Montana Small Business Health Insurance Options

Welcome to the HSA for America Complete Guide to Montana Small Business Health Insurance. This guide focuses specifically on companies with 30 employees or fewer, headquartered anywhere in Montana.

This health plan guide for Montana is intended to help small business owners, freelancers, and independent professionals provide the best, most cost-efficient set of employee health benefits possible. So you can stay more competitive, while still offering the benefits and overall compensation package you need to attract the best available talent and keep them on the job.

Montana Small Business Health Insurance: Overview of Options

Small businesses in Montana have multiple options when it comes to providing health benefits to employees.

Option one, the most common, but the most expensive by far, is to implement a traditional group health insurance plan.

Prices vary by age, but according to data from the Kaiser Family Foundation, the average annual cost of employer-sponsored group health insurance covering a worker and family in 2021 was $20,921.

Out of that, Montana employees typically contribute more than $5,801, on average toward their health insurance costs.

Fortunately, Montana businesses also have a variety of other options at their disposal that may reduce their costs substantially. These include:

- health savings accounts (HSAs)

- health reimbursement arrangements (HRAs)

- direct primary care (DPC) memberships

- health sharing programs

The best strategy for your small businesses depends on multiple variables, including size of your business, your available budget, and the age and medical requirements of your workforce and their dependents.

Geographic Considerations for Montana Small Business Health Insurance

It’s also crucial to take into account the unique healthcare environment of Montana, which includes both busy cities like Billings, Helena and Missoula, as more rural areas around places like Bynum and Olive.

For this reason, Montana business owners should think carefully about how their work force is distributed around the state. It does little good for executives in company headquarters located in Missoula to choose an HMO that restricts workers and their families to seeing in-network doctors when a large chunk of their employees and families live and work in Waterloo, far removed from the plan’s network of providers.

Montana Small Business Group Health Insurance

Traditional group health insurance is the most common choice for most Montana employers.

It’s also the most expensive.

Here’s how it works:

An employer contracts with a third-party insurance provider – usually a for-profit corporation – to provide a set of health insurance benefits for workers and – if the employer desires – for their families as well.

Under the Affordable Care Act, all employers with 50 or more employees must offer an ACA-qualified health insurance to all employees who work more than 30 hours per week, or pay a penalty.

The health insurance must offer the ten minimum essential coverages (MEC) required under the Affordable Care Act. These are:

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services

- Hospitalization (like surgery and overnight stays)

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

Additionally, the ACA requires health insurance to provide coverage for birth control and breastfeeding.

While traditional health insurance is the most expensive option for businesses, it does have the advantage of guaranteed enrollment.

As long as the worker enrolls during his or her initial enrollment period when they first qualify for coverage, during a special enrollment period triggered by a qualifying life event, or during the general open enrollment period beginning November 1st of each year, the insurance company cannot turn them down or charge a higher premium because of their medical history.

Read on the go, download our Complete Guide To Small Business Healthcare Plans.

Request a Group Quote for Your Company

Health Insurance is Optional for Montana Small Businesses

Under the Affordable Care Act, employers with fewer than 50 workers are not required to offer health insurance at all.

There is also no requirement under Montana state law. If you have fewer than 50 employees, you don’t have to offer health insurance at all.

You won’t pay a penalty.

However, it’s a great idea for employers of all sizes to offer health benefits – even for very small companies – because it may be much more difficult to recruit and retain quality employees without offering a competitive health benefit.

Especially in Montana, where unemployment is generally low and competition for talent among employers is keen.

Montana employers can potentially save a lot of money by offering a medical cost sharing or health sharing plan (more info below), and pay some or all of the costs for your employees.

The HRA Alternative

Alternatively, you can offer a qualified small employer health reimbursement arrangement (QSEHRA), and help your employees pay for their own individual health insurance on a tax-free basis.

This technique allows your workers to take advantage of any subsidies they may qualify for under the Affordable Care Act. Which, in turn, potentially reduces your outlay as the employer, since instead of paying the workers’ full premium in your group plan, plus any local administrative costs, you pay the smaller subsidized premiums your employee qualifies for in the individual and family market, via the Obamacare exchange established for the state.

Taxation of Employer Health Coverage in Montana

Health insurance premiums you pay as an employer are fully deductible as a business expense under both federal and Montana state law. They are also not taxable to the employee.

Healthsharing plans feature lower overall costs. Their monthly costs are also tax-deductible to the employee. However, employer assistance for paying health sharing costs are taxable to the employee.

Disadvantages of Employer Group Health Insurance Coverage in Montana

Traditional employer group health insurance has some important disadvantages for employers and their workers.

- Cost. As we mention above, the sheer monthly cost of providing health insurance can be crippling: Especially for labor-intensive industries where labor costs are high in relation to revenue.

Part of the reason traditional health insurance costs so much is overkill: Government regulators in Washington and Jefferson City have loaded up health insurance policies with mandatory coverages and requirements that make little sense for many workers.

For example, traditional health insurance requires carriers to price in drug and alcohol addictions coverage and mental health coverage, and maternity benefits that many workers don’t need or want.

This makes them much less efficient and cost effective than they need to be.

- Inflexibility. Group health insurance programs often provide a one-size-fits-all strategy that may not sufficiently address specific employee’s needs and budgets. Employer-sponsored group health insurance plans by nature tend to offer just one or two solutions that may not be optimal for specific employees.

In some cases, workers would be better off buying their own plan on the individual market – potentially taking advantage of a subsidy under the Affordable Care Act.

They may also be better off with a less expensive health sharing plan, discussed below. These innovative and affordable alternatives to health insurance can be a great solution – especially for workers who are in good health, with no pre-existing conditions.

Health sharing plans are discussed in more detail below.

- Administrative burden. Managing a full-fledged health benefit involves substantial administrative costs. This includes managing documentation and compliance, auditing plans to ensure employees don’t enroll non-qualified people into the plan, and responding to questions from staff members. These duties are essential to ensuring that the health insurance program inside an organization runs smoothly and effectively.

But they constitute a substantial burden to very small employers who don’t have the headcount to justify a full-time HR staff to run the plan.

Alternatively, business owners can employ strategies such as Health Reimbursement Arrangements and health care stipends.

These alternative approaches encourage workers to buy their own insurance coverage via the Affordable Care Act. This may help workers benefit from available subsidies. It also gets the employer out of the process altogether, reducing overhead and administrative costs.

Request a Group Quote for Your Company

Health Sharing Plans for Montana Small Business Health Insurance

Health sharing plans are a viable and economical alternative to overpriced health insurance coverage for small businesses in Montana.

Businesses in Montana are increasingly utilizing medical cost sharing plans as a budget-friendly substitute for traditional group health insurance plans. By switching from health insurance to health sharing, companies can frequently save up to 50% on premiums compared to their old traditional group health plans.

That means Montana small businesses could potentially save more than $10,000 per year per employee for family coverage, and more than $3,500 per employee per year for single coverage.

These programs present a cutting-edge method for funding healthcare, enabling companies to give employees access to high-quality healthcare while controlling expenses. Health sharing programs work under the premise of sharing resources among a group of people or organizations.

Health sharing programs entail participants making a predetermined amount of money per year in place of typical health insurance, which involves paying premiums to an insurance provider.

Health Sharing Plans vs. Health Insurance

Health sharing plans are not the same thing as health insurance.

Instead, healthsharing organizations are voluntary associations of like-minded people who agree to help share the medical expenses of other members. In contrast to health insurance companies, which are usually for-profit corporations, health sharing ministries are non-profit organizations.

Mandated Coverages

While federal and state laws require traditional health insurance policies to include coverage for many things that many people don’t want or need, health insurance plans have no such requirements. The Ten Minimum Essential Coverage requirements don’t apply to health sharing organizations.

Medical cost-sharing plans are not required to cover the cost of addictions treatment for people who never use drugs, for example. And they don’t need to cover the cost of treating injuries as a result of the members’ drunk driving.

Pre Existing Conditions

Unlike traditional health insurance plans, healthsharing plans may impose waiting periods before they will share the costs of treating pre-existing conditions.

They often also impose waiting periods on surgeries, except for injuries and accidents that could not have been foreseen prior to the member’s enrollment.

These waiting periods eliminate a great deal of adverse selection, and help health sharing organizations provide a terrific set of benefits at just a fraction of the cost of an unsubsidized ACA-qualified group health insurance policy or one purchased via the Healthcare.gov online exchange for Montana.

Note: Healthsharing plans don’t qualify for subsidies under the Affordable Care Act. But the price savings is so great that many people still benefit from switching to healthsharing, even if they do qualify for a subsidy, depending on their circumstances.

Since small group health insurance plans don’t get a premium tax credit subsidy under the ACA, switching to health sharing often makes even more sense for Montana employers.

Health Sharing and Network Restrictions in Montana

Unlike traditional managed care plans such as HMOs and PPOs, which are by far the most common employer-sponsored group health insurance plans, health sharing plans often offer more choice when it comes to choosing healthcare providers.

In most cases, healthsharing organizations in Montana do not restrict patients to in-network providers. Instead, health sharing plan members have the freedom to choose their own doctor or prover. giving people the freedom to select the doctors of their choice.

Is Health Sharing Right for Your Business?

Every business is different. Choosing the best possible plan, whether it’s a healthsharing approach or a traditional group health insurance plan, takes some careful analysis.

The good news is, it’s easy for business owners in Montana to get a full case analysis and recommendation specific to your organization and workforce.

Just click here to make an appointment with one of our experienced Personal Benefits Managers licensed in Montana, and we’ll start the process.

It will help if you have an employee census prepared.

In most cases, switching to health insurance will save thousands of dollars per covered employee. But health sharing may not be indicated if you have workers with pre-existing conditions.

The consultation and analysis is always free.

Health Reimbursement Arrangements for Montana Small Business Health Insurance

Health Reimbursement Arrangements (HRAs) are employer-funded benefits that provide tax-free reimbursement to employees for individual healthcare costs.

Often, Montana small businesses simply drop the group health insurance benefit altogether. Instead, they establish an HRA, and use the HRA to provide workers the cash to buy their own health insurance coverage with pre-tax dollars on the individual market.

This allows workers to take advantage of available subsidies – further reducing the net cost for the company and employee.

If any HRA money is left over after paying the premium, workers can tap their HRA benefit to pay for other out-of-pocket costs such as deductibles, co-pays, prescriptions, and durable medical equipment. Again, HRA benefits are tax-free to the employee.

With an HRA in lieu of a formal group health insurance plan, your employees are empowered to choose the health insurance plans that best meet their needs and preferences.

Click here to learn more about HRAs for small businesses.

QSEHRAs – The HRA for Small Businesses

Small businesses can use a special type of HRA called the Qualified Small Employer Health Reimbursement Arrangement or QSEHRA (pronounced “Cue Sarah”).

This benefit is designed for companies with fewer than 50 full-time employees or the equivalent, and who don’t offer a traditional group health insurance plan at all.

Businesses are free to set their own QSEHRA allowance maximums, within certain limits. As of 2023, Montana employers can contribute up to $5,850 for individual employees (up to $487.50 per month) and up to $11,800 for employees with a family (up to $983.33 per month).

Employees take this money and use it to purchase their own insurance via the online health insurance exchange site or via a broker in the individual and family health insurance market. This preserves their eligibility for a subsidy, which they would not get under an employer-paid group health insurance plan.

As the employer, you can elect to reimburse your employees for their health insurance premium only, or for their premiums plus additional medical expenses.

QSEHRAs and Special Enrollment Periods

When you cancel your health insurance plan and replace it with an HRA, your employees will qualify for a Special Enrollment Period. This is a 60-day window during which your workers can purchase their own ACA-qualified insurance plan with guaranteed issue rights, without going through medical underwriting.

This helps ensure your employees don’t face a break in coverage when you drop your group health insurance plan altogether and replace it with a QSEHRA.

HRA Advantages

There are many advantages to Health Reimbursement Arrangements (HRAs).

Money you spend on HRA benefits for your employees is fully tax deductible to you, as well as tax-free to your workers.

You retain control of HRA money until it’s actually disbursed to workers. It remains available to you as operating capital. You don’t have to deposit it with any third party.

Employers have a great deal of flexibility in designing their own HRA benefits, including what expenses you are willing to reimburse.

Workers don’t lose health insurance coverage if they leave the company, or change to contractor status. With the QSEHRA approach, the worker owns his or her insurance policy, and controls it. Not the employer.

HRA Disadvantages

Not all workers want the responsibility of having to research and choose their own health insurance plan. Some workers may need extra help navigating the transition.

If this is the case, your HSA for America Personal Benefits Manager is here to help. So no worker is left behind.

Just have your workers click this link to make an appointment for personalized, individual service, or call 800-913-0172.

Click here to learn more about alternatives to employer-sponsored health insurance for Montana small businesses.

The Direct Primary Care Advantage

Direct Primary Care plans (DPC) present an alternative healthcare model that’s undergoing an explosion of popularity in Montana and across the country.

It’s a membership-based model: In return for a flat, affordable monthly fee, like a gym membership, your employees receive as many visits as they need, either in person or via telehealth.

With monthly membership costs as low as $80, DPC provides an attractive and viable approach for individuals to prioritize their health without the burden of copays or coinsurance.

DPC plans provide members with unlimited access to routine primary, preventive, and chronic care services.

Examples of services commonly provided by direct primary care practices include:

Here are some of the medical services commonly provided by Direct Primary Care doctors:

- Preventive care. DPC doctors emphasize preventive medicine and provide services such as routine check-ups, immunizations, and screenings for various conditions.

- Acute care: DPC doctors treat acute illnesses and injuries such as infections, colds, flu, minor injuries, and skin conditions.

- Chronic disease management. DPC doctors help patients manage chronic conditions like diabetes, hypertension, asthma, arthritis, and others. They provide ongoing care, monitoring, and adjustments to treatment plans as needed.

- Comprehensive physical exams. DPC doctors offer thorough physical examinations to assess overall health, identify potential risks, and provide personalized health recommendations.\

- Urgent care. DPC doctors are often available for same-day or next-day urgent care appointments, allowing patients to receive prompt attention for non-emergency medical issues.

- Laboratory and diagnostic services. DPC doctors may offer or coordinate a variety of laboratory tests, such as blood work, urine analysis, imaging studies (X-rays, ultrasounds), and electrocardiograms (ECGs).

- Mdication management. DPC doctors can prescribe medications, monitor their effectiveness, and make adjustments as needed. They also provide education and counseling on medication usage.

- Mental health services. Many DPC practices include mental health services as part of their comprehensive care. DPC doctors may provide counseling, therapy, and referrals to mental health specialists when necessary.

- Minor procedures. Some DPC doctors are trained to perform minor procedures in their office, such as suturing lacerations, removing moles or skin lesions, joint injections, and others.

- Care coordination and referrals. DPC doctors act as patient advocates and coordinate care with specialists, hospitals, and other healthcare providers when referrals are necessary.

Meanwhile, since there’s no insurance company involved, there are no co-pays, co-insurance, or deductibles to worry about. The monthly subscription covers everything. This means cash-strapped workers can seek the care they need right away. They never need to put off seeing the doctor because they can’t afford the deductible or co-pay.

To cover services beyond what DPC offers, patients can choose supplemental plans such as high deductible health plans, health sharing plans, or accident insurance. Since routine care is already included in the DPC membership, patients can opt for much more cost-effective coverage options, such as healthsharing rather than traditional health insurance.

Health Savings Accounts (HSAs)

HSAs (Health Savings Accounts) can be very powerful tools to help workers manage their medical costs, as well as to help keep premiums lower for workplace health insurance plans.

Montana residents and businesses need every tax break they can get. The good news is, employer contributions to employees’ Health Savings Accounts (HSAs) are fully deductible from the Montana corporate income tax as a compensation expense.

With HSAs, individuals can set aside pre-tax money to save for future medical costs. Both employees and employers can contribute to HSAs – subject to an annual limit that is adjusted by Congress every year to keep up with the cost of living.

Money in an HSA enjoys tax-deferred growth, and withdrawals to pay for qualified healthcare expenses is tax free.

HSA Eligibility

To contribute to a health savings account, or to enjoy employer pretax contributions to an HSA, employees must enroll in a qualified high deductible health plan (HDHP).

For 2023, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,500 for an individual or $3,000 for a family.

An HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t be more than $7,500 for an individual or $15,000 for a family. (This limit doesn’t apply to out-of-network services.).

Can I combine HSAs with health sharing?

Currently, only one major health sharing plan preserves an employee’s eligibility for pre-tax contributions to a health savings account: The HSA SECURE Plan, which is available through HSA for America.

The HSA SECURE Plan is an excellent way to combine the tax and healthcare advantages of a health savings account with the cost saving advantages of healthsharing.

However, in order to enroll in this plan, your employees MUST have some self-employed or small business income or ownership.

HSA SECURE is not available to straight W-2 employees. But if your employee or their spouse has any small business, freelance work, or side hustle of their own, and they are in good health with no preexisting conditions that need ongoing care, the HSA SECURE plan could be a great match.

And, of course, the HSA SECURE Plan may also be a great money-saving option for you and your partners as a small business owner.

Your employees would have to enroll in HSA SECURE on their own. But once they’ve enrolled and established an HSA, you can make pre-tax contributions to it on their behalf, up to the annual limit Congress establishes each year.

Click here to learn more about HSA SECURE.

How Are Health Benefits Taxed?

Now that you know a bit about each of the alternative strategies available to small employers in addition to traditional health insurance, here is a brief table explaining how each of these benefits are taxed.

| Plan Type | Employer | Workers |

|---|---|---|

| Traditional health insurance premiums | Tax deductible. May qualify for a tax credit (see below) | Non-taxable |

| HSA contributions | Tax deductible | Pre-tax, up to certain limits. No income limitations. |

| Health sharing costs | Tax deductible as a compensation expense | Taxable as ordinary W-2 income |

| Health reimbursement arrangements | Tax deductible | Benefits are non-taxable to the employee |

| HSA withdrawals | N/A | Withdrawals for qualified medical expenses are tax-free. Otherwise taxable as ordinary income. A 20% penalty for non-qualified withdrawals applies up until age 65. |

| Direct primary care costs | Tax deductible as a compensation expense | Taxable to the employee |

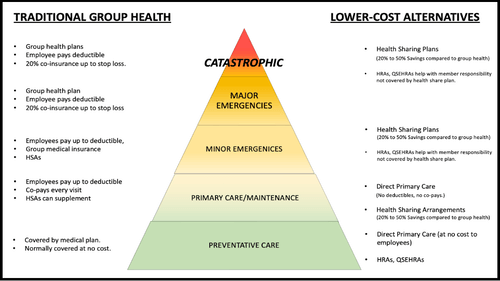

Address All Levels of the Montana Small Business Health Insurance Care Pyramid

A good employee health benefits package should address all levels of the Employee Healthcare Pyramid – from routine preventive care, through primary care access for maintenance and early detection of health problems, all the way through catastrophic incidents, as shown below:

On the left, we list common traditional insurance-based solutions that address each level of the Care Pyramid.

On the right, we list a number of alternative, more affordable approaches to providing meaningful protection for employees at each respective level of the Pyramid.

Good plan design provides employees with affordable solutions at each of these levels. So that no employee needs to delay or go without care because they can’t afford a premium, coinsurance, or copay.

Your Personal Benefits Manager can help you create a custom plan design for your work force that provides a solution at each level of the Care Pyramid – often at a fraction of the cost of a traditional group plan to the employer.

The Montana Small Business Health Insurance Tax Credit

The Small Business Health Care Tax Credit, passed along with the ACA, allows some small businesses to claim a federal tax credit of up to 50% of their employee health insurance costs.

It’s designed to offer small businesses with 25 workers or fewer and who tend to hire lower-wage workers.

In general, the credit can be claimed by for-profit and non-profit businesses that:

- Have fewer than 25 employees and average salaries of around $53,000 or less (excluding the salaries of all owners). In general, owners are not included when figuring out the number of employees and average salaries for the business. Also, the number of employees is based on “full-time equivalents” (FTEs). That means two half-time employees would equal one full-time employee.

- Pay at least half of the cost of premiums for employees; and

- Offer Affordable Care Act-qualified coverage available on the state exchange (in Montana’s case, on healthcare.gov, the federal online insurance marketplace website.

The tax credit is eliminated once an employer has 25 employees or the average wage is about $53,000 or higher.

How do I claim the credit?

You can claim this tax credit on your annual income tax return with attached IRS Form 8941 (Tax-exempt small businesses must file a Form 990-T tax return to claim, even if not otherwise required to file).

Your employees are not subject to tax on the contributions you make toward their coverage.

I don’t owe taxes this year for my business. Can I still claim the tax credit?

Yes. This tax credit can be carried back and used to offset income tax liability incurred the previous year or carried forward to offset liability incurred over the next 20 years.

If you’re a tax-exempt business, the credit is refundable.

Consult your tax advisor for full information about the Small Business Health Care Tax Credit.

Combining Montana Small Business Health Insurance Strategies

Combining various programs can be a smart move when it comes to maximizing your health insurance coverage.

Employers frequently find that combining a number of healthcare packages makes it possible for them to control healthcare costs while also providing complete coverage to their employees.

Consider combining a Direct Primary Care (DPC) plan for normal primary care with a low-cost health sharing plan that covers catastrophic occurrences as one possible cost-effective solution.

Compared to conventional group health insurance, this strategy can be more affordable for your company, for your employees, or both.

Offering employees the choice between signing up for a health sharing plan or purchasing an individual health insurance plan, as well as giving them the chance to fund a Health Savings Account (HSA) for those who choose an HSA-qualified HDHP plan, can give them more flexibility and possibly lower costs.

What To Do Now

The best course of action is to put together an employee census and contact us for a free, complementary business health plan analysis and recommendation.

You’ll be connected with an experienced HSA for America Persona Benefits Manager who will go over your work force and families with you, your budget and needs, your employees’ ability to contribute, and any preexisting conditions you may be aware of who need to be considered when designing a new plan.

Many of our PBMs have been successful business owners and entrepreneurs in their own rights. They have been in your shoes, and understand your needs as a business owner, and what it takes to recruit and retain the best possible talent to help you remain competitive.

Here are some additional blogs on the topic: The Small Business Owner’s Guide to Starting a Section 125 Cafeteria Plan | Healthsharing for Small Businesses: What Business Owners Need to Know

Here are some additional pages related to this article: Direct Primary Care (DPC) | Health Sharing Plans for Small Businesses

Can I Offer Health Insurance and Health sharing at the same time?

Yes, you can offer both options side by side, allowing employees to choose which plan suits their needs best.

Note if too many employees opt out of a group health insurance plan, you could fall below the minimum participation rate required to maintain a group plan. However, you can always use an HRA to reimburse the employees for individual health insurance, which will be close to the same cost.

Frequently Asked Questions

About Montana Small Business Health Insurance Plans & Strategies

What is the difference between health insurance and healthsharing for small businesses

Health insurance is a traditional coverage plan offered by insurance companies, while healthsharing involves members contributing to a pool of funds to cover each other’s medical expenses.

How can Health Savings Accounts HSAs help manage medical costs for employees in Montana?

HSAs allow individuals to set aside pre-tax money to save for future medical costs. Both employers and employees can contribute, providing tax advantages and potential savings on healthcare expenses.

Can employer contributions towards HSAs be deducted from state income tax in Montana?

Yes. Employer contributions towards employee HSAs are fully deductible from state income tax as a compensation expense in Montana.

How do I claim the Small Business Health Care Tax Credit?

The tax credit can be claimed on the annual income tax return with IRS Form 8941 for for-profit businesses, while tax-exempt small businesses must file a Form 990-T tax return.

HSA for America does not provide tax advice. Employers should consult their tax advisor for full information on claiming the credit.

Are maternity benefits covered by health sharing plans in Montana?

Maternity benefits are commonly included in health insurance policies and healthsharing plans in Montana, covering prenatal care, labor, and postnatal care. However, some health sharing plans may have restrictions on cost-sharing benefits for children conceived outside of marriage.

Can HRAs be used alongside other coverage options like health sharing plans or individual health insurance plans?

Yes, HRAs can be used alongside other coverage options. Some small businesses choose to cancel group health insurance altogether and use HRAs to reimburse employees’ premiums for individual policies. However, HRA money cannot be used to reimburse employees directly for health sharing plan costs.

How can I determine which combination of health insurance and cost-sharing options is best for my small business in Montana?

Don’t go it alone. Contact a Personal Benefits Manager who can conduct a free analysis and recommendation based on your specific needs, budget, employee census, and any pre-existing conditions that need to be considered. They can help design an optimal plan that maximizes the value for your employees while controlling costs and helping you remain competitive.

Are there waiting periods for pre-existing conditions with health sharing plans?

Yes, some healthsharing plans may have waiting periods for pre-existing conditions before coverage begins. It’s important to review the plan guidelines or consult with a Personal Benefits Manager for more information on specific plans.

Can employers contribute to their employees’ HSAs in Montana?

Yes, employers are allowed to make contributions to their employees’ HSAs, subject to annual limits set by Congress.

Does offering a Direct Primary Care (DPC) plan alongside other coverage options make sense for small businesses in Montana?

Combining DPC with low-cost coverage options like health sharing plans can provide comprehensive and cost-effective healthcare solutions for small businesses and their employees.

Can a business still claim the Small Business Health Care Tax Credit if they don’t owe taxes in Montana?

Yes, even if a business doesn’t owe taxes in a particular year, the Small Business Health Care Tax Credit can be carried back to offset income tax liability from the previous year or carried forward for up to 20 years.

What is an HRA (Health Reimbursement Arrangement) and how does it work?

An HRA is an employer-funded account that reimburses employees for qualified medical expenses not covered by their insurance plan. Employers determine what expenses are eligible and contribute funds accordingly.

Is there any limitation on the size of small businesses eligible for these programs in Montana?

The Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is only available to employers who have fewer than 50 employees. However, if you have more than 50 employees, or your company grows to have more than 50, there are other types of HRAs available to you.

You will also have an ACA requirement to provide a qualified health insurance plan for your employees, or pay a penalty. If you are on the cusp, or planning to hire your 50th full-time worker or equivalent in the near future, speak with your Personal Benefits Manager, as that could affect your plan design.

Available Plans | HSA Info | Healthshare Info | FAQS | Blog | About Us | Contact Us | Agents Needed

1001-A E. Harmony Rd #519 Fort Collins, CO 80525

Telephone: 800-913-0172

[email protected] | © 2024 - All Rights Reserved

Disclaimer: All information on this website is relayed to the best of the Company's ability, but does not guarantee accuracy. Information may be out of date. The content provided on this site is intended for informational purposes only and does not guarantee price or coverage. This site is not intended as, and does not constitute, accounting, legal, tax, and/or other professional advice. Determination of actual price is subject to Carriers.