Introduction to Catastrophic Health Coverage

Health plans aren’t a one-size-fits-all proposition, but the JHS Community is a good place to start.

JHS Community DIVINE Plan

Many people are poorly served by traditional, ACA-qualified, Obamacare-style health insurance products available on the Marketplace.

People who are in good health and who have substantial liquid assets, and who don’t expect to need much healthcare in the coming years often don’t need or want a plan that covers everything. It takes a lot of premium dollars to support those plans. And for these people, it’s a waste of money.

These people are often much better off in a catastrophic-focused health sharing plan, rather than a traditional health insurance plan.

Who Needs Catastrophic-Focused Plans?

Catastrophic-focused plans are tailor-made for individuals who are generally in good health and have a robust financial safety net to handle routine medical expenses.

These individuals are often:

- Young adults with a healthy lifestyle and minimal medical needs.

- Self-employed professionals or those without employer-provided health insurance, seeking a safety net against major health expenses.

- Families with a comfortable savings reserve, preferring lower monthly costs while still ensuring protection against severe health emergencies.

- People in between jobs or those who find traditional health insurance financially burdensome.

These plans are particularly appealing to those who are comfortable with the idea of paying for minor healthcare expenses out-of-pocket, in exchange for significantly lower monthly premiums.

If you can afford to pay $10,000 or $15,000 if you have an unexpected medical need, and you want to focus your protection against catastrophic medical expenses that could potentially bankrupt you, then JHS Community DIVINE plan is among the most compelling offerings on the market.

Compare Pricing on the Best Insurance Plans Available

Health Sharing Is Not Insurance

Health sharing is fundamentally different from traditional health insurance. It’s a system where individuals with similar health and often, value-based commitments come together to share the burden of medical expenses. This model typically involves:

- Lower monthly costs compared to traditional health insurance.

- A focus on sharing major, unforeseen medical expenses, rather than covering routine healthcare costs.

- A community-oriented approach, often aligning with specific values or beliefs.

Because health sharing plans aren’t subject to Affordable Care Act rules, they aren’t required to include as many common, routine medical care costs as insurance plans.

They also don’t have to cover pre-existing conditions from day one, as health insurance plans must do.

As a result, health share plans are typically about 40 to 50 percent less per month than a comparable traditional health insurance plan without an Affordable Care Act subsidy.

With the average unsubsidized cost of health insurance for a family of four at nearly $24,000 per year as of 2023, according to the Kaiser Family Foundation, that’s enough for these families to save close to $1,000 every month.

Introducing the JHS Community Health Share

JHS Community Health Share stands out in the health coverage industry by offering a unique blend of affordability and substantial coverage for catastrophic events.

Unlike traditional health insurance, JHS operates on a health sharing model, which is based on a community of members sharing healthcare costs.

Because health sharing plans aren’t subject to Affordable Care Act rules, they aren’t required to include as many common, routine medical care costs as insurance plans.

This model is not only cost-effective but also fosters a sense of mutual support and collective responsibility.

With their catastrophic-focused DIVINE plan, JHS Health Share has carved a niche in the health coverage market by focusing on catastrophic health events.

This focus appeals to a specific segment of the population that finds traditional insurance plans either too expensive or misaligned with their needs. JHS plans are designed to provide peace of mind for major health crises, without the financial burden of high monthly premiums associated with comprehensive insurance plans.

JHS Community DIVINE Health Membership Tiers

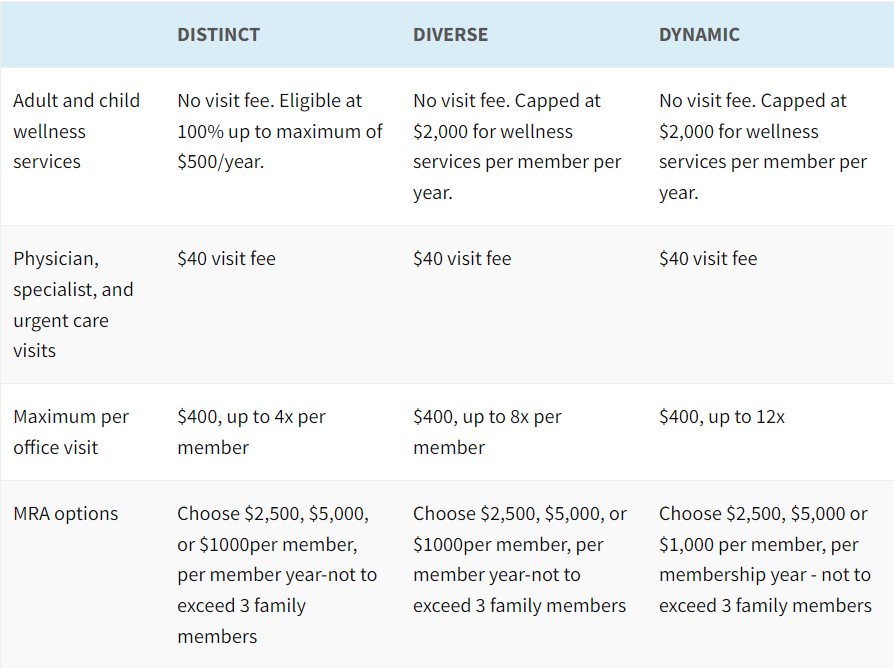

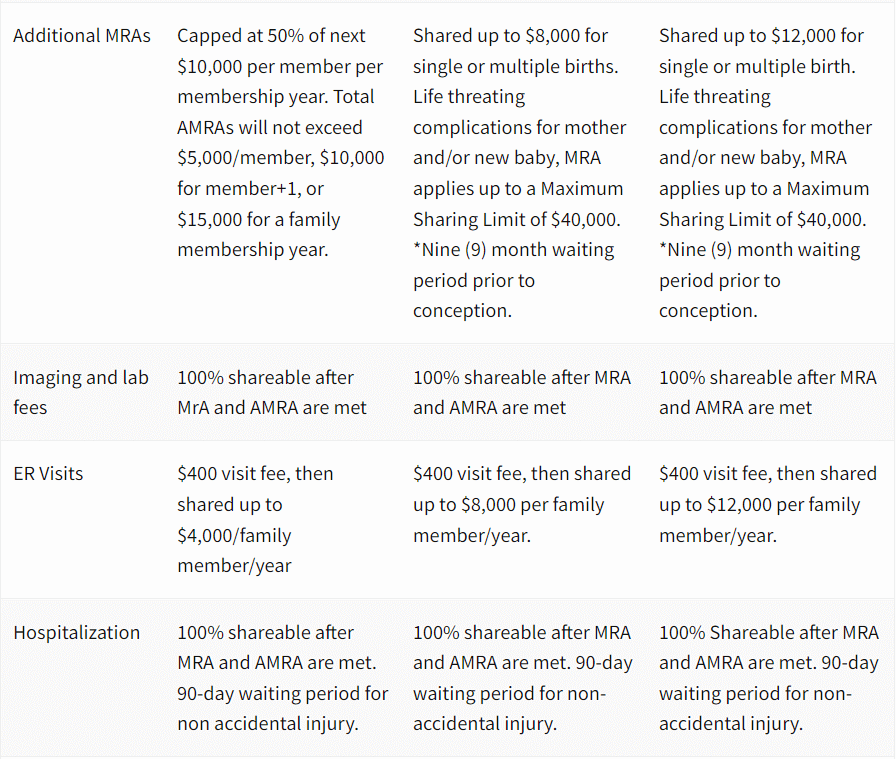

JHS offers three distinct membership tiers: DISTINCT, DIVERSE, and DYNAMIC, each catering to different levels of coverage and financial comfort.

DISTINCT: Simplicity and Clarity

The DISTINCT tier is ideal for those who prefer simplicity in their health coverage.

After meeting the chosen MRA (Member Responsibility Amount), which can be $2,500, $5,000, or $10,000, JHS shares 100% of subsequent costs. This tier is perfect for:

- Individuals seeking a straightforward health plan without complex cost-sharing mechanisms.

- Those who prefer a clear demarcation of out-of-pocket expenses and shareable expenses.

- Members who do not require sharing for maternity or childbirth cost.

DIVERSE: Balanced and Affordable

The DIVERSE tier strikes a balance between cost and coverage. After the MRA is met, JHS shares up to 80% of the next $10,000, leaving the member responsible for up to $2,000.

This tier works best for:

- Individuals and families seeking a middle ground between premium costs and out-of-pocket expenses.

- Those who can manage a moderate level of cost-sharing after the MRA.

- Members who need more comprehensive coverage, including maternity care.

DYNAMIC: Maximum Affordability

The DYNAMIC tier is the most budget-friendly option, designed for those who prioritize low monthly costs.

After the MRA, JHS pays 50% of the next $10,000, then pays 100% of additional costs. This tier is ideal for:

- Young adults or individuals with minimal healthcare needs.

- Those who are financially prepared to handle a higher share of initial costs.

- Members looking for the lowest possible monthly expense in exchange for higher cost-sharing.

Additional JHS Community DIVINE Plan Benefits

All tiers offer essential services like wellness visits, physician consultations, and emergency care, with varying caps based on the plan.

Hospitalization and surgery are fully shareable after meeting the MRA and AMRAs, providing substantial protection against major health events.

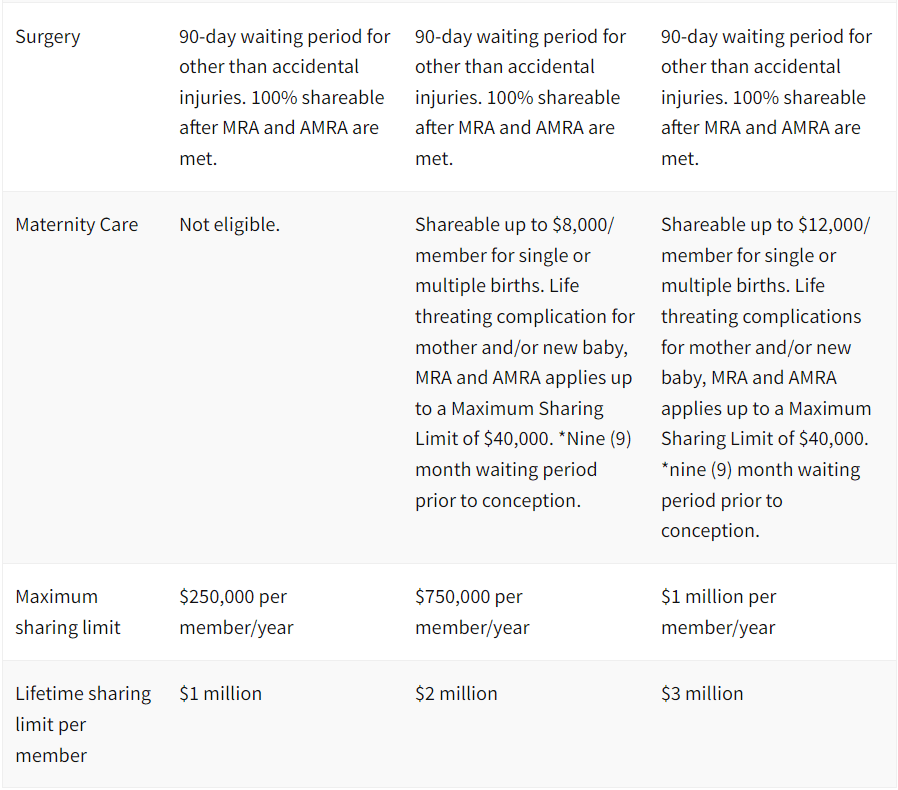

Maximum Sharing Limits

Each tier comes with annual and lifetime sharing limits, ensuring substantial protection for significant medical expenses.

The DISTINCT tier offers up to $250,000 per member per year, with a lifetime limit of $1 million.

The DIVERSE tier increases these limits to $750,000 annually and $2 million lifetime, while the DYNAMIC tier offers the highest coverage of $1 million annually and $3 million lifetime.

How to Enroll in the JHS Community DIVINE Plan

You can get pricing and enroll online in about 5 minutes, through our JHS Enrollment link.

If you have any questions along the way, just reach out!

Combining JHS Health Share With a Health Savings Account (HSA)

It’s now possible to combine JHS Share – or any other health sharing plan, with a Health Savings Account, or HSA.

Contributing to an HSA offers significant tax advantages:

- Tax-free contributions

- Tax-deferred growth

- Tax-free distributions to pay eligible health care expenses.

There is, however, a 20% penalty, plus income tax, on withdrawals not related to an eligible medical expense.

To contribute to an HSA, you must pair your JHS health sharing model with an affordable Minimum Essential Coverage (MEC) health insurance plan, called HSAMEC.

While your JHS health sharing plan provides a safety net for catastrophic medical costs, the HSAMEC policy covers routine and minor healthcare expenses.

The synergy of these plans, complemented by the tax relief from your HSA contributions, can effectively balance and even reduce the overall cost of healthcare.

This strategy works especially well for those in high tax brackets who can afford to invest the savings from choosing a health sharing plan into an HSA.

To learn more and sign up, visit the HSA MEC page.

HSAs As a Retirement Asset

Furthermore, the HSA offers long-term financial benefits.

Funds that remain unused in your HSA grow over time and can be accessed without penalties after you reach the age of 65.

Should you use these funds for non-medical purposes, they are simply subject to regular income tax, just like an IRA.

There is no required minimum distribution with HSAs. You can let your assets compound indefinitely, as long as they remain in the account.

For a comprehensive understanding of how you can leverage the cost-effective combination of JHS Health Share and an HSA, and to explore the substantial tax benefits, consider scheduling a complimentary session with a Personal Benefits Advisor.

Click here to arrange your free appointment and take the first step towards smarter healthcare financial planning.”

Who Should Consider the JHS Community DIVINE Plan?

JHS Share stands out as an excellent choice for those who are in good health, have significant savings and looking for ways to minimize their monthly healthcare expenses.

DIVINE – is particularly suited for individuals who are prepared to pay a significant portion of their medical costs out-of-pocket in case of healthcare needs.

The plan is structured to provide affordable coverage for significant and unforeseen medical incidents, while members might pay more out-of-pocket for smaller, routine healthcare needs compared to other plans.

If you’re someone who can comfortably manage out-of-pocket expenses ranging from $5,000 to $15,000 for major healthcare events, JHS Share offers remarkable value. It’s designed to be cost-effective while providing substantial protection against large and catastrophic medical expenses.

However, JHS DIVINE might not be the best fit for individuals who anticipate needing medical care soon or those with existing health conditions requiring regular attention.

The plan’s structure, with its higher initial member responsibility (akin to a deductible in traditional health insurance), might not be ideal if it leads to postponing necessary medical treatments.

Learn more about all the JHS Community Plans.

Compare Pricing on the Best HealthShare Plans Available

Need Help?

If JHS Community doesn’t seem like the right fit for your current healthcare needs, we’re here to assist.

To learn more, get a quote, or enroll, click here to schedule a meeting with a Personal Benefits Manager who will guide you in selecting a health plan more aligned with your requirements.

Here are some additional articles on healthsharing programs: Why Health Insurance Costs Are Going Up So Much (And What You Can Do About It) | How to Combine a DPC Membership with a Health Sharing Plan | JHS Health Share’s DIVINE vs. netWell Healthshare: Which is Better For You?

Here are some additional pages related to this article: Healthshare Plans | Complete Guide to Direct Primary Care (DPC)