Find the Best Healthshare Plans for You

An affordable, legal way to opt out of the Affordable Care Act (ACA) and cover your qualified medical needs.

By Wiley Long III, President – HSA for America

Reviewed by Leslie Alford – Fact checked by Mike Montes – Updated Sept 1st, 2025

View Healthshare Plans & Pricing Healthshare Costs in Your Area

All You Need To Know About Healthshare Plans

Healthshare plans are not health insurance policies. They are voluntary associations of people who agree to share medical expenses, with particular advantages over health insurance.

Nearly 2 million people nationwide are members of health sharing plans.

Pay Monthly Contributions vs. Monthly Premiums

Health care sharing memberships, or Medical Sharing plans, do not have “premiums”, but rather “contribution amounts”.

Payments Half or Less than Traditional Health Insurance

Numerous factors make health sharing much less expensive than unsubsidized health insurance. This includes a much healthier membership base and less onerous regulation.

Special Requirements & Conditions

Health care sharing programs typically have a waiting period before they will share for pre-existing conditions. As such, they will not be the best option for everyone.

Learn More About Healthshare Plans

Understanding healthshare plans can be confusing, especially when comparing them to traditional health insurance. To help educate consumers, Wiley Long, a trusted health insurance expert and President at HSA for America, has authored a newly published book that explains how healthshare plans work, who they’re best for, and what to consider before enrolling.

Drawing from over 25 years of experience in the health insurance industry, the book provides clear, practical guidance to help individuals and families make informed healthcare decisions.

👉 Learn more about the book here: https://hsaforamerica.com/the-healthshare-alternative-book/

Everything You Need to Know About Healthshare Plans

Free Healthshare PDF Download

Find out exactly how smart consumers are opting out of Obamacare and slashing their healthcare costs. Joining healthshare programs offers the freedom you’ve been wanting. See the full details in our latest report.

Choosing the Right Best Healthshare Plan for You

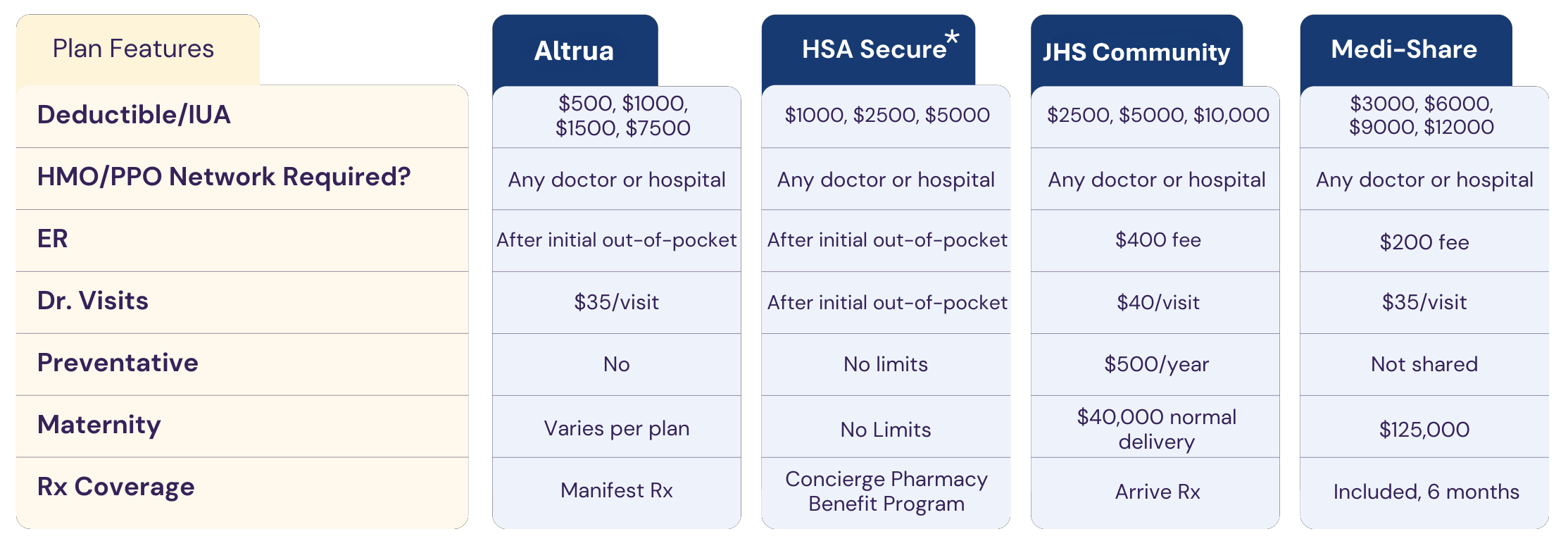

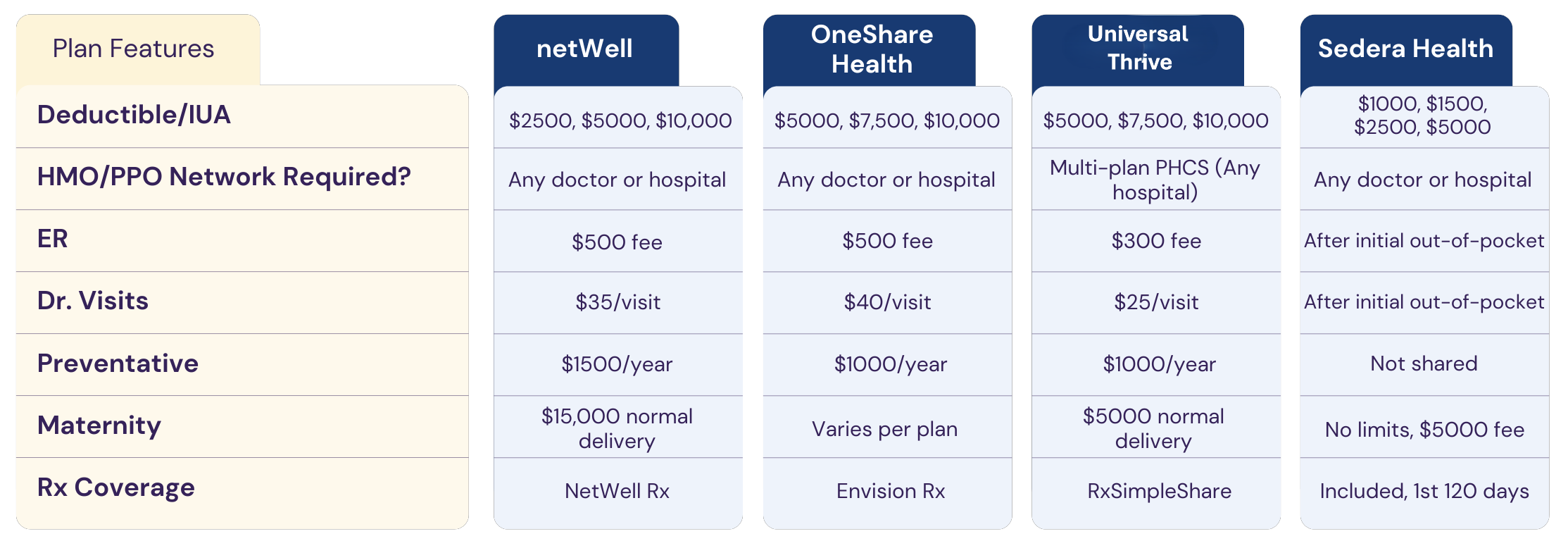

There are countless health sharing plans designed for different patients. Browse options below to discover the best healthshare plans for you and your family:

Click the tables to view full screen!

This is only an overview—for complete details, please review the summary of benefits linked from each healthshare page.

*The HSA Secure uses ZionHealthshare for the healthshare portion, combined with other features the provide preventive care and HSA eligibility.

Choose Based on Your Unique Needs & Priorities

If you’re interested in…

Tax Benefits of an HSA

First-Dollar Doctor Visits & Preventive Care

If you are interested in a more comprehensive plan, we invite you to compare our preventative care plans. Options are available from netWell Healthshare, OneShare Health, and Thrive and include first-dollar doctor visits and preventative care.

Low-Cost Catastrophic Focused Plan

If you want a low-cost catastrophic-focused plan, be sure to look at JHS Community. This plan has a high initial out-of-pocket exposure but generally offers a lower cost for some patients.

Stronger Christian Philosophy

If you are interested in a plan that has a stronger Christian philosophy, take a close look at Medi-Share.

Programs with No Religious Component

If you want a program with no religious affiliation, you can sign up for HSA Secure, Care+, or Sedera.

Small Group Options

If you have a small group that you need a plan for, 1Complete Solution is a popular comprehensive program.

Find the perfect healthshare plan for your medical needs today with HSA for America.

Need Assistance?

Get Help in Figuring Out the Best Plan for You

Schedule a free appointment with our Personal Benefit Managers. It’s fast, friendly and easy with no obligation.

Need a Quote?

View Healthshare Plans & Healthshare Pricing in Your Area

Frequently Asked Questions About Health Care Cost Sharing Plans

Learn about the potential of healthcare sharing in our answers to common healthshare insurance customer questions.

![]()

Q: What is a health share plan?

A: Healthshare plans are a low-cost alternative to traditional health insurance. While not technically insurance, healthshare plans allow members to protect themselves against large or unexpected medical costs. In most cases, healthshare plans are more affordable than unsubsidized ACA health insurance plans..

![]()

Q: Is healthshare an insurance policy?

A: Healthshare plans differ from insurance in many ways.

Chiefly, they are not governed by the statutes that traditional health insurance in the United States must adhere to. Because these healthshare plans are akin to private coverage, they are not regulated. This makes them much more free to craft individualized and unique coverage policy types for members.

Members have access to a fund when needed for medical expenses and other healthcare needs. And members can use their pool for qualified medical services, just like insurance. However, billing, pooling, and more are what make these policies distinct.

![]()

Q: Is medical sharing the same as a healthshare plan?

A: There are many names for health sharing, including:

Like traditional health insurance, healthshare plans come with a monthly fee. Most plans also have an Individual Sharing Amount (ISA) that must be paid by the member. As your personal responsibility, this fee must be paid in full before medical bills can be shared. Different healthshare organizations may use different terms for this amount.

- Medical cost sharing

- Health care cost sharing

- Healthshare plans

- Health care sharing ministry

- Christian health insurance

Because health sharing organizations are not regulated like traditional insurance, options abound. The specific terms and definitions will vary depending on which healthshare plan you go with. But in most cases, healthcare sharing is a smart choice. It is a great option for patients looking for coverages outside of the traditional health insurance industry.

![]()

Q: How do healthshares plans work?

A: With health sharing plans, members make a monthly contribution towards a shared “pool” of resources. When a member incurs a qualified medical expense, they can be reimbursed from this pool. In other words, healthshare plans are inherently communal. They make it possible to share the cost of medical expenses with other members of your church or community.

Like traditional health insurance, healthshare plans come with a monthly fee. Different healthshare organizations may use different terms for this amount.

![]()

Q: Are healthshare plans just for Christians?

A: In the beginning, health sharing plans were only offered by Health Care Sharing Ministries. These faith-based organizations were looking for a way to allow their members to share the cost of medical expenses. Plans were designed around fulfilling the biblical principles of community, charity, and caring for the less fortunate.

Today, however, medical sharing plans are available to almost everyone. While some healthshare plans do have a Christian religious component, there are plenty of non-Christian plans.

There are also countless plans that do not have a religious component at all. One of the chief benefits of plans like these is breadth of options. What is a healthshare plan, after all, but an offering of grace for a specific segment of the community?

![]()

Q: How much does healthshare cost?

A: In many cases, a good healthshare plan can be as little as 50% of the cost of unsubsidized insurance. But like insurance plans, most healthshare companies let their members choose from a range of monthly costs and coverage options.

We recommend would-be customers compare the healthshare cost to prospective costs under a traditional insurance policy. You’re likely to find that savings abound for a variety of cases.

![]()

Q: Is health sharing legal?

A: Healthshare plans are 100% legal, which has made them the single most popular alternative to traditional health insurance.

However, healthshare organizations are not regulated on the federal level the way that insurance companies are. This is part of the reason why they are more affordable. However, it also means that there is no federal guarantee that your medical expenses will be shared.

![]()

Q: Do healthshare plans cover pre-existing conditions or preventive care?

A: Healthshare plans are not required to share medical costs of pre-existing conditions or preventive care. However, most plans make sharing available for pre-existing conditions after a waiting period of 1 or 2 years. This predetermined period is often noted in plan documentation, where applicable.

Recently, more and more health care sharing organizations are making preventive services available to their members. If you’re looking for a more comprehensive healthshare plan with these benefits, talk to your Personal Benefits Manager.

![]()

Q: Who is eligible for sharing?

A: All customers covered under a healthshare plan are eligible for sharing the pool. All you need to get access is to enroll you and your loved ones.

What Our Clients Say

We have helped over 20 thousand people find health insurance or a health sharing plan.

View Healthshare Plans & Healthshare Pricing in Your Area

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | News | About Us | Contact Us | Privacy Policy | Agents Needed

Contact Information:

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

800-913-0172

info@HSAforAmerica.com

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of the actual price is subject to the Carriers.