to data from the Kaiser Family Foundation, the average annual cost of employer-sponsored group health insurance covering a worker and family in 2023 was $22,771.

Out of that, Montana employees typically contribute more than $5,496, on average toward their health insurance costs.

Fortunately, Montana businesses also have a variety of other options at their disposal that may reduce their costs substantially. These include:

- health savings accounts (HSAs)

- health reimbursement arrangements (HRAs)

- direct primary care (DPC) memberships

- health sharing programs

The best strategy for your small businesses will depend on the size of your business, your available budget, and the age and medical requirements of your workforce and their dependents.

Geographic Considerations for Montana Small Businesses

Montana’s healthcare environment is as diverse as its landscape.

With bustling cities like Billings, Helena, and Missoula, and rural communities like Bynum and Olive.

Because of this, it’s important for Montana business owners to consider where their employees live and work.

If your headquarters is in Missoula, choosing an HMO with a limited network might not be the best fit — especially if many of your employees are based in places like Waterloo, far from in-network providers.

Offering a plan that works for your entire team, no matter where they are, ensures everyone has access to the care they need.

Montana Small Business Group Health Insurance

Traditional group health insurance is the most common choice for most Montana employers.

It’s also the most expensive.

Here’s how it works:

An employer contracts with a third-party insurance provider, usually a for-profit corporation, to offer health insurance benefits for workers. If desired, the employer can extend these benefits to employees’ families as well.

Under the Affordable Care Act, all employers with 50 or more employees must offer an ACA-qualified health insurance to all employees who work more than 30 hours per week, or pay a penalty.

Minimum Essential Coverages (MEC) Under ACA

The health insurance must offer the ten minimum essential coverages (MEC) required under the Affordable Care Act.

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services

- Hospitalization (like surgery and overnight stays)

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

Additionally, the ACA requires health insurance to provide coverage for birth control and breastfeeding.

While traditional health insurance is the most expensive option for businesses, it does have the advantage of guaranteed enrollment.

If a worker enrolls during their initial enrollment period when they first qualify for coverage, they cannot be denied. The same applies if they enroll during a special enrollment period triggered by a qualifying life event.

They can also enroll during the general open enrollment period, which begins on November 1st each year. In these cases, the insurance company cannot turn them down or charge a higher premium based on their medical history.

Health Insurance is Optional for Montana Small Businesses

Under the Affordable Care Act, employers with fewer than 50 employees aren’t required to offer health insurance — and Montana state law doesn’t add any extra requirements.

If you have a team of fewer than 50, you won’t face any penalties for skipping health coverage.

That said, offering health benefits can be a smart move for businesses of any size.

In a state like Montana, where unemployment is low and competition for talent is high, a solid health plan can make it much easier to attract and retain quality employees.

If traditional insurance feels too costly, there are budget-friendly alternatives.

Options like medical cost-sharing or health-sharing plans can help you provide valuable coverage while keeping costs manageable. You can even cover part or all of the costs for your employees, making your business even more competitive.

The HRA Alternative

You can also offer a qualified small employer health reimbursement arrangement (QSEHRA) to help employees pay for individual health insurance tax-free.

With a QSEHRA, employees can use the funds you provide to purchase their own off-exchange, non-subsidized health insurance plans. This gives your team the flexibility to choose coverage that fits their needs while keeping the process simple for you. Unlike traditional group plans, this approach eliminates the need for employers to handle full premiums or extensive administrative costs, making it a cost-effective option for small businesses.

Taxation of Employer Health Coverage in Montana

Employer-paid health insurance premiums are fully deductible as a business expense and are not taxable to employees under federal and Montana state law.

Healthsharing plans feature lower overall costs and the monthly costs are tax-deductible to the employee. However, employer assistance for paying health sharing costs is taxable to the employee.

Disadvantages of Employer Group Health Insurance Coverage in Montana

Traditional employer group health insurance has some disadvantages for employers and their workers.

Cost

Under the Affordable Care Act (ACA) and various state regulations, traditional health insurance plans must include certain essential health benefits (EHBs).

These mandated coverages aim to ensure comprehensive care but may increase costs for some employers and employees who feel they don’t need every benefit.

The 10 essential health benefits required under the ACA include:

- Ambulatory (outpatient) services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services (including dental and vision for children)

While these coverages provide broad protection, they can drive up premiums for groups that might not need certain benefits, such as maternity care for a workforce that doesn’t plan to use it.

State-Level Regulations

Montana, also adds some specific mandates for group health insurance plans.

These regulations include coverage for reconstructive surgery following a mastectomy, and coverage for outpatient management of diabetes.

The mandated coverages are designed to protect against gaps in care, but they may increase costs for employers who feel the requirements don’t align with their employees’ needs. However, they also ensure that employees are not left without coverage for critical services.

Inflexibility

Group health insurance programs often provide a one-size-fits-all strategy that may not sufficiently address specific employee’s needs and budgets.

Employer-sponsored group health insurance plans by nature tend to offer just one or two solutions that may not be optimal for specific employees.

In some cases, workers would be better off buying their own plan on the individual market – potentially taking advantage of a subsidy under the Affordable Care Act.

They may also be better off with a less expensive health sharing plan. These affordable alternatives to health insurance are ideal for healthy workers without pre-existing conditions.

Administrative burden

Managing a comprehensive health benefits plan can quickly become a headache for small business owners.

The paperwork, compliance checks, and ensuring only qualified employees are enrolled — not to mention fielding endless questions from staff — all add up.

These tasks are essential to keeping the plan running smoothly, but for very small businesses without a full-time HR team, they can be overwhelming.

Fortunately, there are simpler options.

Strategies like Health Reimbursement Arrangements (HRAs) and health care stipends allow you to offer support without the administrative burden.

With these approaches, employees can buy their own insurance through the ACA marketplace and take advantage of any available subsidies.

This way, you’re still helping your team get coverage, but you’re cutting down on paperwork and saving yourself time and money.

Health Sharing Plans in Montana

Health sharing plans offer Montana small businesses an affordable alternative to traditional health insurance.

More and more companies are turning to these medical cost-sharing options to cut down on expenses while still providing healthcare access to their employees. In fact, switching to health sharing can often reduce premiums by up to 50%!

For a small business, this could mean saving over $10,000 per year per employee on family coverage, or around $3,500 per year for individual coverage.

Health sharing works by pooling resources among members who agree to share each other’s medical costs.

Instead of paying premiums to an insurance company, participants contribute a set amount each year. This approach helps businesses control healthcare expenses while still giving employees access to quality care.

It’s a modern, budget-friendly way to support your team’s health — without the high price tag of traditional insurance.

Health Sharing Plans vs. Health Insurance

Health sharing plans are not the same thing as health insurance.

Instead, healthsharing organizations are voluntary associations of like-minded people who agree to help share the medical expenses of other members.

In contrast to health insurance companies, which are usually for-profit corporations, health sharing ministries are non-profit organizations.

Mandated Coverages

While federal and state laws require traditional health insurance policies to include coverage for things that many people don’t want or need, health sharing plans have no such requirements.

The Ten Minimum Essential Coverage requirements don’t apply to health sharing organizations.

Medical cost-sharing plans are not required to cover the cost of addictions treatment for people who never use drugs, for example. And they don’t need to cover the cost of treating injuries as a result of the members’ drunk driving.

Pre Existing Conditions

Unlike traditional health insurance plans, healthsharing plans may impose waiting periods before they will share the costs of treating pre-existing conditions.

They often impose waiting periods on surgeries, except for injuries and accidents that could not have been foreseen prior to the member’s enrollment.

These waiting periods reduce adverse selection significantly. This helps health-sharing organizations offer excellent benefits.

These benefits come at a fraction of the cost of unsubsidized ACA-qualified group plans or policies from Montana’s Healthcare.gov exchange.

Note: Healthsharing plans don’t qualify for subsidies under the Affordable Care Act. The price savings are often so significant that switching to health-sharing can still be beneficial, even for those who qualify for a subsidy.

Small group health insurance plans don’t qualify for ACA premium tax credits. This makes switching to health-sharing a smart choice for many Montana employers.

Health Sharing and Network Restrictions in Montana

Unlike traditional managed care plans such as HMOs and PPOs, health sharing plans often offer more choice when it comes to choosing healthcare providers.

In most cases, healthsharing organizations in Montana do not restrict patients to in-network providers.

Instead, health sharing plan members have the freedom to choose their own doctor or provider.

Is Health Sharing Right for Your Business?

Every business is different.

Choosing the best possible plan, whether it’s a healthsharing approach or a traditional group health insurance plan, takes some careful analysis.

The good news is, it’s easy for business owners in Montana to get a full case analysis and recommendation specific to your organization and workforce.

Make an appointment with one of our experienced Personal Benefits Managers licensed in Montana, and we’ll start the process.

It will help if you have an employee census prepared.

In most cases, switching to health insurance will save thousands of dollars per covered employee. But health sharing may not be indicated if you have workers with pre-existing conditions.

The consultation and analysis is always free.

Health Reimbursement Arrangements for Montana Small Businesses

Health Reimbursement Arrangements (HRAs) are employer-funded benefits that provide tax-free reimbursement to employees for individual healthcare costs.

Often, Montana small businesses simply drop the group health insurance benefit altogether.

Instead, they establish an HRA and use it to provide workers the cash to buy their own health insurance coverage with pre-tax dollars on the individual market.

This allows workers to take advantage of available subsidies – further reducing the net cost for the company and employee.

If HRA funds remain after paying the premium, workers can use them for out-of-pocket costs. This includes deductibles, co-pays, prescriptions, and durable medical equipment.

With an HRA in lieu of a formal group health insurance plan, your employees are empowered to choose the health insurance plans that best meet their needs and preferences.

To learn more about HRAs for small businesses, read The Complete Guide to Health Reimbursment Accounts for Small Buisnesses [2025 Update].

QSEHRAs – The HRA for Small Businesses

Small businesses can use a special type of HRA called the Qualified Small Employer Health Reimbursement Arrangement or QSEHRA (pronounced “Cue Sarah”).

This benefit is designed for companies with fewer than 50 full-time employees or the equivalent, and who don’t offer a traditional group health insurance plan at all.

For 2025, the IRS has increased the maximum contribution limits for QSEHRAs.

Employers can now contribute up to $6,350 annually for individual employees (approximately $529.16 per month) and up to $12,800 for employees with families (about $1,066.66 per month).

Employees take this money and use it to purchase their own insurance via the online health insurance exchange site or via a broker in the individual and family health insurance market.

This preserves their eligibility for a subsidy, which they would not get under an employer-paid group health insurance plan.

As the employer, you can elect to reimburse your employees for their health insurance premium only, or for their premiums plus additional medical expenses.

QSEHRAs and Special Enrollment Periods

When you cancel your health insurance plan and replace it with an HRA, your employees will qualify for a Special Enrollment Period.

This is a 60-day window during which your workers can purchase their own ACA-qualified insurance plan with guaranteed issue rights, without going through medical underwriting.

This ensures your employees don’t face a break in coverage when you drop your group health insurance plan altogether and replace it with a QSEHRA.

HRA Advantages

There are many advantages to Health Reimbursement Arrangements.

Money you spend on HRA benefits for your employees is fully tax deductible to you, as well as tax-free to your workers.

You retain control of HRA money until it’s actually disbursed to workers. It remains available to you as operating capital. You don’t have to deposit it with any third party.

Employers have a great deal of flexibility in designing their own HRA benefits, including what expenses you are willing to reimburse.

Workers don’t lose health insurance coverage if they leave the company, or change to contractor status. With the QSEHRA approach, the worker, not the employer, owns and controls their insurance policy.

HRA Disadvantages

Not all workers want the responsibility of having to research and choose their own health insurance plan. Some workers may need extra help navigating the transition.

If this is the case, your HSA for America Personal Benefits Manager is here to help. So no worker is left behind.

Just have your workers make an appointment for personalized, individual service, or call 800-913-0172.

To learn more about alternatives to employer-sponsored health insurance for Montana small businesses, read Alternatives to Employer Health Insurance.

The Direct Primary Care Advantage

Direct Primary Care plans (DPC) present an alternative healthcare model that is very popular in Montana and across the country.

In return for a flat, affordable monthly fee, like a gym membership, your employees receive as many visits as they need, either in person or via telehealth.

With monthly membership costs as low as $80, DPC provides an attractive and viable approach for individuals to prioritize their health without the burden of copays or coinsurance.

DPC plans provide members with unlimited access to routine primary, preventive, and chronic care services.

Medical Services Commonly Provided by DPC Doctors

- Preventive care. DPC doctors emphasize preventive medicine and provide services such as routine check-ups, immunizations, and screenings for various conditions.

- Acute care: DPC doctors treat acute illnesses and injuries such as infections, colds, flu, minor injuries, and skin conditions.

- Chronic disease management. DPC doctors help patients manage chronic conditions like diabetes, hypertension, asthma, arthritis, and others. They provide ongoing care, monitoring, and adjustments to treatment plans as needed.

- Comprehensive physical exams. DPC doctors offer thorough physical examinations to assess overall health, identify potential risks, and provide personalized health recommendations.

- Urgent care. DPC doctors are often available for same-day or next-day urgent care appointments, allowing patients to receive prompt attention for non-emergency medical issues.

- Laboratory and diagnostic services. DPC doctors may offer or coordinate a variety of laboratory tests, such as blood work, urine analysis, imaging studies (X-rays, ultrasounds), and electrocardiograms (ECGs).

- Medication management. DPC doctors can prescribe medications, monitor their effectiveness, and make adjustments as needed. They also provide education and counseling on medication usage.

- Mental health services. Many DPC practices include mental health services as part of their comprehensive care. DPC doctors may provide counseling, therapy, and referrals to mental health specialists when necessary.

- Minor procedures. Some DPC doctors are trained to perform minor procedures in their office, such as suturing lacerations, removing moles or skin lesions, joint injections, and others.

- Care coordination and referrals. DPC doctors act as patient advocates and coordinate care with specialists, hospitals, and other healthcare providers when referrals are necessary.

Simplified Healthcare Costs with DPC

Since there is no insurance company involved, there are no co-pays, co-insurance, or deductibles to worry about. The monthly subscription covers everything.

This means cash-strapped workers can seek the care they need right away. They never need to put off seeing the doctor because they can’t afford the deductible or co-pay.

To cover services beyond what DPC offers, patients can choose supplemental plans such as high deductible health plans, health sharing plans, or accident insurance.

Since routine care is already included in the DPC membership, patients can opt for much more cost-effective coverage options, such as healthsharing rather than traditional health insurance.

Compare Pricing on the Best HealthShare Plans Available

Health Savings Accounts (HSAs)

HSAs (Health Savings Accounts) can be very powerful tools to help workers manage their medical costs and keep premiums lower for workplace health insurance plans.

Employer contributions to their employees Health Savings Accounts are fully deductible from the Montana corporate income tax as a compensation expense.

Individuals can set aside pre-tax money to save for future medical costs. Both employees and employers can contribute to HSAs – subject to an annual limit that is adjusted by Congress every year to keep up with the cost of living.

Money in an HSA enjoys tax-deferred growth, and withdrawals to pay for qualified healthcare expenses are tax-free.

HSA Eligibility

To contribute to a health savings account, or to enjoy employer pretax contributions to an HSA, employees must enroll in a qualified high deductible health plan (HDHP).

For the 2025 tax year, the IRS has updated the definitions and limits for High Deductible Health Plans (HDHPs) as follows:

- Minimum Deductible:

- Self-only coverage: $1,650 (an increase from $1,600 in 2024)

- Family coverage: $3,300 (up from $3,200 in 2024)

- Maximum Out-of-Pocket Expenses:

- Self-only coverage: $8,300 (an increase from $8,050 in 2024)

- Family coverage: $16,600 (up from $16,100 in 2024)

These out-of-pocket limits encompass deductibles, copayments, and coinsurance but exclude premiums. It’s important to note that these limits apply only to in-network services; out-of-network services may incur higher costs.

These adjustments reflect the IRS’s annual inflation indexing to ensure that HDHPs remain aligned with current economic conditions.

Can I combine HSAs with health sharing?

Currently only one major health-sharing plan allows employees to make pre-tax contributions to a health savings account (HSA).

This option is the HSA SECURE Plan, available through HSA for America. The HSA SECURE Plan is an excellent way to combine the tax and healthcare advantages of a health savings account with the cost-saving advantages of healthsharing.

However, in order to enroll in this plan, your employees MUST have some self-employed or small business income or ownership.

HSA SECURE is not available to regular W-2 employees. However, if your employee or their spouse has a small business, freelance work, or a side hustle, they may qualify. If they are in good health with no ongoing preexisting conditions, the HSA SECURE plan could be a great fit.

The HSA SECURE Plan is a great money-saving option for you and your partners as a small business owner.

Your employees would have to enroll in HSA SECURE on their own. But once they’ve enrolled and established an HSA, you can make pre-tax contributions to it on their behalf, up to the annual limit Congress establishes each year.

Learn more about these plans, read: HSA Secure Plans.

How Are Health Benefits Taxed?

Now that you know a bit about each of the alternative strategies available to small employers, here is a brief table explaining how each of these benefits are taxed.

| Plan Type | Employer | Workers |

|---|---|---|

| Traditional health insurance premium | Tax deductible. May qualify for a tax credit (see below) | Non-taxable |

| HSA contributions | Tax deductible | Pre-tax, up to certain limits. No income limitations |

| Health sharing costs | Tax deductible as a compensation expense | Taxable as ordinary W-2 income |

| Health reimbursement arrangements | Tax deductible | Benefits are non-taxable to the employee |

| HSA withdrawals | N/A | Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income. A 20% penalty for non-qualified withdrawals applies up until age 65. |

| Direct primary care costs | Tax deductible as a compensation expense | Taxable to the employee |

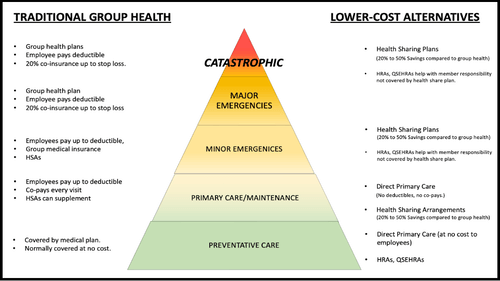

Address All Levels of the Care Pyramid

A good employee health benefits package should address all levels of the Employee Healthcare Pyramid.

From routine preventive care, primary care access for maintenance and early detection of health problems, all the way through catastrophic incidents.

On the left, we list common traditional insurance-based solutions that address each level of the Care Pyramid.

On the right, we list a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level of the Pyramid.

A well-designed plan offers employees affordable options for premiums, coinsurance, and copays. This ensures no employee has to delay or skip care due to cost.

Your Personal Benefits Manager can help you create a custom plan design for your work force that provides a solution at each level of the Care Pyramid.

The Small Business Health Care Tax Credit

The Small Business Health Care Tax Credit is designed to assist small businesses in offsetting the cost of providing health insurance to their employees.

To qualify for this credit in 2025, your business must meet the following criteria:

- Employee Count: Fewer than 25 full-time equivalent (FTE) employees.

- Average Wages: Pay average annual wages less than $66,600 per FTE.

- Premium Contribution: Cover at least 50% of the health insurance premiums for your employees.

- Qualified Health Plan: Offer a qualified health plan through the Small Business Health Options Program (SHOP) Marketplace.

It’s important to note that the tax credit begins to phase out when average annual wages exceed $33,300 and is completely eliminated once they reach $66,600.

Additionally, the credit is available for a maximum of two consecutive taxable years.

By meeting these requirements, your business may be eligible for a tax credit of up to 50% of the premiums paid for employee health insurance, providing significant financial relief.

How do I claim the credit?

You can claim this tax credit on your annual income tax return with attached IRS Form 8941 (Tax-exempt small businesses must file a Form 990-T tax return to claim, even if not otherwise required to file).

Your employees are not subject to tax on the contributions you make toward their coverage.

I don’t owe taxes this year for my business. Can I still claim the tax credit?

Yes. This tax credit can be carried back and used to offset income tax liability incurred the previous year or carried forward to offset liability incurred over the next 20 years.

If you’re a tax-exempt business, the credit is refundable.

Consult your tax advisor for full information about the Small Business Health Care Tax Credit.

Combining Small Business Health Plan Strategies

Combining various programs can be a smart move when it comes to maximizing your health insurance coverage.

Employers frequently find that combining a number of healthcare packages makes it possible for them to control healthcare costs while also providing complete coverage to their employees.

Consider combining a Direct Primary Care (DPC) plan for normal primary care with a low-cost health sharing plan that covers catastrophic occurrences as one possible cost-effective solution.

Compared to conventional group health insurance, this strategy can be more affordable for your company, for your employees, or both.

Offering employees a choice between a health-sharing plan or an individual health insurance plan provides greater flexibility. Allowing them to fund a Health Savings Account (HSA) with an HSA-qualified HDHP can also help lower costs.

What To Do Now

Ready to take the next step? Start by putting together your employee census and get in touch for a free, personalized health plan analysis.

Our experienced HSA for America Personal Benefits Managers are ready to walk you through every detail.

Many of our Personal Benefits Managers are former business owners and entrepreneurs themselves. They know firsthand the challenges you face and the importance of offering competitive benefits to attract and keep top talent.

We’re here to help you design a health plan that works for your business and your team. Let’s build a solution that saves you money, reduces stress, and keeps your workforce happy and healthy.

For Further Reading:

Frequently Asked Questions About Small Business Health Plans for Montana

What is the difference between health insurance and healthsharing for small businesses?

Health insurance is a traditional coverage plan offered by insurance companies, while healthsharing involves members contributing to a pool of funds to cover each other’s medical expenses.

Are there waiting periods for pre-existing conditions with health sharing plans?

Yes, some healthsharing plans may have waiting periods for pre-existing conditions before coverage begins. It’s important to review the plan guidelines or consult with a Personal Benefits Manager for more information on specific plans.

How can Health Savings Accounts HSAs help manage medical costs for employees in Montana?

HSAs allow individuals to set aside pre-tax money to save for future medical costs.

Both employers and employees can contribute, providing tax advantages and potential savings on healthcare expenses.

Can employers contribute to their employees’ HSAs in Montana?

Yes, employers are allowed to make contributions to their employees’ HSAs, subject to annual limits set by Congress.

Can employer contributions towards HSAs be deducted from state income tax in Montana?

Yes. Employer contributions towards employee HSAs are fully deductible from state income tax as a compensation expense in Montana.

Does offering a Direct Primary Care (DPC) plan alongside other coverage options make sense for small businesses in Montana?

Combining DPC with low-cost coverage options like health sharing plans can provide comprehensive and cost-effective healthcare solutions for small businesses and their employees.

How do I claim the Small Business Health Care Tax Credit?

The tax credit can be claimed on the annual income tax return with IRS Form 8941 for for-profit businesses, while tax-exempt small businesses must file a Form 990-T tax return.

HSA for America does not provide tax advice. Employers should consult their tax advisor for full information on claiming the credit.

Can a business still claim the Small Business Health Care Tax Credit if they don’t owe taxes in Montana?

Yes, even if a business doesn’t owe taxes in a particular year, the Small Business Health Care Tax Credit can be carried back to offset income tax liability from the previous year or carried forward for up to 20 years.

Are maternity benefits covered by health sharing plans in Montana?

Maternity benefits are commonly included in health insurance policies and healthsharing plans in Montana, covering prenatal care, labor, and postnatal care.

However, some health sharing plans may have restrictions on cost-sharing benefits for children conceived outside of marriage.

What is an HRA (Health Reimbursement Arrangement) and how does it work?

An HRA is an employer-funded account that reimburses employees for qualified medical expenses not covered by their insurance plan.

Employers determine what expenses are eligible and contribute funds accordingly.

Can HRAs be used alongside other coverage options like health sharing plans or individual health insurance plans?

Yes, HRAs can be used alongside other coverage options.

Some small businesses choose to cancel group health insurance altogether and use HRAs to reimburse employees’ premiums for individual policies. However, HRA money cannot be used to reimburse employees directly for health sharing plan costs.

Is there any limitation on the size of small businesses eligible for these programs in Montana?

The Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is only available to employers who have fewer than 50 employees.

However, if you have more than 50 employees, or your company grows to have more than 50, there are other types of HRAs available to you.

You will also have an ACA requirement to provide a qualified health insurance plan for your employees, or pay a penalty.

If you are on the cusp, or planning to hire your 50th full-time worker or equivalent in the near future, speak with your Personal Benefits Manager, as that could affect your plan design.

How can I determine which combination of health insurance and cost-sharing options is best for my small business in Montana?

Don’t go it alone. Contact a Personal Benefits Manager who can conduct a free analysis and recommendation based on your specific needs, budget, employee census, and any pre-existing conditions that need to be considered.

They can help design an optimal plan that maximizes the value for your employees while controlling costs and helping you remain competitive.

Can I Offer Health Insurance and Health sharing at the same time?

Yes, you can offer both options side by side, allowing employees to choose which plan suits their needs best.

Note if too many employees opt out of a group health insurance plan, you could fall below the minimum participation rate required to maintain a group plan. However, you can always use an HRA to reimburse the employees for individual health insurance, which will be close to the same cost.