This month, I’ll be taking a look at the features and benefits of two of the best and most popular health sharing plans available in the market today: netWell and HSA SECURE.

These excellent plans are built on very different concepts and structures. If you’re looking for a cost-saving healthsharing plan, both netWell and HSA SECURE have a lot to offer for the right family.

netWell vs. HSA SECURE: The Commonalities

netWell and HSA SECURE are healthsharing plans – also known as medical cost sharing plans.

They should not be confused with traditional health insurance plans. While health insurance policies are marketed, sold, and administered by health insurance companies, healthsharing plans are non-profit associations of people who share similar values and who agree to share each other’s medical expenses.

As such healthsharing organizations harken back to mutual aid associations, rather than insurance companies in their modern form.

Healthsharing organizations have more freedom when it comes to plan design. They also restrict benefits or impose waiting periods before costs arising from pre-existing conditions become fully shareable.

As a result, you can join an individual or family healthsharing plan for 30 to 50 percent less than the monthly premium for a comparable traditional health insurance plan without an Affordable Care Act Subsidy.

netWell and HSA SECURE are sold at a fraction of the cost of an unsubsidized traditional health insurance plan you can buy under the Affordable Care Act. Cost savings are especially significant for those who don’t qualify for an ACA subsidy, and for those in generally good health with no preexisting conditions that require ongoing medical care.

Compare Pricing on the Best HealthShare Plans Available

netWell vs. HSA SECURE: Key Differences

The main difference between netWell and HSA Secure is in plan structure:

netWell is designed as a conventional healthsharing program, focusing its benefits on what most people need: powerful healthsharing capacity for both catastrophic health events and primary care, at a deep discount compared to comparable health insurance plans.

Benefits for routine and predictable medical needs are limited to save costs.

HSA SECURE, on the other hand, is specifically designed to maintain members’ eligibility to contribute to health savings accounts (HSAs). These are special tax-advantaged savings accounts that allow members to pay for qualified medical expenses with tax-free dollars.

In order to comply with federal rules defining what plans are eligible to be combined with tax deductible HSA contributions, HSA SECURE plan designers had to build the HSA SECURE healthsharing plan on top of a basic insurance chassis that provided the minimum essential coverages (MEC) required of high-deductible health plans, or HDHPs.

At present, HSA SECURE is the only major health sharing platform compatible with health savings accounts contributions.

Membership Eligibility

netWell is open to all who agree to adhere to its statement of principles.

However, HSA SECURE membership is limited to business owners, independent contractors, and those with documented self-employment income.

In Depth: netWell

netWell members can choose between two membership tiers: Advantage and Elite+.

netwell Advantage

The Advantage plan focuses on higher-cost medical events, and excludes routine primary care services. It is the least costly of the netWell plans on a monthly basis, and much less costly than traditional insurance without a major ACA subsidy.

But members take on more responsibility for their own day-to-day basic preventive and health maintenance needs and primary care.

Many people choose to combine the netWell Catastrophic plan with a Direct Primary Care membership.

netwell Elite+

Elite+ is the most comprehensive and the most popular of the netWell membership options. It features full-spectrum cost-sharing from primary care services to catastrophic hospitalizations and surgeries.

The Elite+ membership tier will share medical costs up to $1 million per year, and up to $2 million over your lifetime.

You can choose an annual member contribution amount of $2,500, $5,000, or $10,000. This is the amount you must pay out of pocket before your netWell plan will begin to share qualified medical costs.

Eligible costs you incur each year above this amount is generally 100% shareable.

Additionally, the Elite+ membership tier comes with steep discounts on a variety of services not ordinarily included in traditional health insurance plans, including dental, vision and LASIK, diabetic supplies, and gym memberships.

Maternity Benefits

netWell has some of the best maternity benefits in the medical cost-sharing industry.

Under netWell’s Elite+ membership tier, the cost of normal pregnancies and normal and C-section deliveries are fully sharable up to $15,000. The member commitment portion is waived. The plan picks up costs from the first dollar.

If there are life-threatening complications arising from the pregnancy, costs are fully shareable up to $100,000.

Note: There’s a 6-month waiting period prior to conception. Pregnancy and delivery costs for pregnancies beginning within 6 months of your effective membership date are not shareable.

Also, as netWell is a faith-based healthsharing membership plan, both the husband and wife must be members in the same plan. No maternity costs are shareable unless both the husband and wife are netWell plan members.

Cost

netWell costs are just a fraction of what traditional Affordable Care Act-Qualified plans charge each month without a subsidy. Individual contribution amounts per month for a netWell plan range from $144 to $269, depending on the membership tier you select and the amount of your annual member contribution you select.

The higher your member contribution amount, the lower your monthly contribution amount will be.

Family plans cost commensurately more, depending on the ages of the adults in the plan and the number of children. Costs also may vary depending on your location.

In Depth: HSA SECURE

HSA SECURE is specifically designed for small business owners, independent contractors, and the self-employed.

This innovative solution actually combines two types of health plans: a basic MEC (minimum essential coverage) plan that includes preventive care services such as prostate exams and mammograms. It’s this part of the plan that enables members to contribute to a health savings account just like people who are covered under a high-deductible health plan (HDHP).

Then, on top of that, HSA SECURE also includes a very competitive, robust health sharing plan to cover catastrophic health care events, such as hospitalizations and surgeries.

Why contribute to an HSA?

Health savings accounts are among the most powerful savings and accumulation tools in the U.S. tax code. These popular savings vehicles provide a triple tax whammy:

- Tax free contributions of up to $3,850 per year for self-only coverage or $7,750 for family coverage as long as you’re covered by a qualifying HDHP or the HSA SECURE healthsharing plan. There are no income limits.

- Tax-deferred growth – as long as the assets remain within the HSA. That is, there are no taxes on interest, dividends, or capital gains.

- Tax-free withdrawals provided the withdrawal is to pay for qualified medical expenses.

- A tax of 20% applies to withdrawals prior to age 65 that are not to pay for eligible medical expenses.

Don’t need the money for health care? No problem! Your health savings account balances will continue to grow tax-deferred for as long as you leave it alone.

Once you reach age 65, the penalty goes away. At that point, you can make withdrawals as needed to supplement your retirement income, penalty-free. You just pay income taxes on the amount you withdraw, just as you would with a traditional IRA or 401(k) account.

The benefits are especially powerful for those in higher tax brackets.

Pre-Existing Conditions

Both HSA SECURE and netWell accept members with most pre-existing conditions. But they both impose a waiting period on pre-existing conditions before bills for treating these pre-existing conditions are fully shareable.

With netWell, the waiting period is at least 24-months for costs arising from pre-existing conditions. This is less stringent than many other health share programs on the market, which have waiting periods as long as five years, including for cancer treatment.

With HSA SECURE, members must wait 12 months before expenses relating to pre-existing conditions are shareable. After 12 months, up to $25,000 in costs can be shared. After 36 months, this amount increased to $50,000. After year four, it increases to $125,000.

Healthsharing may not be suitable for those with pre-existing conditions who need ongoing care.

How to Enroll

Both netWell and the HSA SECURE plans are easy to enroll online in just minutes!

Enroll Yourself and Your Family in HSA SECURE

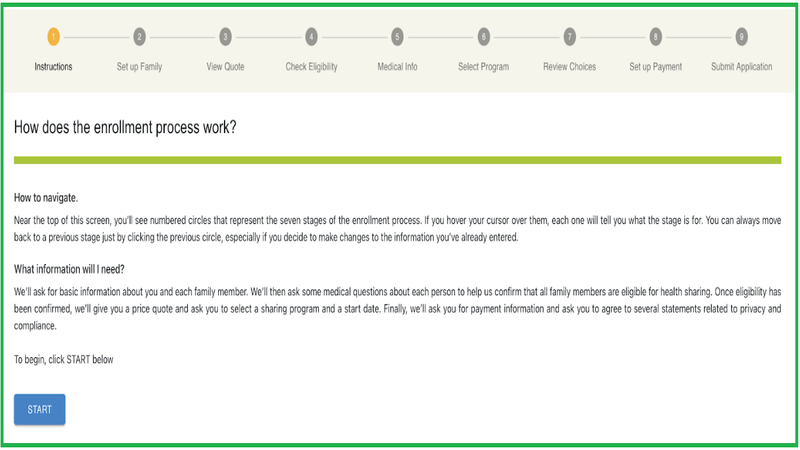

Here’s a step-by-step guide to enrolling in HSA SECURE:

- Step 1: Click here, and follow the instructions:

- Step 2: On the first page, enter your name and date of birth.

- Step 3: Below your name and DOB fields, you’ll see an option to add dependents. Click the “add spouse” or “add children” buttons on the screen and add their names and dates of birth as appropriate.

- Step 4: Scroll down to the bottom of the page and click “UPDATE.”

- Step 5: Select your desired IUA from the drop-down menu. The higher your IUA, the lower your monthly pricing. You’ll be able to see the different monthly costs just by clicking each of the three options. Select the one you want, and click “Continue.”

- Step 6: On the next page, fill in your address, contact, and Social Security number information. To complete the form for all your dependents, click the “Pencil” icon next to each name. After you’re done, click “Save Dependent” and repeat the process until you have entered all your dependents on the plan.

- Step 7. Scroll down and review the SECURE plan’s Statement of Principles. Click “Yes” or “No” on each one as appropriate.

- Step 8: Review the Health History section. Make sure you understand the HSA SECURE plan limitations on sharing for pre-existing conditions, pregnancies, and other exclusions. Click “Yes” or “No” on each paragraph as appropriate.

- Step 9: Select your payment method. You can pay by bank ACH draft or by major credit or debit card.

- Step 10: Check the “I’m not a robot.” box.

- Step 11: Click and drag your mouse or touchpad to digitally sign the document.

- Step 12: Type out your name in the box below.

- Step 13: Click “Submit.”

- Step 14: Check for error messages. If you skipped an entry, you’ll be prompted to go back and fix the error.

- Step 15: Confirm your application went through. Fix any errors as directed.

Tip: If you enroll in HSA SECURE by the 20th of the month, your membership will be effective as of the 1st of the following month. If you apply after the 20th, your membership will be effective the first day of the month after that.

Once you’re enrolled, you should schedule a 30-minute orientation phone call with the HSA SECURE Plan concierge.

Make sure to take advantage of this orientation opportunity, as it can help prevent a lot of confusion and help keep the process as smooth and seamless as possible.

Enroll Yourself and Your Family in netWell

- Step 1: Click this link, which will take you to the enrollment page. Or start by running a quote.

- Step 2: Create a netWell account. You’ll need to enter your name, email address, and a password. You can use the automatically-generated ‘strong password,’ which is virtually impossible to hack, or you can input your own.

- Step 3. Check your email for verification. You may have to check your spam filter.

- Step 4. Enter the verification code sent to your email into the prompt and click through. You’ll be taken to the general enrollment page, which looks like this:

Read the directions and click the blue “START” button.

- Step 5. Enter your name, gender at birth, date of birth, and Zip code. Click “Save and Proceed.”

- Step 6: If you have additional family members, click the blue “+” button in the lower right hand side of the window. If you are only inputting one person, go to Step 7.

- Step 7. Click “Save and Proceed.” You’ll be taken to the “View Quote” menu.

- Step 8. Choose your netWell healthsharing plan. The biggest decision you’ll have is choosing your Member Commitment Portion. This is the amount you will have to pay out of pocket each year before your medical expenses become shareable under the plan.

- 8.a. Choose your Member Commitment Portion. You can choose an MCP of $2,500, $5,000, or $10,000. The higher your MCP, the lower your monthly healthsharing contribution will be.

- 8.b. Choose a maximum sharing limit per year option. You can select either $250,000 (Advantage) or $1 million (Elite +)

- 8.c. Choose a lifetime sharing limit. You can choose a lifetime limit of $500,000 (Advantage) or $1 million (Elite +).

At the bottom of the table, you’ll see the monthly contribution amount for each of the available plans, so you can select the best plan that fits your budget.

Note that there’s a small non-refundable application fee, and a monthly family membership fee listed at bottom right. That’s in addition to your plan monthly contributions.

At the bottom left, you can click the buttons to read a brief fact sheet outlining the basic elements of the Elite + and Advantage plans.

- Step 9: If you are not using an agent and enrolling yourself, click “PROCEED.” If you are using an HSA for America Personal Benefits Manager to enroll, then click “Send Quote” and your PBM will get back to you to help you finalize your selection and enroll. If you prefer to self-enroll, go on to Step 10.

- Step 10: Click “PROCEED” at the bottom of the screen. You’ll be taken to the “Verify Eligibility” section. Answer the health questions by clicking either the “Yes” or “No” buttons. Keep answering the questions via the “Yes” or “No” radial buttons, and clicking “Next.” Repeat the process until all questions are answered. Then click “Proceed.” You’ll be taken to the section called “Medical Info.”

- Step 11: Enter your height and weight information. Click “Next.”

- Step 12: Continue to answer medical questions using the “Yes” or “No” radio buttons. Keep clicking “Next” until complete.

- Step 13: Select your desired language, and click “Continue.” You’ll be taken to the Member Enrollment section.

- Step 14: Select your plan name from Step 8 in the dropdown menu. Then select your desired effective date from the next dropdown menu below.

- Step 15: Verify your monthly family contribution at the lower right hand corner of the table.

- Step 16: Click “Select Program.” You’ll be taken to the “Review Choices” page.

- Step 17: Verify that your personal info and plan information is correct. If something is incorrect, edit the appropriate choices. When all is correct, click “Proceed”

- Step 18: Set up your payment information. Input your banking or credit card information as desired. That’s the account netWell will use to debit your monthly membership fee , a one-time non-refundable application fee, and a monthly family membership fee.

- Step 19: Click “Continue.” You’ll be taken to the “Submit Application” part.

- Step 20: Verify that all information is correct, and then click “Submit Application.”

That’s it!

If you have pre-existing conditions, you may not be eligible for immediate membership. Or your netWell plan may impose a waiting period before your healthcare costs related to treating pre-existing conditions become shareable.

Get Help Enrolling

Need help? We’re here for you.

Your Personal Benefits Manager can help you find out whether healthsharing is a good choice for you, and which plan might be the best fit.

To get expert, personalized assistance, click here to make a free, no-obligation appointment with a Personal Benefits Manager.Here are some additional articles: Best Healthshare Plans Comparison Guide 2023 | Why Are Insurance Agents Enrolling More People in Medical Cost Sharing Plans?| Higher 2024 HSA Contribution Limits Allow You To Save Even More on Taxes

Here are some additional pages related to this article: netWell Healthshare | HSA Secure Plan