NEW! Primary Care + HealthShare Solution Saves Money And Improves Access to Care

Read reviews, FAQs, and get instant quotes!

By Whitney Kline – Updated Sept 4th, 2025

Reviewed by Lou Spatafore – Fact checked by Wiley Long

At last: You can now get a single plan combining the best of Health Sharing and Direct Primary Care (DPC), all in a single convenient package.

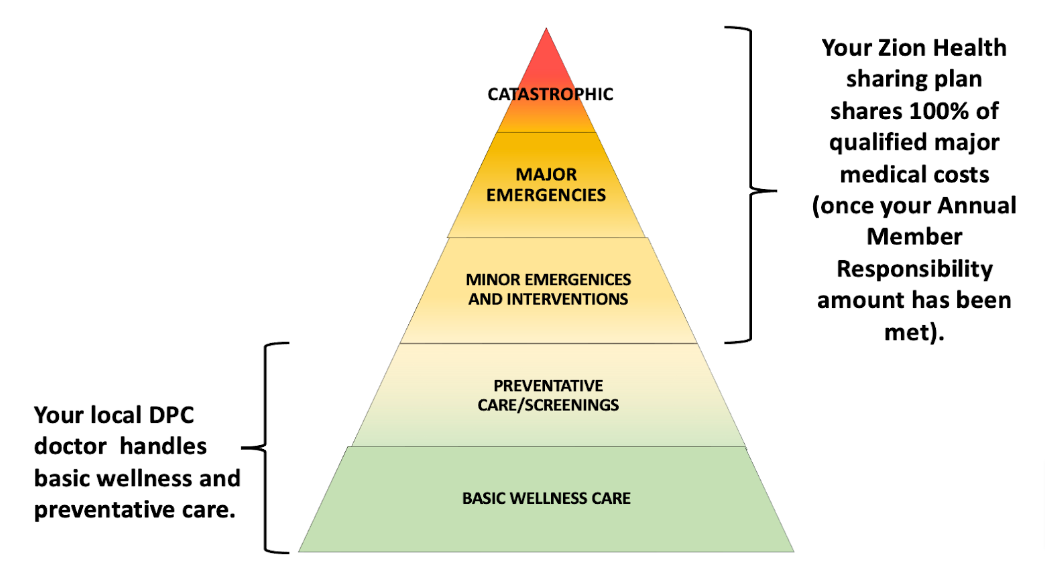

Primary Care + HealthShare is healthcare innovation that pairs a select Direct Primary Care (DPC) practice in your area with an affordable health sharing plan from Zion HealthShare.

This non-insurance solution offers direct, personalized access to DPC providers for routine, primary care, and wellness needs, combined with an affordable health share plan to help with managing larger and even catastrophic medical expenses.

Primary Care + HealthShare is personal, accessible, and community-driven, and gives you more control over your care.

Advantages of

Direct Primary Care

- One simple monthly payment includes all primary care services

- As many appointments as you need to treat or maintain your condition – no extra cost

- No deductibles, co-pays, or coinsurance amounts to worry about

- Same-day or next-day appointments are routinely available

- Unlimited telehealth visits – with no copay

Advantages of

Health Sharing

- Powerful cost sharing benefits – even for catastrophic-level medical needs

- Up to 50% less expensive compared to unsubsidized traditional health insurance premiums

- Choose your own doctors and other providers. No narrow network restrictions!

- Eligible medical costs 100% shareable once your member responsibility amount has been met

Who Should Consider the Healthshare + DPC Plan?

Check to see if there is a participating DPC in your area. (Use the password HintConnect!) If there is not a participating DPC in your area, you may want to check out the DPC Direct plan.

Zion Healthshare + DPC may be a good match for you if you meet these criteria:

You want to save money each month.

You don’t get a subsidy under the Affordable Care Act.

You don’t have any significant pre-existing conditions. The Zion health share plan imposes a waiting period before it will share costs related to pre-existing conditions.

You want the longer appointment times and deeper doctor-patient relationship that the DPC model enables.

You want the freedom to choose your own providers, and don’t want to be limited to a narrow network of pre-approved care providers for non-emergency care.

How It Works

The Primary Care + HealthShare plan has two main components:

1. A direct primary care membership with a leading DPC practice in your area

2. An affordable health sharing plan from Zion HealthShare, one of the most reputable health sharing organizations in the country

Here’s a closer look at each of these components, and how they work together to provide affordable healthcare access across the full spectrum of medical care.

Direct Primary Care

Direct primary care doctors don’t take insurance – and patients don’t need it.

Instead, patients pay a flat monthly membership fee to their doctor for a range of primary care services –– similar to a gym membership.

As a DPC patient, you’ll receive an unlimited number of primary care and wellness appointments with your DPC doctor. The doctor will provide whatever primary care is necessary to address your medical needs––with no additional out-of-pocket costs*.

DPC services include basic family medical care normally provided by a generalist in a doctor’s office setting.

You see your direct primary care doctor for small, routine, and preventive care visits that are normally handled in a doctor’s office. Your monthly subscription includes as many visits as necessary to manage your care.

There are no additional deductibles, copays, or coinsurance. As long as you pay your predictable and affordable monthly subscription, there are no other cost barriers to seeing your primary care provider.

Note: DPC plans aren’t catastrophic plans. They don’t include hospital or ER visits, surgeries, or specialist care. That’s what the health sharing component of the plan is for. The DPC component strictly focuses on the primary and preventive care pieces.

*If your doctor needs outside services such as lab work or imaging done, these outside organizations may charge a fee. However, HSA for America clients have access to a powerful discount program that can save you up to 75% on outside labs, imaging services, and on hundreds of commonly-prescribed prescription drugs.

Your Initial Unshareable Amount (IUA)

For larger unexpected medical bills for services not included in your DPC membership, you’ll pay an annual initial unshareable amount (IUA).

The IUAis your out-of-pocket share of your eligible medical expenses under the health sharing plan. It functions similarly to a health insurance deductible: It’s your “skin in the game.”

You can choose an IUA of $1,000, $2,500, or $5,000.

The higher your IUA, the lower you can expect your monthly costs to be, all other things being equal.

Health Sharing

The health sharing component acts as your safety net against large medical needs.

Once you have met your MRA for the year, your health sharing plan kicks in, and your fellow health sharing members generally share 100% of the costs above your MRA for the rest of your plan year.

So your DPC doctor handles routine care, family doctor matters, basic pediatric matters (with some DPCs,), checkups, wellness visits, medication updates, minor colds, flus, and scrapes and sprains, and other minor urgent care issues that don’t require special equipment or additional staff.

Your health sharing plan is there for ER visits, hospitalizations, surgeries, advanced imaging (MRIs), and

How to Enroll in Primary Care + HealthShare

Enrolling in the Primary Care + HealthShare plan is simple and straightforward:

- Complete the online enrollment form.

- Choose your plan. Select the Zion Healthshare plan with an Initial Unshareable Amount (IUA) that best matches your healthcare needs and budget.

- Select a DPC provider. Select a Direct Primary Care (DPC) provider in your area that partners with Zion Healthshare. Our Personal Benefits Manager can assist you in identifying a participating practice for you.

- Enter your payment information. Complete your membership applications for both the DPC practice and the Zion Healthshare plan.

- Complete the signup process. Once enrolled, you’ll have access to the DPC services and health sharing benefits that work together to provide comprehensive, cost-effective care.

Speak with one of our Personal Benefits Manager for tailored guidance. They’ll help you evaluate your options and finalize your enrollment.

How Primary Care + Healthshare Combines To Provide Full-Spectrum Healthcare

How DPC and Health Sharing Plans Combine

| Direct Primary Care Plans | Health Sharing Plan (Zion) |

|---|---|

| 1 monthly fee includes as many primary care visits as needed | Pays up to 100% of large and catastrophic healthcare needs (after MRA is met) |

| Free telehealth visits | ER visits |

| Zero copay on telehealth or in-person visits | Urgent care |

| Preventive care and routine checkups | ICU/Trauma center care |

| Medication adjustment, monitoring and maintenance | Specialist visits |

| Routine chronic disease monitoring/maintenance | Surgical center fees |

| Well baby visits and routine pediatric care (with some DPC practices | Specialist fees |

| Minor urgent care issues (scrapes and sprains, colds and flus | Labs and radiology |

| Strep throat screening | MRIs, CAT scans, and X-rays |

| Immunizations | Access to Powerful Prescription Drug Discount Plans* |

| Antibiotics | Anesthesiologist fees |

| Breast exams | Ambulance transport |

| Prostate exams/screening | Prenatal and maternity care |

| Minor wound care | Neo-natal ICU costs |

| Routine follow-up care | Durable medical equipment |

| EKGs |

*Zion Health Share plans do not include drug insurance coverage. However, members have access to the powerful Zion drug discount program.

HSA for America clients additionally have access to our proprietary HSA AdvantageRx discount program, as well, which gets up to 80% off hundreds of commonly-prescribed drugs, as well as discounts on labs, imaging, and many other medical services.

Compare Costs

As of 2024, the average monthly unsubsidized health insurance premium for single coverage is $746, and the average for family coverage is $2,131, according to the Kaiser Family Foundation.

With the Healthshare + DPC plan, your monthly membership cost ranges from $193 for an 18-29 year old with a $5,000 IUA to a maximum of $383 for a 64-year-old with a $1,000 IUA.

COMPARE THE COST OF A BROKEN ANKLE

| Medical Service | Actual Cost of Service | Your Cost With Conventional Health Insurance Policy (Silver-Tier, With $5,000 Deductible) | Your Cost With DPC + Healthshare (With $1,000 IUA) |

|---|---|---|---|

| ER Visit With X-Ray | $2,500 | $2,500 | $1,000 |

| Surgery | $20,000 | $2,500 (remaining half of $5,000 deductible), plus 20% coinsurance on remaining costs | $0. Everything above your IUA is 100% shareable |

| Follow-up visit with surgeon | $400 | ||

| Physical therapy | $1,500 | ||

| TOTAL COSTS | $24,400 | $8,800 | $1,000 |

Already Have a DPC Doctor?

If you already have a direct primary care doctor you’re happy with, that’s no problem –– You can keep your doctor, and still get all the benefits and savings of health sharing by enrolling in DPC Direct.

This is a health share plan specifically designed to work with DPC practices. The plan keeps costs down by structuring benefits to avoid redundancy.

It’s the same great plan you’d get with the Healthshare + DPC Solution, but without the additional built-in DPC component

Why We Recommend Zion Healthshare + DPC

Because DPC practices don’t take insurance, they don’t need an office full of billing professionals who do nothing but submit paperwork to insurance companies.

With much lower overhead compared to traditional insurance-based practices, DPC practices can carry much smaller patient loads. As a result, patients receive much longer appointment times with their doctors.

The result is a much closer doctor-patient relationship. Doctors have the time to go beyond the symptoms to explore the root causes of ailments, and spend more time on patient education.

The lower patient loads with DPC also mean same-day or next-day appointments are routinely available.

Get a Free, Individualized Recommendation and Quote

Employee Group Plans

The Zion Healthshare + DPC Plan can be an excellent solution for small businesses looking for a valuable and affordable employee benefit that costs much less than a traditional group health insurance plan.

Because health sharing plans like Zion Healthshare are available at just a fraction of the total cost of a traditional health insurance plan, there is tremendous savings potential for employers and group members.

Employer Considerations

There are a few major considerations employers should be aware of, however:

Taxable to Employees

Unlike traditional group health insurance, the value of the health sharing benefit is taxable to employees.

It’s still fully deductible as an employee compensation expense to the business, though.

No Prescription Drug Insurance Programs

The Zion Healthshare plan has a great prescription drug discount plan. However, it does not have a prescription drug insurance component.

This may be a factor if a plan beneficiary needs an expensive brand name drug that’s not available as a generic.

Pre-Existing Condition Waiting Periods

Zion Healthshare has a waiting period before it will share costs related to pre-existing conditions.

So this plan may not be suitable for some employees or family members who have significant pre-existing conditions or ongoing medical needs.

Not HSA-Eligible for DPC Members

Plan members who are also members of a DPC may not contribute new money to health savings accounts.

However, if they already have balances in their HSA accounts, they can still use their HSA balances to pay for qualified medical expenses tax-free.

Our team of expert Personal Benefits Managers can help you navigate the advantages and disadvantages of health sharing plans in the group context, and help you design a plan or a combination of plans that suits your workforce and budget.

Contact an HSA for America Personal Benefits Manager for help designing a group plan for your employees and their families.

Frequently Asked Questions

We’ve helped over 16 thousand people find health insurance or a health sharing plan.

Each customer gets the same amazing service.

Lou (Personal Benefits Manager) made me feel comfortable with the new concept of Health Sharing by being himself, honest, and sharing his own experiences.

Neil DeFrancisco, MD

Mike Montes (Personal Benefits Manager) is my go-to referral for my clients.

Daniel DuBois, TN

Misty Berryman (Personal Benefits Manager) was fantastic to work with! I explained our situation/needs to her and she went through a number of options very thoroughly. We (Misty and I) worked through each of our options and determined the best path forward for my family. She is the best and any time we are in need for insurance, she will be our first call!

Travis Lawler, TX

The process of how everything went through the process and with Leslie (Personal Benefits Manager) was great! Things went smoothly and promptly, and all the information I needed was construed concisely.

Ted Chiero, WI

Whitney Kline (Personal Benefits Manager) was amazing and went far above my expectations in customer service. She answered every question and so far everything has been just like she said it would be!!! thank you

Wendy Skeesick, LA

We’re Here to Help!

HSA for America can offer you free and professional advice so you can make the best choice possible regarding your health care plan. Your Personal Benefits Manager is available to answer any questions about Primary Care + HealthShare Solution health plans, ultimately maximizing the amount of money you can save annually while truly understanding the type of health care you will receive.

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.